Does a credit increase an equity account?

Is equity increased by debit or credit

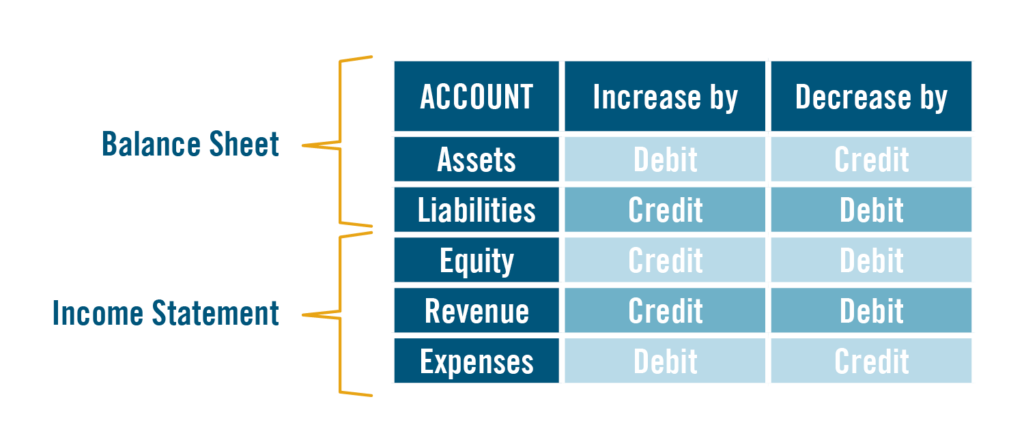

Debits increase the value of asset, expense and loss accounts. Credits increase the value of liability, equity, revenue and gain accounts.

Cached

Why does a credit increase equity

Since the normal balance for owner's equity is a credit balance, revenues must be recorded as a credit. At the end of the accounting year, the credit balances in the revenue accounts will be closed and transferred to the owner's capital account, thereby increasing owner's equity.

CachedSimilar

What are equity accounts increased with

The main accounts that influence owner's equity include revenues, gains, expenses, and losses. Owner's equity will increase if you have revenues and gains. Owner's equity decreases if you have expenses and losses.

Do credit amount increase in equity accounts True or false

Equity accounts. A debit decreases the balance and a credit increases the balance.

Is equity a debit or a credit

credit

Equity accounts normally carry a credit balance, while a contra equity account (e.g. an Owner's Draw account) will have a debit balance.

What transactions increase equity

The transactions involving income and gains, such as revenue, service revenue, and sales, increase the equity balance. The equity balance increases with the issue of shares. The transactions that involve expenses and losses, such as rent, salaries, depreciation, and losses on sales, lower the equity balance.

Which account ultimately increases the equity

Income accounts record all increases in Equity other than that contributed by the owner/s of the business/entity.

Which account would be decreased with a credit

Credits increase liability, equity, and revenue accounts. Credits decrease asset and expense accounts.

Which of the following transactions increases an equity account

Detailed Solution. When the Owner is bringing capital by issuing shares, it increases owners' equity along with the cash or bank balance. Hence both assets and owner's equity increases.

What accounts would be increased by a credit

Credits increase liability, equity, and revenue accounts. Credits decrease asset and expense accounts.

Does equity decrease on the credit side

The key difference between debits and credits lies in their effect on the accounting equation. A debit decreases assets or increases liabilities, while a credit increases assets or decreases liabilities. In other words, debits always reduce equity while credits always increase it.

Does a credit decrease owner’s equity

Credit. On the other hand, a credit (CR) is an entry made on the right side of an account. It either increases equity, liability, or revenue accounts or decreases an asset or expense account (aka the opposite of a debit).

How do you increase equity balance

How To Build Equity In A HomeMake A Big Down Payment.Refinance To A Shorter Loan Term.Pay Your Mortgage Down Faster.Make Biweekly Payments.Get Rid Of Mortgage Insurance.Throw Extra Money At Your Mortgage.Make Home Improvements.Wait For Your Home's Value To Increase.

What are the four items that affect equity

Four components that are included in the shareholders' equity calculation are outstanding shares, additional paid-in capital, retained earnings, and treasury stock.

Which type of transaction increases the owner’s equity

Owner's equity may increase from selling shares of stock, raising the company's revenues and decreasing its operating expenses.

What is an equity account

What are Equity Accounts Equity accounts are the financial representation of the ownership of a business. Equity can come from payments to a business by its owners, or from the residual earnings generated by a business. Because of the different sources of equity funds, equity is stored in different types of accounts.

Does a credit increase or decrease an account

A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account. Thus, a credit indicates money leaving an account.

Which of the following accounts is increased by a credit

Credits increase liability, equity, and revenue accounts. Credits decrease asset and expense accounts.

Which type of account is increased with a credit

A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account.

Which accounts increase debit or credit

Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. Credits do the reverse. When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice-versa.