Does a credit note cancel an invoice?

What impact does a credit note have on an invoice

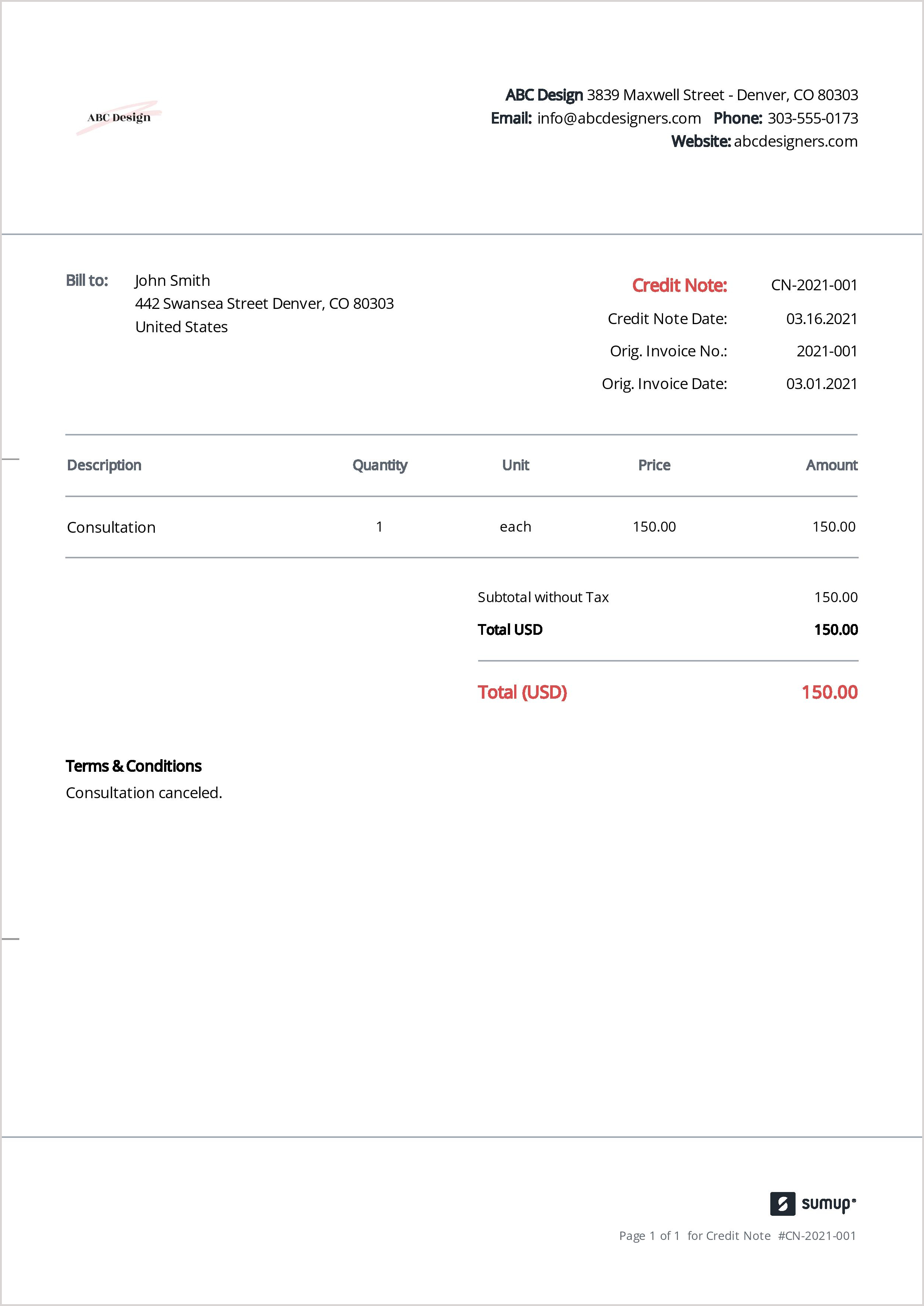

Credit notes are legal documents, just like invoices, that give you the important ability to cancel out an already issued invoice, either in full or in part. Issuing a credit note essentially allows you to delete the amount of the invoice from your financial records, without actually deleting the invoice itself.

What happens when you issue a credit note

A credit note, also known as a credit memo, is a commercial document issued by the seller and sent to the buyer when there is a reduction in the amount payable to the seller. By issuing a credit note, the seller promises to pay back the reduced amount or adjust it in a subsequent transaction.

What is the relationship between credit note and invoice

A credit note (also known as credit memo) is issued to indicate a return of funds in the event of an invoice error, incorrect or damaged products, purchase cancellation or otherwise specified circumstance.

Can a invoice be Cancelled

Therefore, an e-invoice can be cancelled on the IRP only within 24 hours. Further, the whole of the invoice would have to be cancelled since partial cancellation is not possible.

How do you offset an invoice with a credit note

If you have a sales invoice and a credit note for the same customer, you can fully or partially offset them against each other.Select Sales – Sales invoices.Select the credit note you want to offset.Select Actions – Offset.Select the debit invoice the credit note is to offset.

What are the disadvantages of a credit note

Disadvantages of a credit note include missing out on revenue due to having to credit mistakes and returns. It also may contribute to lower profits when returns and credits exceed sales.

What is the main purpose of a credit note

A credit note is a document issued by a seller to a buyer to notify them that credit is being applied to their account.

What is the purpose of a credit note

A credit note is a financial document issued by supplier companies to reduce the amount owed to them by the buyers. It helps firms maintain a proper paper trail and is issued when the goods are returned, the price is under dispute, or when there are invoicing errors.

What is difference between credit note and invoice

What is the difference between an invoice and a credit invoice An invoice is an itemized bill sent to customers to request payment for goods and services rendered, whereas a credit invoice is a statement that details a credit to the buyer, acting as a “negative” invoice to correct errors and issue refunds as needed.

Do you void or cancel an invoice

Void – If there was an error in a customer invoice and if you do not want to delete it, you can simply void it. Voided invoice will not be removed from the organization, hence it will not affect the invoice numbering sequence. Also, the customer cannot make payment for a voided invoice.

Why would an invoice be canceled

Cancellation – Canceling an invoice should only be used when an error has been made on the bill. An error can include the incorrect customer, contact or location identified on the bill. A duplicate bill for services already invoiced would be a good reason to cancel the bill.

Can you use a credit memo to offset an invoice that has already been paid

If a buyer has already paid the previously issued invoice in full, then they can use this credit note to offset their future payments to the seller. Alternatively, they can also demand a cash payment based on the credit note invoice.

How do I offset an invoice with a credit note in Quickbooks

From the Customer dropdown, select the customer. From the Outstanding Transactions section, select the open invoice you want to apply the credit note to. From the Credits section, select the credit notes you want to apply. Note: You will not be able to see the credits section if you have not created the credit note.

What are the pros and cons of credit note

On the customers' side, a credit note allows them to recover their money and enjoy a lower price. On both the customers' and the vendor's side, credit notes allow mistakes on invoices to be corrected. Disadvantages of a credit note include missing out on revenue due to having to credit mistakes and returns.

What is the difference between a credit note and an invoice

A credit note is effectively a negative invoice – it's a way of showing a customer that they don't have to pay the full amount of an invoice. A credit note might either cancel an invoice out completely if it's for the same amount as the invoice, or it might be for less than the invoice.

What is it called when you cancel an invoice

You can cancel individual invoices that have an approved or paid status, without doing a return transaction. Reverse invoices can be used to remove erroneously entered invoices, and credit or debit memos.

How do I cancel my invoice to go

WebClick on your Company name in the upper right corner.Click on Account & settings.Under the Account section, click on Manage subscription.Click on Cancel subscription.Please follow the on-screen prompts to complete the cancellation process.

What is the reason for issuing a credit note

As a seller, you may issue a credit note when there's a need to cancel all or part of an invoice for a variety of reasons, including: Changes to an order after an invoice is issued. Goods returned or services rejected.

What is credit note invoice

Credit notes are documents that decrease the amount owed on an invoice. You can adjust the amount of a finalized invoice using credit notes or by revising it.

Can a credit note be applied to a paid invoice

You can issue a credit note for open, paid and uncollectible invoices. When you issue a credit note for an open invoice, it decreases the amount due on the invoice. When you issue one for a paid invoice, it's usually because you need to refund or credit a specified amount to the customer.