Does a PayPal Credit card build credit?

Does PayPal Credit help build your credit

Can PayPal Credit help you build credit Yes, responsible use of PayPal Credit can help you build credit. PayPal Credit reports to credit bureaus, so timely payments and responsible use can increase your credit score and help you establish a favourable credit profile.

Does PayPal card affect credit score

Similar to regular PayPal accounts, PayPal Credit allows you to use a credit line rather than your own money to make purchases. The credit bureaus will receive information about your PayPal Credit account, which means it will appear on your credit report and have an impact on your credit score.

Is PayPal Credit an actual credit card

PayPal Credit is an open end (revolving) credit card account that provides a reusable credit line built into your account with PayPal. It gives you the flexibility to pay for your purchases later. You can use PayPal Credit just about anywhere PayPal is accepted online.

What is the downside to PayPal Credit

Two of the biggest downsides of the PayPal Credit Card are its high APR (19.99% – 26.99% (V), depending on creditworthiness) and its 3% foreign transaction fee. Both costs are avoidable, however, if you only use the card in the U.S. and always pay the full balance owed by the due date.

Cached

Is PayPal Credit a soft or hard pull

Does PayPal check credit PayPal will conduct a soft credit pull when you apply for a payment plan. This doesn't affect your credit score, and there is no minimum credit score requirement to use PayPal.

What credit score is required for PayPal Credit

To get approved for PayPal, credit borrowers generally need a credit score of 670 or higher. Applicants with a credit score of 700 or higher have the best odds of getting approval for lending from PayPal.

What credit score would I need for PayPal Credit

To get approved for PayPal, credit borrowers generally need a credit score of 670 or higher. Applicants with a credit score of 700 or higher have the best odds of getting approval for lending from PayPal.

What is maximum PayPal Credit limit

While the PayPal transfer limit for normal users is $4,000, verified users can send or accept a maximum of $10,000 in a single payment. Additionally, users with a linked bank account can send a maximum of $25,000 per transaction.

What is the difference between PayPal Credit and credit card

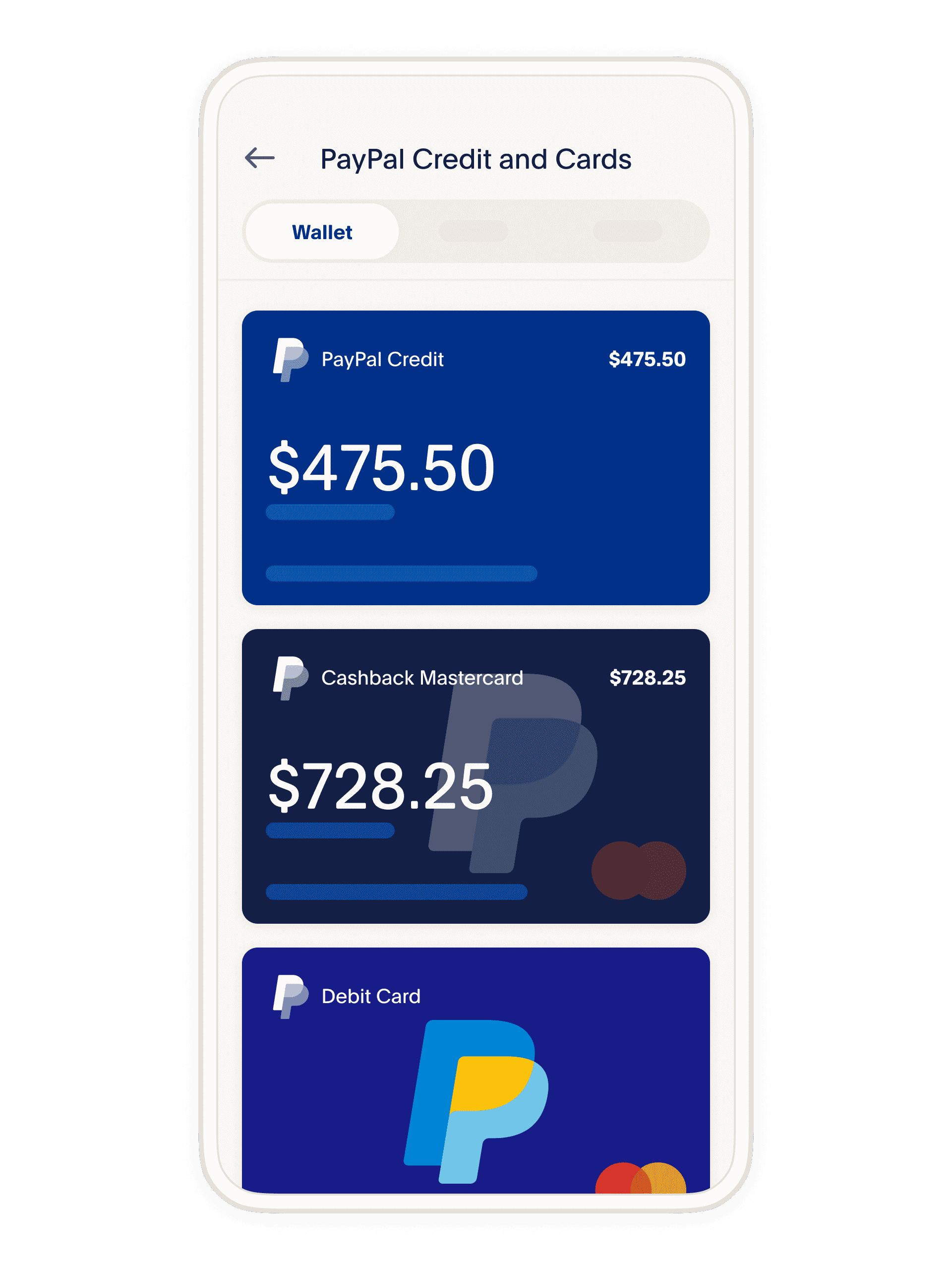

The platform has expanded its presence in the global economy, connecting consumers to retailers through its credit options: PayPay Credit and PayPal Mastercard. One functions as a virtual credit line, while the other is a traditional credit card.

What is the credit limit on PayPal Mastercard

The credit limit for the PayPal Cashback Mastercard® usually ranges from $300 to $10,000, although some cardholders have reported receiving higher limits. When your application is approved, the card issuer sets your credit limit based on your income, credit profile, and other financial information.

What is the maximum PayPal Credit line

Is there a limit to how much money you can spend with PayPal Credit Like other lines of credit, how much you can qualify for depends on your individual credit and circumstances. Lines of credit can be anywhere from $250 up to $20,000, says Schmidt.

What kind of credit score do you need for PayPal Credit

(a credit score of 700+)

Alternative Credit Card Option

The PayPal Cashback Credit Card requires at least good credit (a credit score of 700+) to get approved.

What is the PayPal card limit

The PayPal Debit Card has a daily spending limit of $3,000 USD and a daily cash ATM withdrawal limit of $400 USD. The card resets at 12:00 a.m. CST.

How often does PayPal Credit increase limit

We review your credit limit monthly and may invite you to increase your limit once you've been a PayPal Credit customer for at least 6 months. You can always request a credit limit decrease or opt out of receiving offers to increase your credit limit.

How long do you have to pay back PayPal Credit

the credit will be repaid in 12 equal monthly payments over the period of one year; the interest rate that applies is your standard variable rate set out at Condition 4.1, and that this rate does not change during this period; and. you will not break the terms of this Agreement.

Why do people use PayPal instead of credit card

First, PayPal lets you connect your preferred payment method to your account, whether you want to pay with a credit card, a debit card, a bank account or a rewards balance. PayPal also encrypts your bank or credit card information, which helps keep that information safe.

What is the difference between PayPal Credit and PayPal Mastercard

PayPal Credit allows you to take advantage of the interest-free period again and again as long as your transactions are above the $99 threshold. If you are more interested in earning cash back rewards or want more flexibility in using your credit card, the PayPal Cashback Mastercard is the better option.

How much does PayPal credit card give

Earn 3% cash back on PayPal purchases and 2% on all other purchases. With the new PayPal Cashback Mastercard®, earn unlimited cash back1 at millions of merchants. No restrictions. No rotating categories.

What is the difference between PayPal Mastercard and PayPal Credit

PayPal Credit allows you to take advantage of the interest-free period again and again as long as your transactions are above the $99 threshold. If you are more interested in earning cash back rewards or want more flexibility in using your credit card, the PayPal Cashback Mastercard is the better option.

Will PayPal Credit let you go over limit

If we approve a transaction that makes you go over your credit limit, we do not give up any rights under this Agreement and we do not treat it as an increase in your credit limit. However, we may, from time to time, increase your credit limit, including after approval of such a transaction.