Does a Repo show on your credit if you get the car back?

How do I get a recovered repo off my credit report

The Three Ways to Remove a Repossession RecordNegotiation with the lender.Filing a dispute with the credit reporting bureau(s)Hiring a third party to act on the consumers behalf.

Cached

Can you remove a repo from your credit

It's possible to remove a repossession from your credit report, but you don't have many options. You can either negotiate with the lender or file a dispute. That's it. You can only file a dispute if something is inaccurate.

Why is my car repo not on my credit report

If the lender doesn't prove that your debt is accurate, fair and substantiated, the credit bureaus may remove the repossession from your credit reports. Your window to negotiate with your lender may be short or already closed if they've already repossessed your asset.

Cached

What happens to credit score after a repo

Having a repossession on your credit report can decrease your credit score by approximately 100 points or more. Keep in mind that someone with a FICO credit score of 669 or below is considered to be a subprime borrower, while an exceptional credit score is above 800.

How long does it take for a repo to clear

seven years

A repossession stays on your credit report for seven years, starting from the first missed debt payment that led to the repossession. In the credit world, a repo is considered a derogatory mark. After a repo, it's not unusual to see a person's credit score take a substantial drop.

How many points will my credit score increase when a repo is removed

On average, however, many individuals see their score improve anywhere from 75 to 150 points once they no longer have the repossession on their report.

How do I remove myself from a repo

Removing yourself from a collaborator's repositoryIn the upper-right corner of any page, click your profile photo, then click Settings.In the left sidebar, click Repositories.Next to the repository you want to leave, click Leave.Read the warning carefully, then click I understand, leave this repository.

What does paid repossession mean on credit report

Paying off a derogatory account, such as an account that shows a status of repossession, foreclosure or charge off, will result in that debt being updated to show as "paid" on your credit report. The exception would be if the account has already been sold to a collection company.

How long does a repo affect you

seven years

Once completed, repossession is a fact that you cannot easily erase. In fact, it will appear on your credit history for seven years.

How long does it take to remove a repo off your credit

seven years

A repossession stays on your credit report for seven years, starting from the first missed debt payment that led to the repossession. In the credit world, a repo is considered a derogatory mark. After a repo, it's not unusual to see a person's credit score take a substantial drop.

How much does your credit score go down for a repossession

50-150 points

How Much Does a Voluntary Repossession Affect Your Credit Estimates vary, but you can expect a voluntary repossession to lower your credit score by 50-150 points. How big of a drop you will see depends on factors such as your prior credit history and how many payments you made before the repossession.

How do you clean a repo

git cleanIf you just clean untracked files, run git clean -f.If you want to also remove directories, run git clean -f -d.If you just want to remove ignored files, run git clean -f -X.If you want to remove ignored as well as non-ignored files, run git clean -f -x.

What happens if you hide from repo

A repossession agency with authorization from the legal owner will attempt to take your vehicle for the legal owner. If you hide the vehicle to avoid repossession, you may give up your right to continue with the same contract with the legal owner.

Is a repossession a charge-off or collection

Lenders can repossess your car in a charge-off. If they then sell the vehicle at auction, they might deduct the sale price from your total debt. If your vehicle is repossessed, a third-party company usually comes to your home or work and takes it.

What are the consequences of a repo

A repossession stays on your credit report for seven years, damages your credit score and is a big red flag to lenders. It's also possible that your car loan may be turned over to a debt collection agency, which could lead to a lawsuit, wage garnishment, and even more damage to your finances for years to come.

How long does a repo stay on your credit as a cosigner

seven years

Repossessions stay on your credit report for seven years, so you want to do everything you can to make sure that the car you co-signed for doesn't get repossessed. Depending on your relationship with the primary borrower, you may be able to work out a deal.

How bad will my credit drop with a voluntary repossession

How Much Does a Voluntary Repossession Affect Your Credit Estimates vary, but you can expect a voluntary repossession to lower your credit score by 50-150 points. How big of a drop you will see depends on factors such as your prior credit history and how many payments you made before the repossession.

How does a repo affect a cosigner

In addition to putting your cash on the line when cosigning an auto loan, you're also risking your credit. If the loan ends up in default or the car is ultimately repossessed, your credit will be damaged—even if you have a long history of paying all of your bills on time.

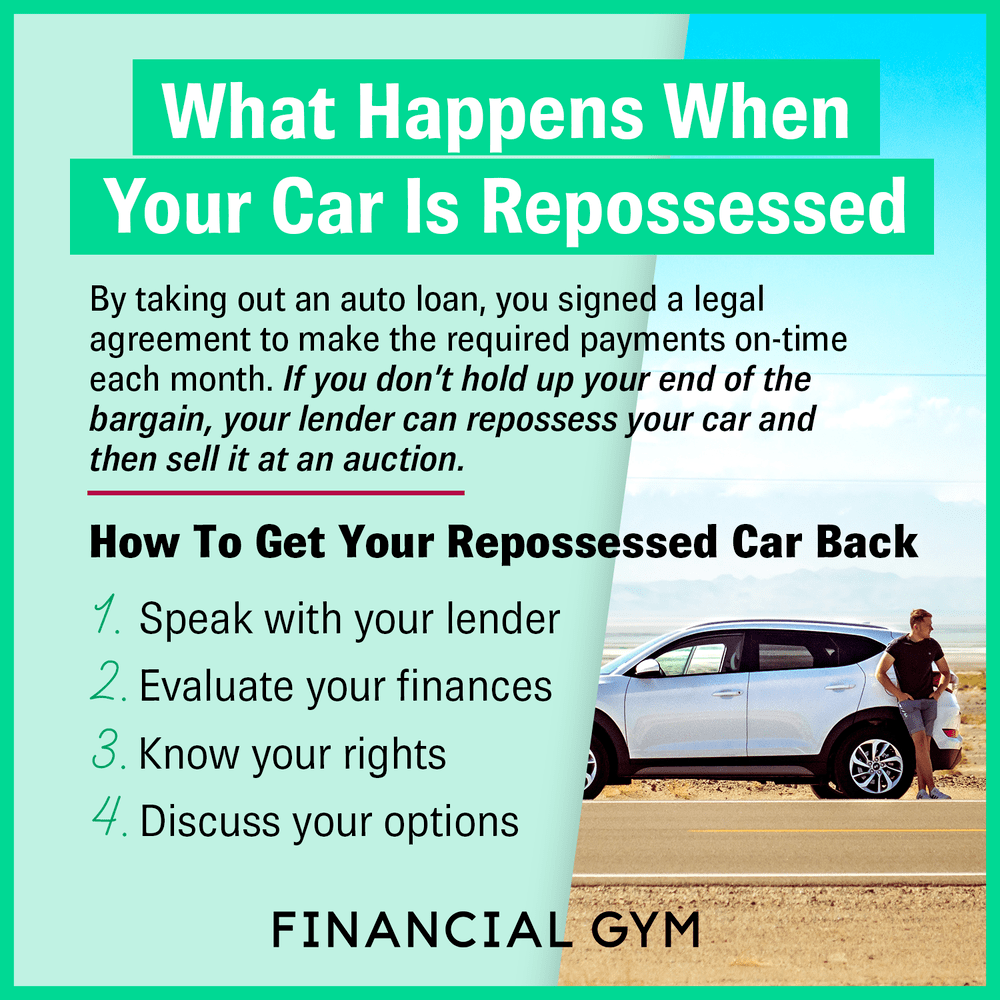

How do you get around a repo

6 ways to avoid repossessionStay in contact with your lender. Keep your lender up to date on your situation, ability to make payments and overall finances.Request a loan modification. Repossession is a significant inconvenience for the lender.Get current on the loan.Sell the car.Refinance your loan.Surrender your car.

Do cars have tracking devices for repo

For hidden cars and even for some vehicles parked at great distances from a subject's typical haunts, a repo agent might use an electronic detector to track down a vehicle for repossession. These days, many lenders require that all new vehicles be equipped with such devices.