Does a Verizon phone bill build credit?

Does paying Verizon phone bill build credit

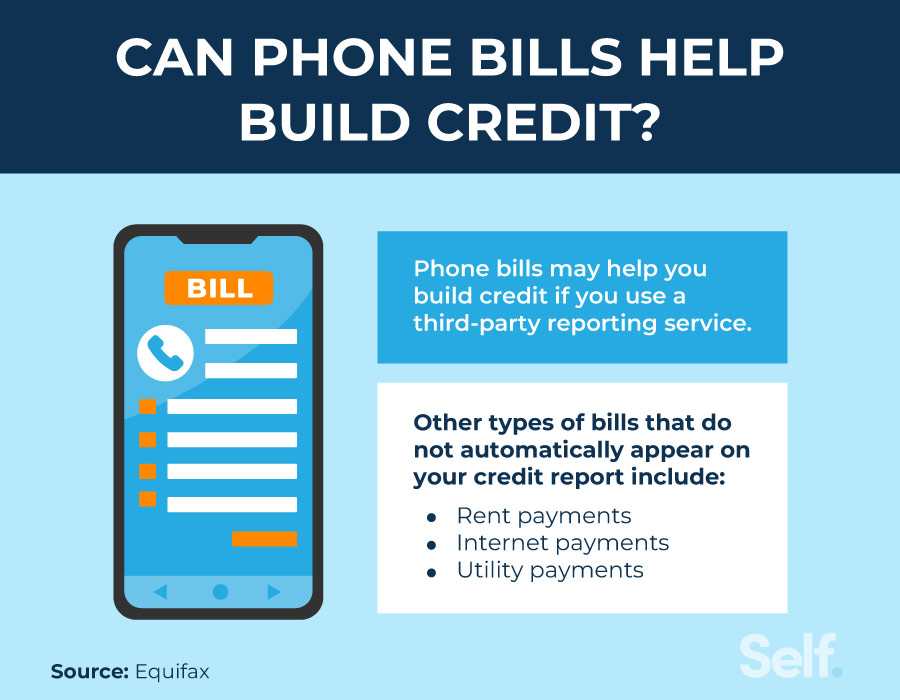

The short answer: No, paying your phone bill will not help you build up credit. Phone bills for service and usage are not usually reported to major credit bureaus, so you won't build credit when paying these month to month.

Cached

Does Verizon report to your credit

Learn who's handling your debt by reviewing your credit report. Verizon will show as the creditor if it hasn't sold your debt. A collection agency will appear as the creditor if Verizon did sell the debt. Removing a collection from your credit file depends, in part, on the owner of the debt.

What bills build credit

What Bills Help Build CreditRent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health.Utility Bills.Auto Loan Payments.Student Loan Payments.Credit Card Payments.Medical Bills.

How does Verizon bill credit work

You receive credit for your device(s) in one of these ways: Account credit applied within 1-2 bill cycles. Verizon Gift Card, sent to the email address you provided during your trade-in request. This takes about 2 weeks from the time we receive your device and you accept the Agreements.

Is a phone bill a good way to Build credit

Unlike your mortgage or car payments, paying your cell phone bill regularly each month alone will not help increase your credit score. Typically, cellphone providers don't report your payments to the bureaus—though newer services like Experian Boost can help you manually add it.

Does paying for a phone increase credit score

Your mobile phone contract is a type of borrowing, so monthly payments show up on your credit report. That means if you pay on time you can dial up your credit score. But of course there's a flip side! If you're late paying your contract or you miss payments, your credit score could drop.

Does a cell phone bill raise your credit

Unlike your mortgage or car payments, paying your cell phone bill regularly each month alone will not help increase your credit score. Typically, cellphone providers don't report your payments to the bureaus—though newer services like Experian Boost can help you manually add it.

How can you build credit

If you're having difficulty getting approved for a credit card or you're looking for alternative methods, consider these ways to build credit:Make your rent and utility payments count.Take out a personal loan.Take out a car loan.Get a credit builder loan.Make payments on student loans.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

What increases your credit score

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit.

Why did I get a credit on my Verizon bill

Since we bill in advance for certain services, when a customer disconnects service they may end up with a credit balance on their final bill. This credit balance will automatically be refunded if you don't owe any money on any Verizon accounts. This can take 60 days or more.

Does your phone bill go down when you pay off your phone

When you pay off your device: You continue paying your monthly costs for your talk, text and data plan, but you no longer have a device payment charge on your monthly bill. Any monthly promotional credits you're getting will stop.

How can I build my credit fast

The quickest ways to increase your credit scoreReport your rent and utility payments.Pay off debt if you can.Get a secured credit card.Request a credit limit increase.Become an authorized user.Dispute credit report errors.

Do monthly bills build credit

If you want to improve your credit score, simply paying your utility bills on time usually won't do the trick. Strategies to boost credit scores include repaying debt on time and keeping debt utilization ratios low.

How much credit score do you need to get a phone contract

There is no minimum credit score required for a phone contract.

How can I improve my mobile credit score

Improving your credit scoreCheck for mistakes. When you look at your credit report, check for any errors or mistakes.Make sure your address is up to date. Having your current address on your credit report is very important.Paying bills on time.Avoid multiple applications.Rent payments.Experian Boost.

What contributes to credit score

The primary factors that affect your credit score include payment history, the amount of debt you owe, how long you've been using credit, new or recent credit, and types of credit used. Each factor is weighted differently in your score.

How to build a 700 credit score

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to get 600 credit score fast

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.