Does accruing interest hurt your credit score?

What hurts credit score the most

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

Does 0 percent APR hurt credit score

Credit scoring models don't consider the interest rate on your loan or credit card when calculating your scores. As a result, having a 0% APR (or 99% APR for that matter) won't directly impact your scores. However, the amount of interest that accrues on your loan could indirectly impact your scores in several ways.

Why is my credit score going down if I pay everything on time

A short credit history gives less to base a judgment on about how you manage your credit, and can cause your credit score to be lower. A combination of these and other issues can add up to high credit risk and poor credit scores even when all of your payments have been on time.

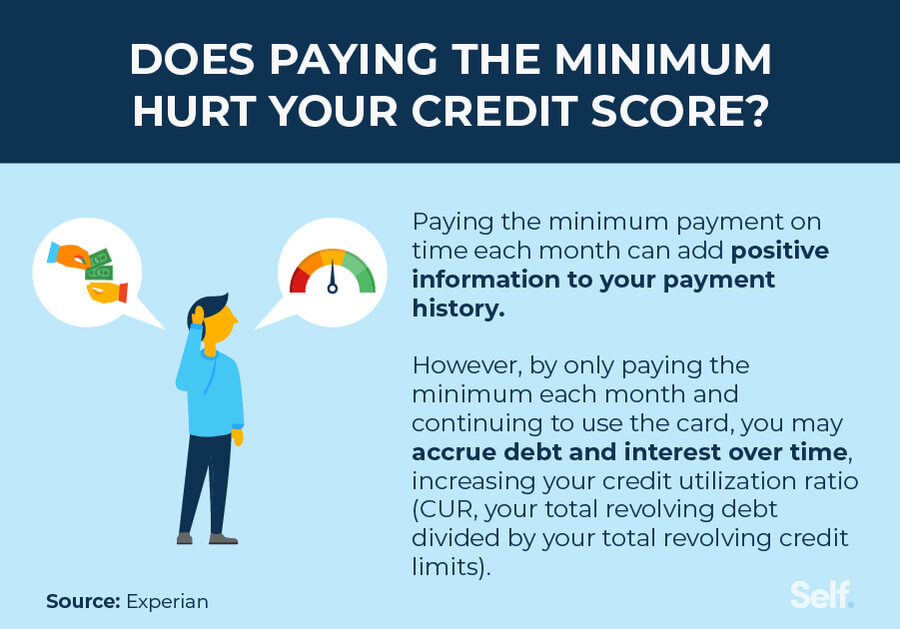

Does it hurt your credit to not pay in full

If you're carrying a balance on your credit card from month to month, you're increasing the odds that additional purchases will tip you over the 30% credit utilization rate that lenders like to see. When this happens, it's likely that your credit scores will be negatively affected.

Cached

Why is 850 the highest credit score

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates.

What is the #1 way to hurt your credit score

Making a late payment

Your payment history on loan and credit accounts can play a prominent role in calculating credit scores; depending on the scoring model used, even one late payment on a credit card account or loan can result in a decrease.

Is it better to have 0% APR or no annual fee

A card with a 0% intro APR period will save you the most on interest in the short term. Look for one with an introductory interest-free period longer than a year. If you tend to carry a balance most months, a card with a low ongoing interest rate will work to your advantage in the long run.

What is the problem with 0% APR

You don't make the minimum payments

By missing payments, you run the risk of lowering your credit score and racking up late payment fees. Plus, you'll probably lose your promotional interest rate — which means that any balance you are carrying on your 0 percent intro APR card will start accruing interest.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Why did my credit score drop 80 points for no reason

Your credit score may have dropped by 80 points because negative information, like late payments, a collection account, a foreclosure or a repossession, was added to your credit report. Credit scores are based on the contents of your credit report and are adversely impacted by derogatory marks.

What has the biggest impact on your credit score

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score.

Is it bad to have a zero balance on your credit card

If you have a zero balance on credit accounts, you show you have paid back your borrowed money. A zero balance won't harm or help your credit.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How can credit score drop 100 points

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

What brings your credit score down

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

What are the disadvantages of an interest-free period

Interest-free deals let you take goods home or go on a holiday and pay off the cost over time. But interest-free doesn't mean cost-free. Fees can add up quickly and if you don't repay the balance in the interest-free period, you'll be charged a lot in interest.

Is there a catch to 0% APR

Even with a 0% APR card, you'll still have to make monthly minimum payments — usually a small percentage of your balance. And if your payment is late, even by a single day, your card issuer could cancel the 0% offer and reset your card's interest rate to the ongoing APR.

Why should you avoid 0% interest

Zero-interest loans, where only the principal balance must be repaid, often lure buyers into impulsively buying cars, appliances, and other luxury goods. These loans saddle borrowers with rigid monthly payment schedules and lock them into hard deadlines by which the entire balance must be repaid.

Why did my credit score drop 70 points after paying off debt

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.