Does Ace Hardware offer payment plans?

Does Ace Hardware offer Afterpay

Afterpay – Love the way you pay.

Cached

Does Ace Hardware do buy now pay later

Pay for your next purchase at Ace Hardware in 4 installments over 6 weeks when you check out with Zip.

Cached

Does Ace have financing

No Money Down – 0% Financing Available

Get your Ace Collection® purchase using affordable financing. 0% APR available, subject to credit check and approval. Rates from 0-36% APR over 6, 12, or 18 months based on creditworthiness and purchase amount.

Does Ace Hardware offer store credit

Yes, you need a receipt to return Ace Hardware purchases and get a full refund. Without a receipt, there's a chance you'll get store credit for your return if your item is unopened and unused. However, you're much more likely to get store credit if you bring your return to the store.

Cached

Does Afterpay accept everyone

Customer must be 18 years of age or older, and be the authorized holder of an eligible debit or credit card. Purchases need to be over $35. Customer pays 25% of total cost up front. Customers may pay in four installments every two weeks until the entire purchase is paid off.

What major stores use Afterpay

Stores That Accept AfterpayAdidas.Anthropologie.Asos.Bed Bath & Beyond.Buy Buy Baby.Calvin Klein.Carters.CVS.

Can I buy something now and pay later

Buy now, pay later (BNPL) is a type of short-term financing. These loans are also called point-of-sale (POS) installment loans. Consumers can make purchases and pay for them over time after an up-front payment. Buy now, pay later plans typically charge no interest.

How do I buy with pay later

How does BNPL workMake a purchase at a participating retailer.Opt for the 'Buy now, pay later' option.Make a small down payment of the overall purchase amount.The remaining amount shall be deducted in a series of interest-free EMIs.

Can I use affirm as a loan

You may borrow anywhere from $0 to $17,500, but the amount may vary by store. 1 Affirm offers personal loan terms for three, six, or 12 months, but depending on the retailer and the size of the purchase, terms could be as short as two weeks to three months, or as long as 48 months.

Is affirm financing hard to get

You won't get approved if you don't have good credit — You'll need to have a good credit score to qualify for an Affirm loan. You may have to pay a downpayment — For some borrowers, Affirm asks for a down payment that must be paid during purchase. This can be anywhere from 10% – 50% of the cost of the item.

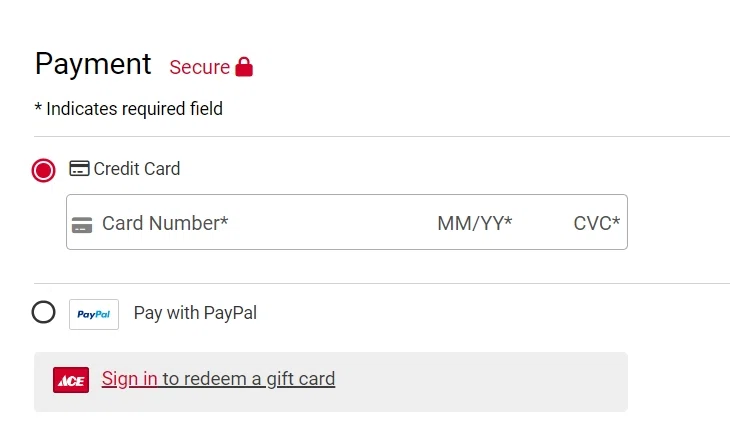

Does Ace give credit cards

Ace Hardware Credit Card's Additional Info

You will first be considered for the Signature card. If you do not qualify for the Signature card, you will be considered for the Platinum card which may not offer the same Visa Signature benefits.

How does credit work at stores

Store credit is not cash because it is just valid in the issuing retailers. But it has a value that can be exchanged for a cash equivalent amount to purchase new stuff. There are four types of store credit that retailers normally use, including return and exchanges, store credit cards, gift cards, and loyalty rewards.

Is Afterpay hard to qualify for

Afterpay may perform a soft credit check, which does not hurt your credit score. While Afterpay does not disclose its minimum credit score requirement, borrowers with bad credit or no credit are likely eligible to use Afterpay's payment plan.

Does Afterpay mess with your credit

No. Afterpay Buy now, Pay Later payments will not affect your credit score, as they are not reported to credit reporting agencies.

Does Lowe’s use Afterpay

Afterpay – Love the way you pay.

Can I use Afterpay at Walmart

Afterpay is a popular “buy now, pay later” service that allows customers to make purchases and pay for them in installments over a period of time. However, Walmart does not currently accept Afterpay as a payment method.

What companies allow you to pay later

The 5 best 'buy-now, pay-later' platforms of 2023Sezzle.Zip.Klarna.Afterpay.Paypal.

Who is eligible for buy now, pay later

Eligibility criteria for Buy Now Pay Later

You must be aged above 18 years. The maximum age of eligibility in some cases can be up to 55 years. You must be a salaried individual. You must have a bank account and all the KYC documents in place.

Can I buy something now and Pay Later

Buy now, pay later (BNPL) is a type of short-term financing. These loans are also called point-of-sale (POS) installment loans. Consumers can make purchases and pay for them over time after an up-front payment. Buy now, pay later plans typically charge no interest.

What is the minimum credit score for Affirm

The lender has no minimum credit score to qualify for a loan, and checking whether you prequalify will not damage your credit score.