Does Affirm open a credit line?

Does Affirm give you a credit line

The thing is, Affirm doesn't just give you a credit limit: they give you a line of credit. The credit line fluctuates when you make payments, so you might want to monitor it to keep track of your credit and know when you're approaching your credit limit.

Cached

What is my Affirm credit limit

Is There a Credit Limit Affirm does not have a set credit limit. Instead, the company decides your eligibility and loan limit on a case-by-case basis, considering factors like your credit score, past payment history on Affirm loans, and your ability to pay.

Cached

What is the minimum credit score for Affirm

What credit score do I need to qualify for an Affirm loan The Affirm website states there's no minimum credit score to qualify for a buy now, pay later (BNPL) loan. Along with a soft pull on your credit, Affirm determines whether you qualify for a loan based on your: Income.

Cached

Do you get a credit card with Affirm

When you're approved for a loan with Affirm, you can have the loan amount loaded onto a virtual Visa card.

Cached

Can I borrow money from Affirm

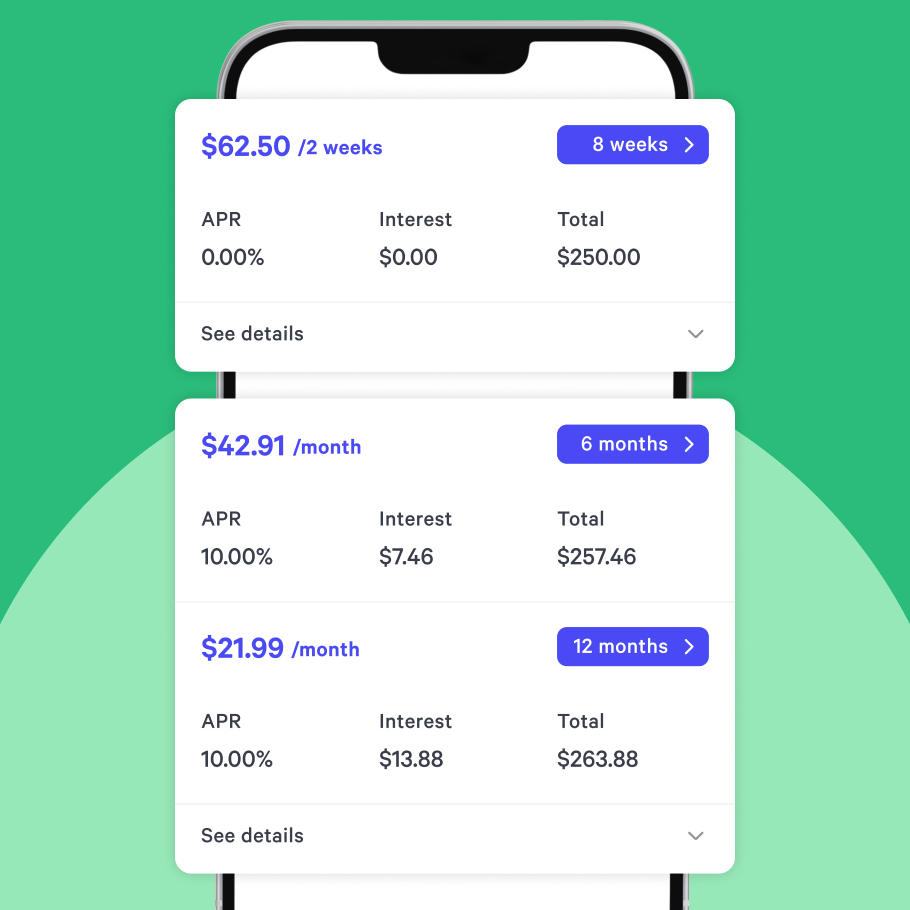

You may borrow anywhere from $0 to $17,500, but the amount may vary by store. 1 Affirm offers personal loan terms for three, six, or 12 months, but depending on the retailer and the size of the purchase, terms could be as short as two weeks to three months, or as long as 48 months.

What is the downside of Affirm

Cons Explained

With standard interest rates ranging from 10% to 30%, customers may want to explore other payment options first for retailers that do not offer 0% financing. May require a credit check. Affirm may do a soft credit inquiry to verify a customer's identity and to prequalify them for their spending limit.

How do I get a high Affirm limit

Things like paying bills on time, reducing debt balances, and limiting how often you apply for new credit could work in your favor for getting a higher credit limit with Affirm or any other lender.

Does Affirm increase your limit

Conversation. The prequalified amount can increase, decrease, or go away depending on several factors outside Affirm, such as credit usage, credit score, etc. Your prequalification amount refreshes every 7 days and results may vary.

Does everyone get approved for Affirm

Affirm doesn't approve every application, so you may be approved for a loan at some stores but not others, or may already have an Affirm loan but not be approved for another right now.

Is Affirm easy to get approved

You won't get approved if you don't have good credit — You'll need to have a good credit score to qualify for an Affirm loan. You may have to pay a downpayment — For some borrowers, Affirm asks for a down payment that must be paid during purchase. This can be anywhere from 10% – 50% of the cost of the item.

Can I borrow cash from Affirm

You may borrow anywhere from $0 to $17,500, but the amount may vary by store. 1 Affirm offers personal loan terms for three, six, or 12 months, but depending on the retailer and the size of the purchase, terms could be as short as two weeks to three months, or as long as 48 months.

Can you borrow cash from Afterpay

Afterpay offers interest-free financing on its point-of-sale loans. All you need to do is make installment payments on or before each due date. If you borrow $6,000, you are only responsible for repaying $6,000. Even if you miss a payment, you are not charged interest, since there is no interest rate.

How do you get approved for money on Affirm

How to get approved for Affirm. To be eligible for Affirm, you'll need to be at least 18 years old, be a U.S. resident, have a Social Security number and have a U.S.-registered phone number that receives texts. According to Affirm, loan approval decisions are instantaneous.

Does Affirm loan hurt credit

Affirm checks your credit with a soft credit pull, which doesn't hurt your credit score. Though there's no minimum requirement, Affirm considers your credit score as part of your application.

Is Affirm good or bad for your credit

If you default on your Affirm loan or make late payments, you risk decreasing your credit score. But your credit score could take a hit even if you're paying your POS loan on time. There are a few reasons why a POS loan could hurt your score.

How long does Affirm take to increase credit limit

The prequalified amount can increase, decrease, or go away depending on several factors outside Affirm, such as credit usage, credit score, etc. Your prequalification amount refreshes every 7 days and results may vary.

What is the biggest Affirm loan

Our review covers everything you need to know about Affirm and how to decide if it's right for you. Affirm offers APRs between 0% to 36% depending on your credit history. You may borrow anywhere from $0 to $17,500, but the amount may vary by store.

Does Amazon Affirm build credit

No, your credit score won't be affected when you create an Affirm account or check your eligibility. If you decide to buy with monthly payments through Affirm, your payments may be reported to credit bureaus. You can find more information in Affirm's help center.

How does Affirm prequalify you

Prequalification customer flow

Signs in or creates a new Affirm account. Verifies their income if it is their first time at this merchant. Sees the amount they are prequalified for and receives an email and SMS.

What makes you not eligible for Affirm

Your loan application may be affected by any or all of the following: Your credit score. Your credit utilization. Your payment history with Affirm, including overdue payments, deferred payment, and loan delinquency.