Does Airbnb count as travel credit?

Does Airbnb count as travel for credit card

Airbnb usually codes as travel. For example, Chase and Wells Fargo classify Airbnb purchases under homeshare. If you're a Delta SkyMiles member, you may use the Delta Airbnb platform to earn 1 mile per dollar on qualifying Airbnb stays globally in addition to the rewards earned from your credit card.

Cached

Does Airbnb count as a travel purchase

The travel category encompasses a wide variety of purchases, from hotels and airfare (which doesn't have to be booked directly with the airline) to cruises, tolls and even parking fees. Uber and Airbnb purchases count as travel as well.

How does Airbnb travel credit work

When you make your next booking, Airbnb will fund and issue a promotional coupon credit in the Offer Amount (the “Travel Credit”). Your next booking must also have a check-in date no later than the Expiration Date to use the Travel Credit.

Cached

How do I get travel credit on Airbnb

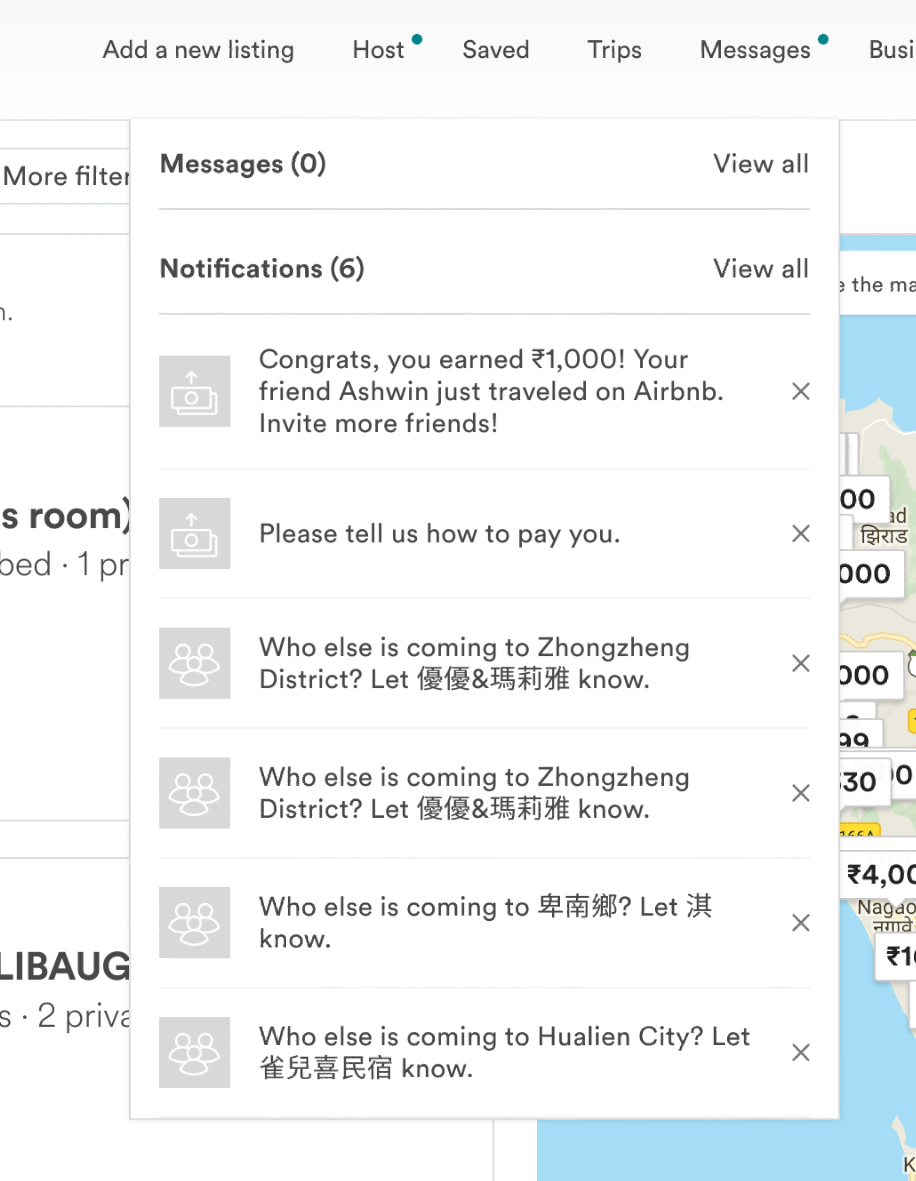

If your friend signed up for Airbnb using your referral link and completed a qualifying reservation, travel credit will be automatically added to your account. Your travel credit will appear on the checkout page when you pay for your next reservation.

Does Airbnb count as travel for Capital One

Plus, Capital One miles don't expire as long as you keep your account open. Capital One miles are extra-useful because you can redeem them for a wide variety of travel costs, including Airbnb stays, Uber rides and flights or hotels with no blackout dates.

Does Airbnb count as proof of residence

Yes, it is possible to establish residency in a new state while living in an AirBnB or hotel. The key is to make sure you have proof of your address and that you are actively engaging with the community.

Can you write off Airbnb travel expenses

Tax deductions are available for Airbnb commissions and fees, as well as for most situations, mortgage interest, insurance premiums, and property taxes. Additional indirect costs, like rent, travel costs, utilities, and software subscriptions for property management, may also be deducted.

Does Airbnb count as travel Capital One venture

No airline or credit card company makes it easier to redeem points and miles toward travel than Capital One. Just charge your flight, hotel, Airbnb, or almost any other travel expense to your Capital One card.

How to use Airbnb for business travel

Booking your business travelConfirm your company has enrolled in Airbnb for Work.Add your work email address to your profile.Change your booking permissions to allow others to book trips for you.Go to Booking permissions.Under Booking permissions, choose Manage.

What is the Airbnb travel prize

The Airbnb Athlete Travel Grant, which was launched in 2023, offered up to 500 athletes a year $2,000 USD travel grant to use exclusively on airbnb.com as they travel, train and compete.

Does Airbnb count as travel Capital One

The Capital One Venture X card is Capital One's ultra-premium credit card. It has the ability to earn 2x miles on Airbnb and Vrbo bookings, as this card earns 2x on all other purchases. In addition, there's an up to $300 statement credit for all bookings made through Capital One Travel.

Does Airbnb count as income

Pay self-employment taxes. When you rent out your home, make bookings and provide amenities or services, like coffee or breakfast, the IRS may treat you as being self-employed in the vacation rental business. If you are self-employed, you have to pay self-employment taxes, as well as income taxes.

Do you host on Airbnb as part of a company

If you offer accommodations as a company or sole proprietor in the offline world, then your hosting activities on Airbnb will most likely also constitute a business activity. You also typically act as a professional if you regularly host on Airbnb over a longer period of time in order to make a profit.

Can you use an Airbnb as a permanent address

Many states require that your permanent residence has certain documents such as a deed, lease agreement, or utility bill in order to receive a valid driver's license. An Airbnb address does not typically meet these requirements and may not qualify for a valid driver's license in certain states.

Does owning an Airbnb count as a business

When you rent out your home, make bookings and provide amenities or services, like coffee or breakfast, the IRS may treat you as being self-employed in the vacation rental business. If you are self-employed, you have to pay self-employment taxes, as well as income taxes.

How do I record Airbnb expenses

5 Tips for Tracking Airbnb Income and ExpensesCreate a Business Bank Account.Selecting the Best Credit Card Processor.Employ an Accountant.Keep Your Receipts.Automate Your Airbnb Income and Expenses.Cleaning supplies and services.Maintenance and repairs.Mortgage, insurance, and property taxes.

Are Airbnb supplies tax deductible

Examples of the most common Airbnb tax-deductible expenses are: Service fees charged by a property management company, real estate agent, vacation rental software solution, and/or an online travel agency (OTA) like Airbnb etc. Cleaning supplies.

Does Airbnb code as travel Capital One

Just charge your flight, hotel, Airbnb, or almost any other travel expense to your Capital One card. A few days later, you can go in and remove that charge from your statement using miles. Read our step-by-step guide to covering travel purchases to see how it's done!

Can you claim Airbnb as a business

Your receipts are your first pieces of evidence for your expenditures. These help validate your deductions to the IRS, and, therefore, help lower your taxable Airbnb income. With these receipts, you can show that your expenses were for your business rather than your personal use.

Can I use Airbnb for my business

Joining Airbnb for Work makes it easy to book and manage company travel, with access to listings around the world for short or extended business travel. If you manage your employer's travel or human resources department, you can enroll your company in Airbnb for Work.