Does Ally Auto require proof of income?

Does Ally require proof of income

Your income, assets and credit history will be verified by an underwriter, and you will likely have to provide W2s, income tax returns, pay stubs and bank statements. Expect a hard credit check, as well.

Is Ally Financial hard to get approved

Ally Financial Approval Odds

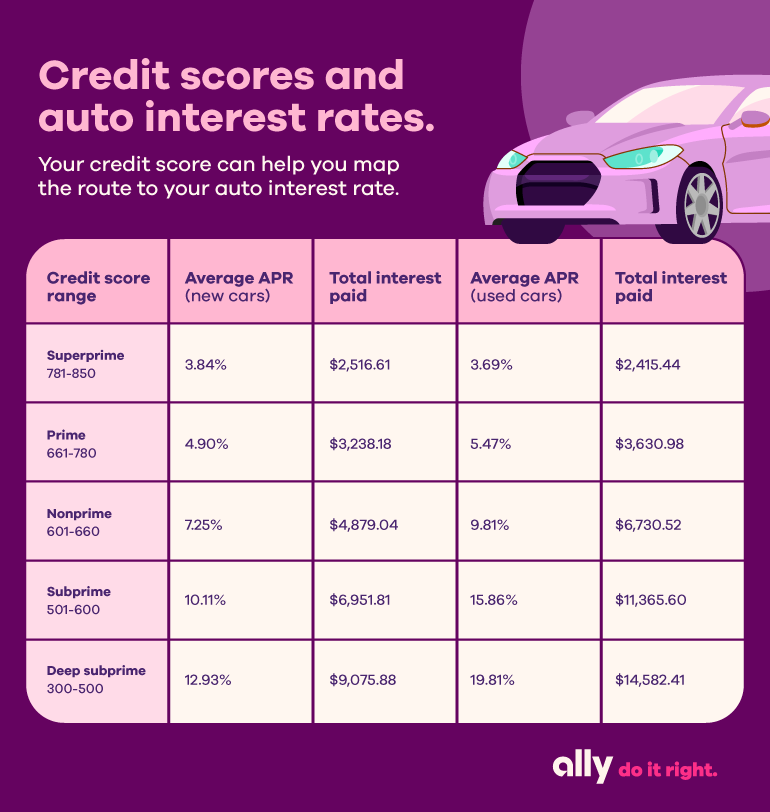

You need a FICO score above 750 for your best approval odds with Ally Financial.

What credit score do you need for an Ally auto loan

What credit score do you need for an Ally Bank auto loan You'll be eligible for better rates with a credit score of 620 or higher, but Ally has extended loan offers to consumers with credit scores as low as 520.

Cached

What proof of income do I need for a car loan

When you're applying for your loan, you'll want to take copies of your pay stubs from the last month, showing the total of what you've been paid year to date. You may also be able to use bank statements to show proof of income — be prepared with up to six months of statements — or a W-2.

Is Ally a good bank to finance a car

Ally Financial auto loan earned a 3.5 out of 5.0 Stars. Ally is a decent option for those with good credit and offers a variety of car buying options. Their mobile app overall has many perks and high ratings.

Can I open an Ally account with no money

At Ally, no initial deposit amount is required, and we only ask to help you plan ahead. If you want to open an account with Ally, all you'll generally need is about five minutes.

What is the downside of Ally Bank

Cons: Ally does not have any physical branches. For customers looking for a more personal banking experience, they won't be able to visit a brick-and-mortar location as an Ally customer. For less digitally-savvy customers, this could be a major drawback.

Is Ally a good bank for car loan

Ally Financial auto loan earned a 3.5 out of 5.0 Stars. Ally is a decent option for those with good credit and offers a variety of car buying options. Their mobile app overall has many perks and high ratings. However, all financing for loans must be done through dealerships, which limits borrowers.

How do I get approved for Ally Bank

You have to be a citizen or a legal permanent resident of the United States. You must be at least 18 years old. You must have a Social Security number to open an Ally Invest account. For bank accounts, you can use your Social Security number or your Taxpayer Identification number.

Can I finance a car without pay stubs

But do you need pay stubs for an auto loan No — other options may be acceptable, including current bank statements, W-2s, and 1099s. If you're self-employed, your most recent two years of income tax returns can also help prove to a lender that you have the income to keep up with a car loan payment.

Do auto loan companies verify income

When it's time to apply for auto financing, you will most likely be asked for documentation to verify your income. If you have great credit and have worked in the same job for years, this may not be an issue.

How do you prequalify for Ally auto

We do what's called a 'soft credit pull' for prequalification. That lets us take a quick look at your credit profile without impacting your score. We'll wait to do a 'hard credit pull' once you decide to officially apply for credit. This lets us see all the information we need to approve you for financing.

What are the minimum requirements for Ally Bank

FAQsYou have to be a citizen or a legal permanent resident of the United States.You must be at least 18 years old.You must have a Social Security number to open an Ally Invest account.For bank accounts, you can use your Social Security number or your Taxpayer Identification number.You need a U.S. street address.

How long does Ally take to approve account

They'll review it and respond to your new account application within 24 hours. It's that simple.

Does Ally hurt your credit

When you apply for a personal loan from Ally Lending, they will conduct a soft credit check only — which means your credit score will not be affected. However, how you manage the loan, such as if you pay on time, can affect your credit score in the long term.

How long does Ally take to approve you

They'll review it and respond to your new account application within 24 hours. It's that simple.

How long does Ally Bank approval take

Get pre-approved in as little as 3 minutes.

We'll get you a personalized quote right away with no impact to your credit score, and a pre-approval letter you can use as leverage when house hunting.

Can you get a car without pay stubs or bank statements

Income: Current pay stubs often provide proof of income for car loans. But do you need pay stubs for an auto loan No — other options may be acceptable, including current bank statements, W-2s, and 1099s.

Does carmax require proof of income

To complete your transaction, you may be required to provide any or all of the following: Valid driver's license. Proof of insurance (required for all vehicle sales) Proof of income.

What loan does not verify income

Best Loans With No Income Verification or Low Income Required

| Lender | Minimum Annual Income Required | Loan Amounts |

|---|---|---|

| Upgrade | No verification | $1,000–$50,000 |

| Universal Credit | No verification | $1,000–$50,000 |

| Best Egg | $3,500 | $2,000–$50,000 |

| Happy Money | 300% of monthly income in bank account | $5,000–$40,000 |