Does Amazon business credit card do a hard inquiry?

Does Amazon business Prime card report to personal credit

No, Amazon Business Prime does not report to credit bureaus. Amazon Business Prime is a subscription service that offers discounted shipping rates and other benefits for businesses that order products from Amazon.

Cached

Does a business credit card count as a hard inquiry

Yes, business credit cards require a hard pull on your personal credit report. Most business credit cards require a personal guarantee, meaning the primary cardholder will pay back any debts that the business cannot, so the issuer needs to evaluate the applicant's personal creditworthiness.

What credit score is needed for Amazon business line of credit

Minimum qualification requirements are a 625 or higher FICO score, six months or more in business, monthly revenue of $10,000 and operation in the U.S. Fixed monthly or weekly payments can be made over six to 12 months.

Does Amazon business credit card report to credit bureaus

Yes, the Amazon Business Card reports to all three credit bureaus.

Do they run your personal credit for a business credit card

Applying for your first business credit card will trigger a hard credit inquiry on your personal credit, which could lower your score by a few points. And lenders might continue to conduct personal credit inquiries when you apply for additional small-business credit cards or small business loans.

Does Amazon business credit card require personal guarantee

Small business owners that can prove steady monthly revenues can apply for a Divvy corporate visa card. No personal guarantee is required! All cardholders can also earn up to 7x reward points on hotels and 5x on restaurant purchases.

What credit card company does not do hard inquiry

Best Credit Cards with No Credit Check Comparison

| Credit Card | Annual Fee | Min. Deposit |

|---|---|---|

| OpenSky® Plus Secured Visa® Credit Card | $0 | $300 |

| OpenSky® Secured Visa® Credit Card | $35 | $200 |

| First Progress Platinum Elite Mastercard® Secured Credit Card | $29 | $200 |

| First Progress Platinum Select Mastercard® Secured Credit Card | $39 | $200 |

Do business credit cards check personal credit

When you apply for a business credit card, the card issuer may consider both your business's track record and your personal credit. This could include running a hard credit check on your personal credit, which could drop your credit scores by a few points.

Can I get an Amazon credit card with a 630 credit score

The Amazon.com Credit Card credit score requirement is 700 or better. That means people with at least good credit have a shot at getting approved for this card. The Amazon.com Store Card, on the other hand, requires a 640+ credit score (fair credit).

What bank does Amazon business credit card use

Customer Service for Financial Institutions

| Card | Details |

|---|---|

| Amazon.com Business Rewards Visa Card | Chase Bank http://www.chase.com/businesscards 1-800-346-5538 24 hours a day, 7 days a week |

| Amazon.com Store Card | Synchrony Bank http://www.syncbank.com/amazon 866-634-8379 24 hours a day, 7 days a week |

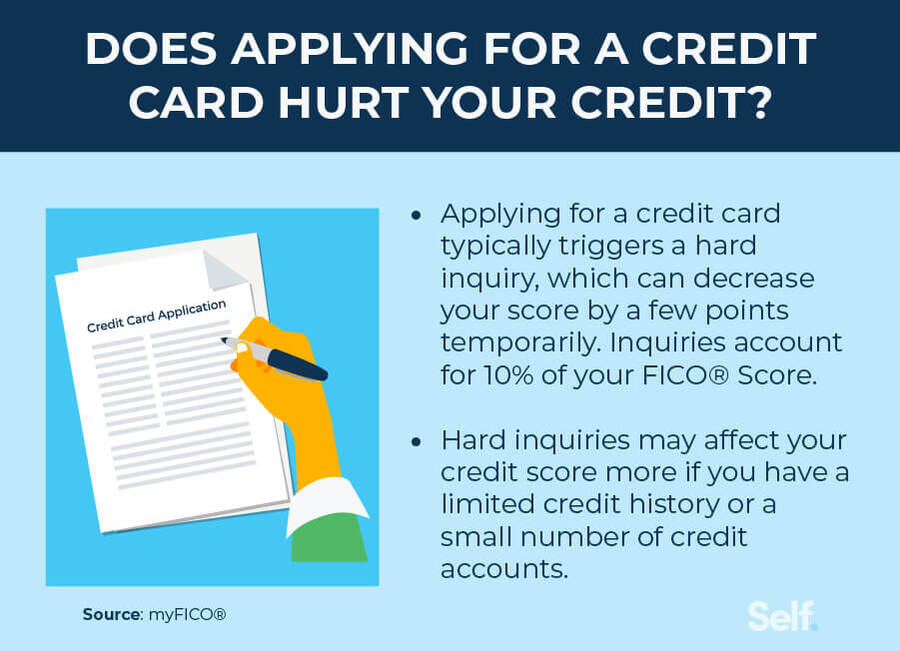

Does applying for a business credit card affect your credit score

Applying for your first business credit card will trigger a hard credit inquiry on your personal credit, which could lower your score by a few points. And lenders might continue to conduct personal credit inquiries when you apply for additional small-business credit cards or small business loans.

Does Chase pull personal credit for business cards

The credit score needed for a Chase business card is typically 700 or higher. This means you need at least good credit for high chances of approval. Your personal credit score will still be taken into account, even though you're applying for a business credit card.

What are 5 things credit card companies don t want you to know

7 Things Your Credit Card Company Doesn't Want You to Know#1: You're the boss.#2: You can lower your current interest rate.#3: You can play hard to get before you apply for a new card.#4: You don't actually get 45 days' notice when your bank decides to raise your interest rate.#5: You can get a late fee removed.

What’s one of the hardest credit cards to get

Centurion® Card from American Express

Why it's one of the hardest credit cards to get: The hardest credit card to get is the American Express Centurion Card. Known simply as the “Black Card,” you need an invitation to get Amex Centurion.

Is business credit score linked to personal

Is a business credit score different to a personal credit score Yes, the two scores are separate and they measure different things. Your personal credit score measures your ability to pay back a debt, and a business credit score looks at the ability of your company to do so.

Does personal credit affect business credit LLC

Are you applying for a business loan Commercial lenders may look at both your business and personal credit scores before they approve your application. If you have poor personal credit and you're wondering if it will affect your approval or the terms of your commercial loan, the answer is yes, it can.

What FICO score does Amazon use

The credit score ranges Amazon provides are based on commonly used scores according to Amazon. They are not traditional FICO® Score ranges. FICO® has its own score ranges, which differ from Amazon's, and individual lenders may have different cutoffs as well.

How much credit should I have for Amazon credit card

To get approved for this card, you'll need to have a good credit score of at least 670, though having a higher one certainly won't hurt your chances.

Does Amazon business offer credit

Pay by Invoice gives eligible Amazon Business customers an extended due date for payment by purchasing on credit. You can improve cash flow and streamline purchasing and payments processes using this method.

Does getting denied for a business credit card hurt your credit score

Being denied for a credit card doesn't hurt your credit score. But the hard inquiry from submitting an application can cause your score to decrease.