Does Amazon Store Card do hard pull for increase?

How often does Amazon Store Card increase limit

every six to 12 months

The Amazon.com Credit Card will increase your credit limit no more than once every six months if you ask for an increase yourself. You can also wait to see if you receive an automatic credit limit increase. This may happen as often as every six to 12 months.

Is Amazon Store Card a soft pull

Yes, the Amazon Store Card will do a hard pull, also known as a hard inquiry, which may cause your credit score to temporarily go down a few points. You will need a credit score of at least 640 to get it, which is on par with what most store cards require.

Does the Amazon Prime card give credit increases

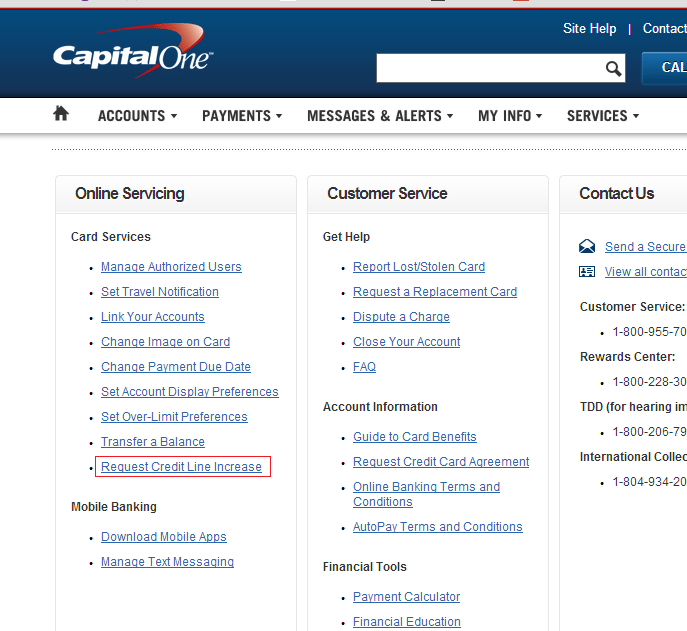

You may request an increase in credit limit by calling Chase's Amazon.com credit card customer service at (888) 247-4080 to be connected to a representative. You may also wait for Chase to automatically give you a credit limit increase without having to ask.

How do I increase my credit on my Chase Amazon card

You may request an increase to your credit line by calling the number on the back of your credit card; you cannot submit a request online at this time. Your request for an increase to your credit limit is subject to the approval of Chase.

What is the minimum credit limit for Amazon Store Card

$500

Editorial and user-generated content is not provided, reviewed or endorsed by any company. The minimun credit limit on the Amazon.com Credit Card is $500, but your credit limit will depend on your credit score and income. But particularly creditworthy applicants could get limits a lot higher than that.

What is the maximum amount Amazon card

Amazon.com Gift Cards are available in $15, $25, $50, and $100 denominations at participating grocery, drug, and convenience stores throughout the U.S. At select stores, you can also choose a variable denomination card, which can be loaded with any amount between $25 and $500.

What score do you need for Amazon Store Card

670 to 739

Typically, you can qualify for Synchrony's Amazon store cards with a fair credit score (580 to 669). On the other hand, you'll likely need at least a good credit score (670 to 739) to qualify for one of the Amazon Visa cards from Chase.

Do store cards do hard pulls

In addition, when applying for a store credit card, the issuer may run a hard inquiry on your credit report, which can temporarily drop your score a few points.

What is the minimum credit score for Amazon Prime Rewards credit card

700 or better

The Amazon.com Credit Card credit score requirement is 700 or better. That means people with at least good credit have a shot at getting approved for this card.

Can I go over my Amazon Store Card limit

No, the Amazon.com Store Card doesn't have a daily credit limit. You can, however, set a daily spending limit for your card by signing in to your online banking account. If you reach your set daily limit, the issuer won't allow further charges to your account until the following day.

How often does Chase Prime increase credit limit

every 6 to 12 months

Chase, like most other banks, will automatically increase your credit if you are using your card responsibly and paying your balance in full and on time. These automatic bumps generally happen every 6 to 12 months. If you're patient, you might get a credit limit increase without doing anything!

How often does Chase give credit limit increases

6 to 12 consecutive months

This typically happens after 6 to 12 consecutive months of on-time bill payments. If you do get an increase, it may help your credit score since your credit utilization ratio could decrease when your credit limit gets higher.

Does an Amazon Store Card have a limit

No, the Amazon.com Store Card doesn't have a daily credit limit. You can, however, set a daily spending limit for your card by signing in to your online banking account. If you reach your set daily limit, the issuer won't allow further charges to your account until the following day.

What FICO score does Amazon use

The credit score ranges Amazon provides are based on commonly used scores according to Amazon. They are not traditional FICO® Score ranges. FICO® has its own score ranges, which differ from Amazon's, and individual lenders may have different cutoffs as well.

Can I go over my Amazon store card limit

No, the Amazon.com Store Card doesn't have a daily credit limit. You can, however, set a daily spending limit for your card by signing in to your online banking account. If you reach your set daily limit, the issuer won't allow further charges to your account until the following day.

Does Amazon credit card let you go over limit

Over-the-Credit- Limit Fee Ensure your total balance stays below your credit limit. If you agree to allow us to charge overlimit fees, we may charge such a fee when your account balance goes over limit. We may charge this fee even though your balance is over limit because of a transaction we allowed.

Can I get an Amazon credit card with 580 credit score

The Amazon.com Credit Card credit score requirement is 700 or better. That means people with at least good credit have a shot at getting approved for this card. The Amazon.com Store Card, on the other hand, requires a 640+ credit score (fair credit).

How much credit should I have for Amazon credit card

To get approved for this card, you'll need to have a good credit score of at least 670, though having a higher one certainly won't hurt your chances.

Are store cards easier to get approved for

Retail credit cards are generally easier credit cards to get and may come with points, coupons or other perks from the retailer. The tradeoff is that these cards usually have higher APRs and lower credit limits than many unsecured credit cards offered by major credit card companies.

What is one disadvantage of using store cards

Store credit cards often have a lower credit limit than other credit cards. If you carry a balance, this can harm your credit score. For example, if your credit limit is $2,000 and you're carrying a $2,000 balance, your credit utilization will be 100%, which is well above the recommended 30%.