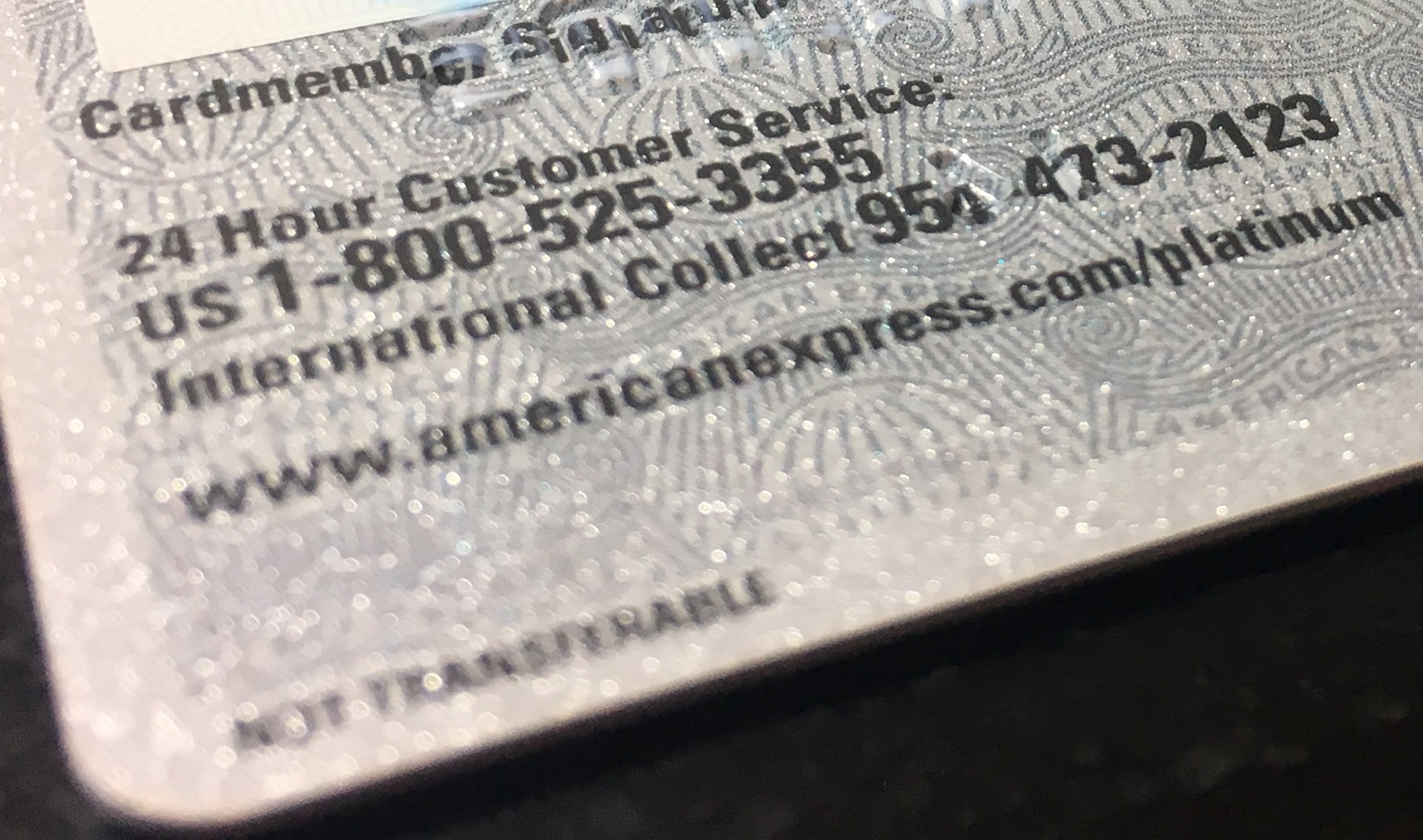

Does Amex have 24hr customer service?

How do I talk to a live person at AmEx

Personal CheckingCustomer Service. Get help with your existing Personal Checking account. 1-877-221-2639. 24/724/7.Check Application Status. Ask about the status of a new account. 1-888-556-2436.Open an Account. If you already have a personal Card, you can learn more and apply online. 1-888-556-2436.

Cached

Does American Express use the 5 24 rule

Does AmEx have a 5/24 rule No; in fact, the AmEx welcome bonus rules work differently than Chase.

Does American Express have a call center

American Express has a few customer service lines depending on your card type: Personal cards — 800-528-4800. Business cards — 800-492-3344.

Cached

What is AmEx cutoff time

What is the latest date I can schedule a payment using the Payment Centre in Online Services The last date available to schedule a payment online is your Payment Due Date before 8 PM Eastern time. Please reference your Card Account Summary Page and on your Statement for this specific date.

Is American Express concierge 24 hours

The Platinum Concierge service is your 24/7 travel & lifestyle service. Whether you need changes to your travel arrangements or would like to discover those places only the locals know, your Platinum Concierge is the easy way to unlock more of your Card benefits, day or night.

Is Direct Express open 24 hours

If you have questions or need assistance with your Direct Express® card, contact Direct Express® customer service 24 hours a day, 7 days a week, by calling the number on the back of your card. Call 1-888-741-1115 if your card starts with 5332 or, call 886-606-3311 if your card starts with 5115.

What is the 2 90 rule for American Express

Amex 2-in-90 rule

American Express restricts card approvals to no more than two within 90 days. You'll want to coordinate this restriction with the 1-in-5 rule to increase your odds of being approved for multiple Amex cards. Unfortunately, there are no exceptions to the Amex 2-in-90 rule.

What is the minimum credit score for Amex EveryDay

To apply for Amex EveryDay® Credit Card from American Express, you should have good credit, meaning a FICO® Score of 670 or higher. American Express will look at several factors in addition to your credit score, but your credit is a key part of whether your application is approved or denied.

Does Amex always side with the customer

American Express is incentivized to keep their customers happy. So, if a customer files an Amex chargeback, the company has good reason to side with their customer over the merchant. If the customer's story matches any of their predetermined reason codes, Amex is likely to let the chargeback go forward.

What is the phone number for serve customer service

If you have any questions or cannot successfully replace your card online, contact Customer Service to request a replacement card: For Serve® American Express® Prepaid Debit Accounts, call 1-800-954-0559. For the Serve® Pay As You Go Visa® Prepaid Card, call 1-833-729-9646.

Does a late Amex payment affect credit score

A payment missed for an entire 30-day billing cycle will likely be reported to the three credit bureaus and appear on their reports. Unfortunately, the better a score is, the more damage a missed payment might do.

What does 24 hour concierge service mean

With 24-hour concierge services, you no longer have to worry about clearing your schedule to do your own dry cleaning. Simply drop off your clothing at the front desk, and your concierge is able to send them to the cleaners, and hand-deliver them to your door when they're ready. Available 24/7 for Inquiries.

How much does a 24 hour concierge cost

For many of these buildings, a concierge is required on-site 24 hours a day, 7 days a week. This means that over the course of a week, 24 hour on-site concierge services can cost management anywhere from $4000 to $6000. Over the course of a year, that's well over $200,000.

How do you get straight to a representative

Things You Should KnowDial 0, *, or # multiple times. This can take you straight to an operator on some systems.Say "I would like to speak to a person". Or, try "operator," "agent," and “representative.”Call a local branch. Sometimes you can get a real person faster this way!

How can I get money off my Direct Express card without a card

You cannot withdraw money from Direct Express without the card. The only ways to withdraw money are at an ATM, by obtaining cash back at a retail location, or by visiting any bank or credit union that displays the MasterCard acceptance mark and getting cash from a teller.

What is the 1 in 5 Amex rule

1 in 5 Rule

You can only get approved for one credit card every five days. The 1 in 5 rule doesn't affect charge cards, so you could apply for one credit card and X charge cards on the same day and be fine. Keep in mind that you'll have to manage the minimum spend requirements.

Will American Express give you a second chance

Yes, American Express does have a reconsideration line for applicants to call and request a second review of their denied credit card application. The American Express reconsideration line is (800) 567-1083.

What is the easiest Amex card to get approved for

Which Amex card is the easiest to get The easiest Amex cards to get are ones with a lower minimum spending requirement for rewards, as well as a low annual fee or no annual fee. Examples include the Blue Cash Everyday Card from American Express and the American Express Cash Magnet Card.

Can I get an Amex with 500 credit score

The American Express credit score requirement is of at least 700, depending on the card. That means people with good to excellent credit are eligible to get approved for an American Express credit card.

Why don t most people take Amex

The different fees often make or break a deal for a merchant. This is why many merchants, especially small businesses, don't accept American Express. American Express' interchange fee is just too high. Providers like Visa and Mastercard charge between 1.15% and 2.5%, while Amex charges merchants between 1.43% and 3.3%.