Does Bank of America do a hard credit check?

Is Bank of America a soft pull

Once you submit the preapproval form, Bank of America will do a soft inquiry of your credit, meaning that they'll take a quick peek at your current credit health Because it's not a hard inquiry, it will not show up on your credit report or have a negative impact on your credit score.

Does Bank of America run a credit check

Bank of America is most likely to check your Experian credit report when you submit a credit card application. After Experian, Bank of America will turn to Equifax. The bank will only use TransUnion data if necessary.

Cached

Does banks do a hard credit check

You're okay: Most banks don't pull a hard credit check to qualify you for a checking account. However, they might look into your ChexSystems report, a banking-industry way of peering into an applicant's history.

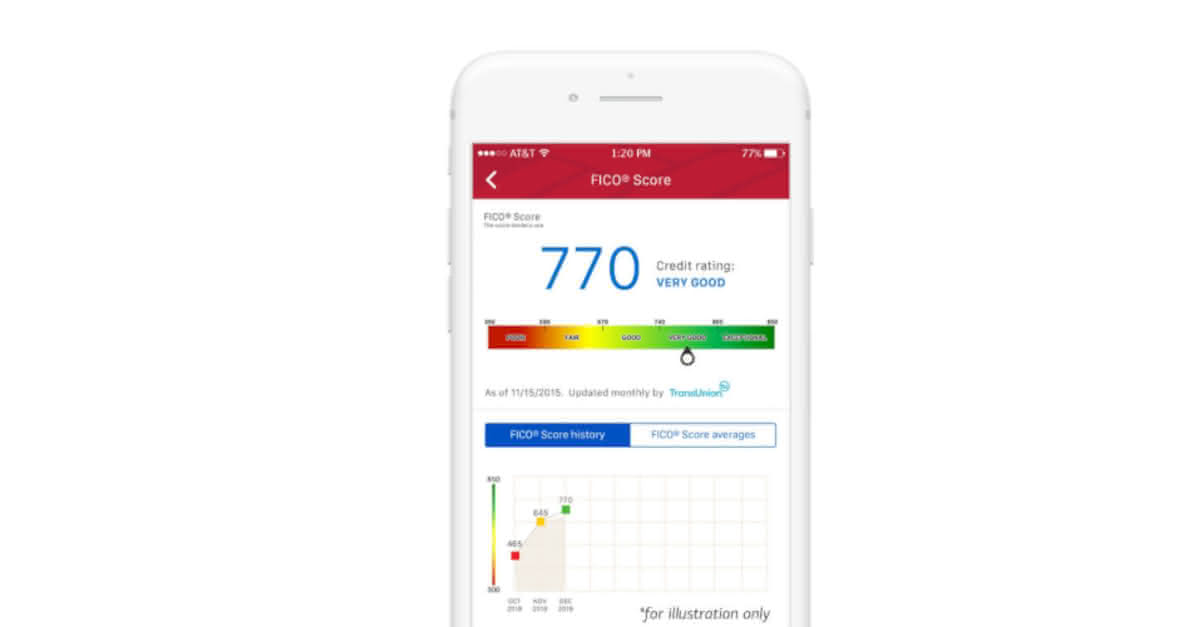

What credit score does Bank of America need

You will need an excellent credit score (740 and above) to be approved for the best Bank of America credit cards. However, Bank of America offers cards for consumers whose scores are as low as 300.

Cached

Does Bank of America increase credit limit without hard pull

The good news is a credit limit increase with Bank of America doesn't trigger a hard inquiry on your credit report. No matter if you request the increase or the bank initiates first, it won't impact your credit score, which means it never hurts to try for that higher credit limit.

Does Bank of America do a hard or soft pull for credit card increase

Bank of America's automatic credit limit increases involve soft credit pulls and have no bearing on your credit score. However, if you request a higher limit, Bank of America might carry out a hard pull.

Will Bank of America hire me if I have bad credit

It is not a requirement to have good credit to work at Bank of America.

Does every Bank do a credit check to open account

It is unlikely that you will be refused a basic bank account because of your credit rating. Although the bank may not be checking your credit score, they will still need to identify you with your ID and address and conduct fraud checks to make sure you are who you say you are.

Does Bank of America do a hard pull for credit limit increase

Bank of America does a hard credit pull for most credit limit increase requests, so be aware of this. This means that it will show up as an inquiry on your credit report. However, a hard pull isn't usually done on limit increase requests of $2,000 or less.

How can I avoid getting a hard credit check

Ways to avoid hard inquiries:Brainstorm before you apply for any new credit. Think twice if you really need that credit or not.Do your rate shopping for any one form of credit in a short span of time.Check your credit report from time to time for any unauthorized hard inquiry.

Can I get a credit card with Bank of America with a 600 credit score

The Bank of America credit score requirement is 750 or higher for the best Bank of America credit card offers, though other options are available for people with lower scores. It is possible to get approved for a credit card from Bank of America with a bad credit score, for example.

Does Bank of America do hard pull for credit increase

Bank of America does a hard credit pull for most credit limit increase requests, so be aware of this. This means that it will show up as an inquiry on your credit report. However, a hard pull isn't usually done on limit increase requests of $2,000 or less.

How much does credit drop after hard pull

about five points

How does a hard inquiry affect credit While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good credit history, the impact may be even less.

Is Bank of America requesting a credit line increase a soft pull

No, a Bank of America credit limit increase will not result in a soft pull, unless the bank raised your credit limit automatically. Therefore, if you request a credit limit increase, this will result in a hard pull, which will temporarily drop your credit score by a few points.

Can you be denied a job because of bad credit

Most job seekers don't' even know this, and it raises a really important question is: can you be denied a job because of bad credit The short answer is yes, you can. Also, keep in mind that bad credit is different than no credit — but in this case, bad credit can be the culprit.

Is it hard to get a job with Bank of America

No, it is not hard to get a job at Bank of America. Being one of the largest banking institutions in the country, they have a myriad of branches in nearly every state. Entry-level roles in the company's banks are fairly easy to obtain.

What bank does not do a credit check to open an account

Best Online Banks with no Credit Check

| Bank Name | Minimum opening deposit | Link |

|---|---|---|

| 👍 Chime | None | Learn More |

| NorthOne | None | Learn More |

| Extra | None | Learn More |

| Wise Business | $10 | Learn More |

Does Bank of America pull credit for credit line increase

Bank of America does a hard credit pull for most credit limit increase requests, so be aware of this. This means that it will show up as an inquiry on your credit report. However, a hard pull isn't usually done on limit increase requests of $2,000 or less.

How much does a hard credit check lower your score

A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant. As FICO explains: “For most people, one additional credit inquiry will take less than five points off their FICO Scores.”

How many points do you lose for a hard credit check

about five points

How does a hard inquiry affect credit While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good credit history, the impact may be even less.