Does Bank of America let you transfer to other banks?

Does Bank of America allow bank transfers

Yes, someone with your account information can wire funds directly to your Bank of America account. You will need to provide your account number and wire transfer routing number.

Cached

How much can you transfer from Bank of America to another bank

How Much Can I Wire Transfer From Bank of America Bank of America lists a $1,000-per-transaction limit for outbound domestic and international wire transfers done by consumers, and a $5,000-per-transaction limit for outbound domestic and international wire transfers done by small businesses.

Cached

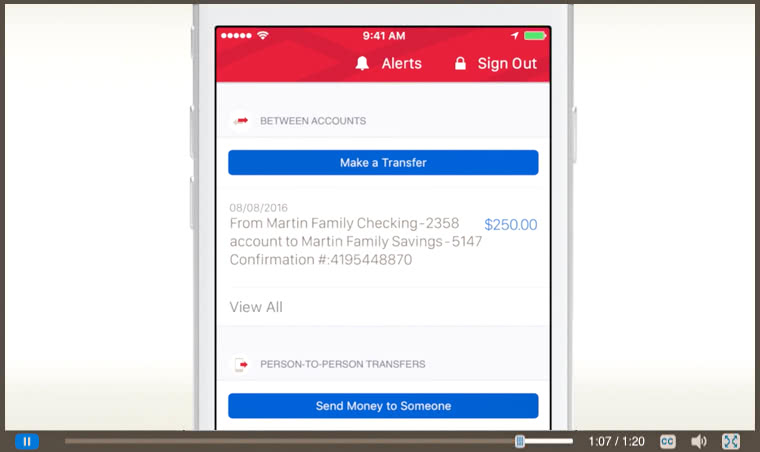

How to transfer money from Bank of America to other banks with app

How to send money using our Mobile Banking appfootnote 3To enroll for mobile money transfers, open the Mobile Banking app and sign in.Select Transfers and then hit Begin Setup–you only have to do this once.On the next screen, select Get Started and then read and accept the agreement.Select Add a Recipient.

How much can I transfer to another Bank of America customer

Consumer wire transfer limits

| Transfer type | Sending limits | Receiving Limits |

|---|---|---|

| Same Business Day Domestic | $1,000 (per 24 hours) | N/A |

| Next Business Day ACH | $1,000 (per 24 hours) | $10,000 (per 24 hours), $50,000 (monthly) |

| Three Business Day ACH | $1,000 (per 24 hours) | $10,000 (per 24 hours), $50,000 (monthly) |

Cached

How to set up transfer from Bank of America to another bank

To perform a transfer, sign in to your account and select Transfers from the navigation menu. You'll need to know the account number and transit routing number of the recipient.

Does Bank of America charge to transfer money between accounts

When transferring domestically, Bank of America charges $15 for each incoming wire transfer, and $30 for each outgoing wire transfer.

Can I transfer $10000 from one bank to another

In summary, wire transfers over $10,000 are subject to reporting requirements under the Bank Secrecy Act. Financial institutions must file a Currency Transaction Report for any transaction over $10,000, and failure to comply with these requirements can result in significant penalties.

How much does Bank of America charge for too many transfers

Make a total of 6 transfers and withdrawals each monthly statement cycle with no Withdrawal Limit Fee. A $10 fee applies for each withdrawal or transfer exceeding 6 in a monthly statement cycle.

How do I send money from Bank of America to another account

To perform a transfer, sign in to your account and select Transfers from the navigation menu. You'll need to know the account number and transit routing number of the recipient.

How to transfer money from Bank of America app to another bank without Zelle

From the mobile app:

Select Pay & Transfer then Transfer between my accounts. Select the account you want to transfer From and then the account you want to transfer To. Enter the Amount you'd like to transfer. Enter the Date you want the transaction to occur and then tap Continue.

Can I transfer 10000 from one bank to another

In summary, wire transfers over $10,000 are subject to reporting requirements under the Bank Secrecy Act. Financial institutions must file a Currency Transaction Report for any transaction over $10,000, and failure to comply with these requirements can result in significant penalties.

Can I transfer money from one bank to another different bank

You can transfer money to accounts you own at the same or different banks. Wire transfers and ACH transfers allow you to move money between your account and someone else's account, either at the same bank or at different banks. You can also transfer money to mobile payment apps or friends and family via those apps.

How do I transfer money directly to another bank account

Steps for Transferring Money Between BanksLog into your bank's website or connect via the bank's app.Click on the transfer feature and choose transfer to another bank.Enter the routing and account numbers for the account at the other bank.Make the transfer.

How much does Bank of America charge for bank to bank transfers

Should I send my wire in foreign currency or U. S. dollars

| Wire type | Fee |

|---|---|

| Outbound domestic wire transfer | $30 |

| Outbound international wire sent in foreign currency, | $0 |

| Outbound international wire sent in U.S. dollars | $45 |

How do I avoid Bank of America transfer fees

Accounts that qualify for a fee waiver on incoming domestic wire transfers include:Bank of America Advantage Relationship Banking.Bank of America Advantage with Tiered Interest Checking.Bank of America Advantage Regular Checking accounts.Bank of America Preferred Rewards customers.

How do I transfer $20000 from one bank to another

Here are four ways to transfer money from your bank to another institution.Wire transfers.Mobile apps.Email money transfers (EMTs)Write a check.5 ways to grow your savings with automatic transfers.6 ways to deposit cash into someone else's account.

How do I transfer $50000 from one bank to another

Steps for Transferring Money Between BanksLog into your bank's website or connect via the bank's app.Click on the transfer feature and choose transfer to another bank.Enter the routing and account numbers for the account at the other bank.Make the transfer.

Can I withdraw $20000 from Bank of America

Unless your bank has set a withdrawal limit of its own, you are free to take as much out of your bank account as you would like. It is, after all, your money. Here's the catch: If you withdraw $10,000 or more, it will trigger federal reporting requirements.

How to transfer money from Bank of America account to another bank account online

Outside the united states to help make the process smooth and easy first gather the recipient's bank account information including bank account number account types such as checking or savings wire

What is the best way to transfer money between banks

A wire transfer is one of the fastest ways to transfer money electronically from one person to another through a bank or a nonbank provider such as Wise, formerly TransferWise. For a domestic wire transfer, you'll need the routing number, account number, the name of the recipient and possibly the recipient's address.