Does Blue Federal Credit Union use Zelle?

Does Zelle work with credit unions

The Zelle® app is only available to users whose banks and credit unions do not offer Zelle® directly to their customers. Because your financial institution offers Zelle®, you can use it directly through your banking app (and online banking, if available) to send and receive money. Was this helpful

Which bank is connected to Zelle

Zelle (/zɛl/) is a United States–based digital payments network run by a private financial services company owned by the banks Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo.

Can you use Zelle with any bank

Zelle is compatible with nearly all major banks, and most even have the service integrated into their mobile banking app. Consumers who download Zelle's standalone app must provide a phone number or email and debit card information to be able to receive and send funds.

Does Federal bank have Zelle

To get started, log in to Home Federal Bank's online banking or mobile app, navigate to Bill Pay and select "Send Money With Zelle®." Accept terms and conditions, enter your email address or U.S. mobile phone number, receive a one-time verification code, enter it and you're ready to start sending and receiving with …

Why don t credit unions use Zelle

Some credit unions won't join the bank-operated Zelle P2P network — even as their members demand the service. Zelle doesn't require a bank or credit union to participate in its network to allow it to receive funds; so even Zelle holdouts will see some activity on their accounts.

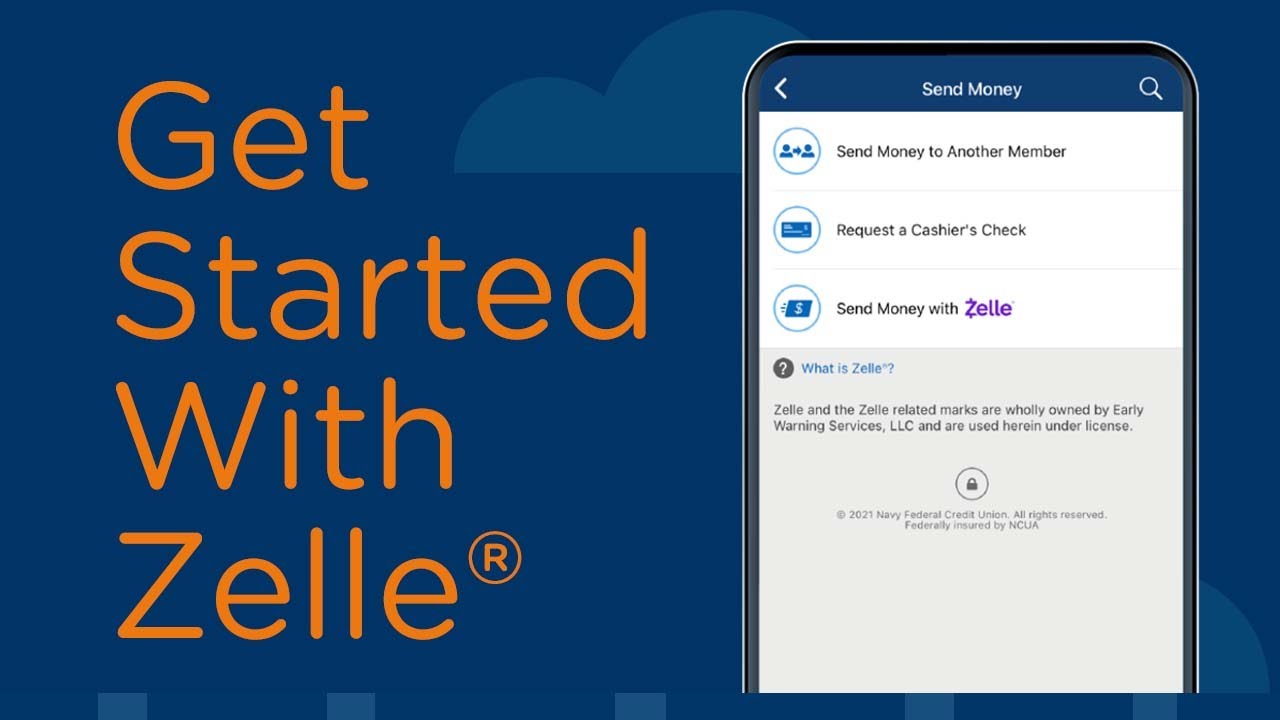

How do I set up Zelle with credit union

how to start using Zelle®Log into your account.Select Send Money with Zelle®Accept the terms and conditions.Select your U.S. mobile number or email address and deposit account.

How does Zelle work if your bank is not listed

If the recipient's financial institution does not offer Zelle®, the recipient can download the Zelle® app and enroll with basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account (not including U.S. territories).

How do I link my bank account to Zelle

If you have not yet enrolled your Zelle® profile, follow these simple steps:Click on the link provided in the payment notification.Select your bank or credit union.Follow the instructions provided on the page to enroll and receive your payment.

Why won t my bank let me use Zelle

Some debit cards don't yet have the capability to receive money in minutes. Those debit cards that are not 'fast funds enabled' can't be used with Zelle®. Your debit card may work in the future as more and more banks and credit unions are enabling their debit cards to have the ability to receive money in minutes.

Is Zelle safer than Venmo

Unlike Zelle, Funds Stored in Venmo Are Not FDIC-Insured

Zelle transfers money directly to and from FDIC-insured bank accounts, so you know the funds you send or receive are protected up to $250,000 per account.

Why is my bank account not eligible for Zelle

Some debit cards don't yet have the capability to receive money in minutes. Those debit cards that are not 'fast funds enabled' can't be used with Zelle®. Your debit card may work in the future as more and more banks and credit unions are enabling their debit cards to have the ability to receive money in minutes.

How do I get Zelle from credit union

If you have not yet enrolled your Zelle® profile, follow these simple steps:Click on the link provided in the payment notification.Select your bank or credit union.Follow the instructions provided on the page to enroll and receive your payment.

How long does Zelle take for credit union

within minutes1

How long does it take to receive money with Zelle® Money sent with Zelle® is typically available to an enrolled recipient within minutes1.

Does Zelle charge a fee

Zelle® is free1 to use.

When you send money to friends or family, it won't cost you any extra money for the transaction.

How does Zelle know which bank to send money to

The payer and payee do not need to have accounts at the same financial institution, but they do both need to be enrolled with Zelle. Users send money through their bank's app or the Zelle app, and that money is automatically deposited into the recipient's bank account that they have linked to their Zelle account.

Does Zelle work if the other person doesn’t have Zelle

What if the person I'm sending money to hasn't enrolled with Zelle® If the person you're sending money to hasn't enrolled yet, they'll receive an email or text notification letting them know you've sent them money. They'll be guided through a few simple steps to get enrolled.

Why does Zelle not recognize my bank

Some debit cards don't yet have the capability to receive money in minutes. Those debit cards that are not 'fast funds enabled' can't be used with Zelle®. Your debit card may work in the future as more and more banks and credit unions are enabling their debit cards to have the ability to receive money in minutes.

How do I get my bank to use Zelle

If you have not yet enrolled your Zelle® profile, follow these simple steps:Click on the link provided in the payment notification.Select your bank or credit union.Follow the instructions provided on the page to enroll and receive your payment.

Do some banks not accept Zelle

Does Zelle only work with bank accounts Yes, Zelle work with bank accounts. In fact, Zelle is a bank-to-bank money transfer app.

What is downside of using Zelle

You can't transfer funds from a credit card

Zelle only supports bank transfers. If you usually use your credit card to send money to family and friends, this isn't the right payments app for you. Be aware that you often have to pay a fee to make a credit card transfer with other payments apps.