Does Carvana care about bad credit?

Does Carvana deny anyone

Carvana considers working with consumers regardless of their credit history — although there are age and income minimums. Because it doesn't require people to have minimum credit scores for a car loan, you might qualify for a Carvana loan even if you have low credit scores.

Cached

Is it easier to get approved on Carvana

Carvana may actually be a lender that is slightly easier to qualify for than most. That's because it doesn't require a minimum credit score to apply — many other lenders do.

Does Carvana check credit scores

When you pre-qualify with Carvana, you see real, personalized terms without affecting your credit score. Though your terms will not change, we do complete a formal credit inquiry when you schedule your delivery or pickup.

Does Carvana verify income

Carvana performs an income verification to help calculate your yearly income and ensure we're providing you the correct financing terms to set you up for financial success with your vehicle loan. Carvana also performs an employment verification to confirm that you're an active employee at the company indicated.

Does Carvana buy cars in poor condition

Carvana can buy wrecked cars, often to incentivise you to purchase one of their vehicles. However, their specialty is not vehicles that have suffered severe damage. They operate like a used car dealership, which means they primarily target vehicles that can easily be repaired and put back on the lot to be sold again.

How does Carvana qualify you

As long as you are 18 years or older†, make at least $4k per year, and have no active bankruptcies, you can finance your purchase through Carvana. To get started, you can fill out the financing application here. Don't worry, filling out the application will not impact your credit!

What’s the minimum credit score for Carvana

Oftentimes, these lenders prefer customers that have a credit score of 700 or higher, or at least in the mid 600s. Carvana does not have a minimum credit score requirement and considers many factors, in addition to traditional credit score, in determining credit offers.

Is everyone approved at Carvana

They do have some requirements: you have to make at least $833 a month. or you make $10,000 per year. you can't be in bankruptcy.

What is Carvana’s minimum credit score

“Carvana is one of the rare lenders that doesn't have a minimum credit score requirement. They do have some requirements: you have to make at least $833 a month.

Can I get a car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023. But it'll take some nuancing and strategic planning to improve your chances.

How does Carvana verify the condition of your car

Once Carvana buys the vehicle, it is sent to one of our inspection centers for reconditioning and a 150-point inspection. This vehicle quality inspection includes everything from a brake check to an oil change, as well as checking for any damage that may have occurred during transport.

Why is Carvana losing so much money

Auto industry supply chain problems that decreased the supply of new cars led to dramatic increases in the price of Carvana's product, used cars. Many of thoe issues have begun to resolve in the new car market and, consequently, used car prices have recently started to come down.

How long does Carvana take to approve

How long does Carvana take to approve Approving a car for sale takes between two and fifteen minutes to approve. Around 99 percent of online car sellers who apply get approved, and their contracts and terms are good for 45 days.

Is Carvana in financial difficulty

After a number of years of massive vehicle sales growth and thus revenues, Carvana hit a wall in 2023. The massive Adesa acquisition added a lot of debt and more expenses, but management eventually realized it couldn't continue on its then current path.

What is Carvana credit requirements

If I have bad credit, can I still finance my purchase through Carvana Yes. As long as you are 18 years or older†, make at least $4k per year, and have no active bankruptcies, you can finance your purchase through Carvana.

Is it hard to get financed through Carvana

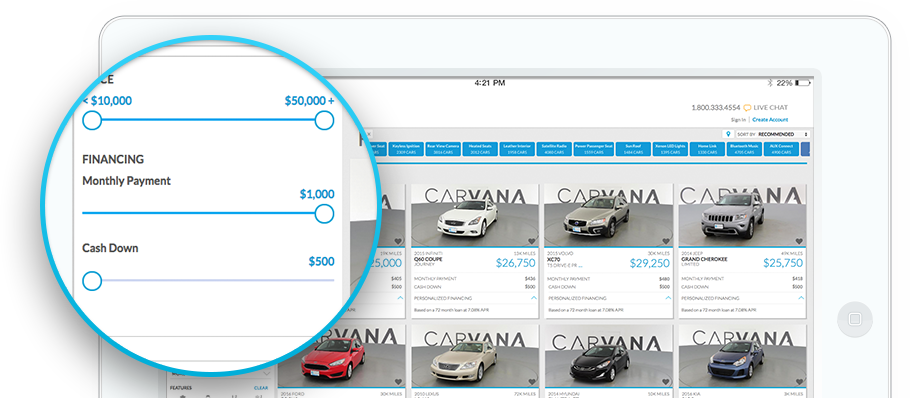

Need more reasons Get approved online in just 2 minutes. 99% of customers who apply get approved and your terms are good for 45 days. There's no impact to your credit and you can see your actual down payment and monthly payment on all vehicles in our inventory.

Does CarMax accept poor credit

Accepts trade-ins: CarMax will buy your vehicle even if you aren't also purchasing a car. Best for low-credit borrowers looking for a used car: As the largest used car dealer in the U.S., CarMax offers a wide range of financing options and works with nearly all credit profiles.

What proof do you need for Carvana

What documentation is required to sell my car to Carvana You'll be asked to provide pictures of the current odometer reading from your dashboard and driver's licenses for the individuals listed on the title or registration.

What is the controversy with Carvana

Carvana has lost its license to sell cars in Illinois twice, been suspended from operating in parts of North Carolina, and had its Florida business license threatened, all because of title problems.

Can I finance a car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.