Does Carvana look at credit?

What credit score is needed with Carvana

Oftentimes, these lenders prefer customers that have a credit score of 700 or higher, or at least in the mid 600s. Carvana does not have a minimum credit score requirement and considers many factors, in addition to traditional credit score, in determining credit offers.

Cached

Can you be denied by Carvana

You may have been denied due to a change in your credit or even a simple clerical error or typo. So, here's what you should do: Reach out and ask: Contact Carvana, and ask why you were denied. They should have details about the situation.

Does Carvana require credit history

If I have bad credit, can I still finance my purchase through Carvana Yes. As long as you are 18 years or older†, make at least $4k per year, and have no active bankruptcies, you can finance your purchase through Carvana.

Cached

How does Carvana determine financing

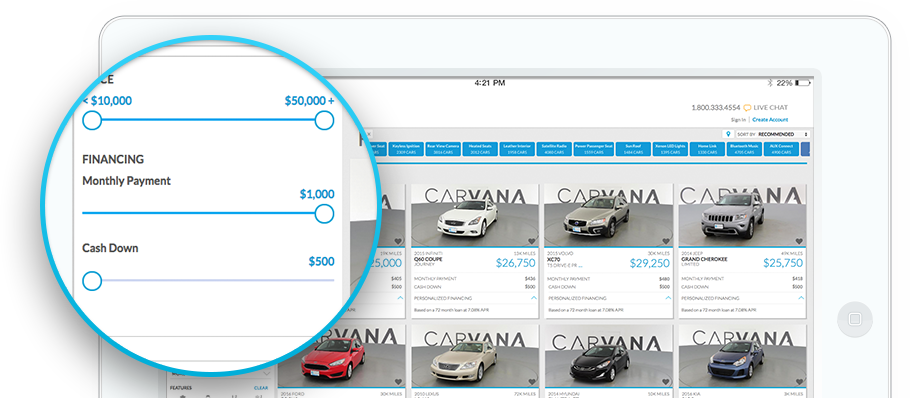

Your terms are non-negotiable and based on your credit history, your individual income, and the price of the vehicle you're looking at. If you live in an eligible state and decide to add a co-signer to your application, your finance terms will also consider your co-signer's credit history and income information.

Is it easier to get approved on Carvana

Carvana may actually be a lender that is slightly easier to qualify for than most. That's because it doesn't require a minimum credit score to apply — many other lenders do.

How does Carvana verify income

You can upload your 2 most recent, consecutive pay stubs for your proof of income or address verification. We may also look at pay stubs as part of your employment verification. You may be asked to submit pay stub documents during the purchase process.

Does Carvana always verify income

Carvana performs an income verification to help calculate your yearly income and ensure we're providing you the correct financing terms to set you up for financial success with your vehicle loan. Carvana also performs an employment verification to confirm that you're an active employee at the company indicated.

How long does Carvana take to approve

How long does Carvana take to approve Approving a car for sale takes between two and fifteen minutes to approve. Around 99 percent of online car sellers who apply get approved, and their contracts and terms are good for 45 days.

Is Carvana in financial difficulty

After a number of years of massive vehicle sales growth and thus revenues, Carvana hit a wall in 2023. The massive Adesa acquisition added a lot of debt and more expenses, but management eventually realized it couldn't continue on its then current path.

Does Carvana check your bank account

When applying for Carvana financing, we may provide an option to connect with Plaid to verify your bank account information after receiving your terms. This allows us to determine if you qualify for a down payment reduction.

What annual income do you need for Carvana

Carvana does require that borrowers have an annual gross income of at least $4,000 and no active bankruptcies. Carvana shoppers can pre-qualify with a soft credit inquiry, which does not affect credit scores.

Can I finance a car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.

What is the controversy with Carvana

Carvana has lost its license to sell cars in Illinois twice, been suspended from operating in parts of North Carolina, and had its Florida business license threatened, all because of title problems.

Does Carvana actually verify income

Carvana performs an income verification to help calculate your yearly income and ensure we're providing you the correct financing terms to set you up for financial success with your vehicle loan. Carvana also performs an employment verification to confirm that you're an active employee at the company indicated.

What do you need to prove income for Carvana

You can upload your 3 most recent, consecutive months of bank statements for your proof of income or address verification. We may also look at bank statements as part of your employment verification. Some customers may be required to upload additional income documents when placing an order.

What is the lowest score to finance a car

In general, you'll need a credit score of at least 600 to qualify for a traditional auto loan, but the minimum credit score required to finance a car loan varies by lender. If your credit score falls into the subprime category, you may need to look for a bad credit car loan.

Can I buy a car with a 525 credit score

Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.

What are the cons of buying from Carvana

Cons of buying on CarvanaNo option to test drive before you buy.Limited quantity per capita.Free delivery is only available within certain mileage.Slightly higher price tags in comparison to dealerships.

Does Carvana really check income

Carvana performs an income verification to help calculate your yearly income and ensure we're providing you the correct financing terms to set you up for financial success with your vehicle loan. Carvana also performs an employment verification to confirm that you're an active employee at the company indicated.

Can you finance a car with 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.