Does Chase charge for balance transfers?

Is there a fee for balance transfer Chase

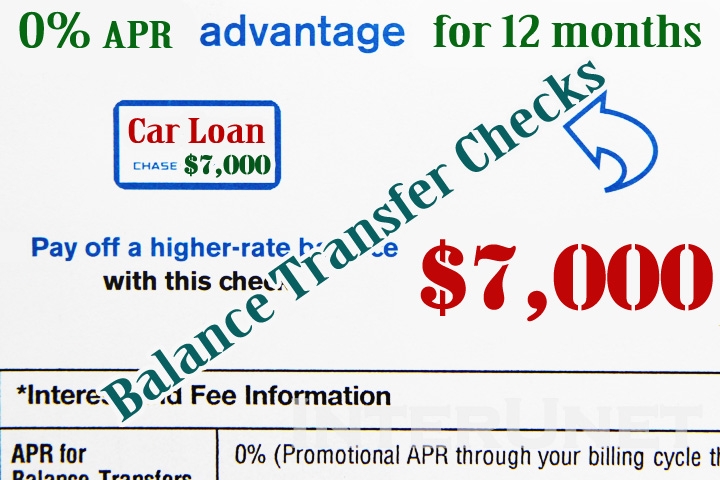

On most Chase cards, you'll be charged a 3 percent intro balance transfer fee (minimum $5) of the amount you transfer, so be sure to add that amount to your total balance to pay off. You must transfer a balance within 60 days of account opening to qualify for the intro balance transfer fee.

Cached

Does Chase bank have a $0 balance transfer fee

With no balance transfer fee on transfers made within 60 days of account opening, you can save a hundreds. For instance, transferring a $5,000 balance to the Chase Slate will cost you nothing as long as you make the transfer within your first 60 days (after there is a 5% fee).

How do you avoid balance transfer fees

The simplest way to avoid balance transfer fees is to apply for a credit card that waives the fee entirely. Getting a credit card with no balance transfer fee that also offers a low balance transfer APR is actually the best overall way to reduce the cost of existing debt and pay off what you owe sooner.

How do Chase balance transfers work

Take advantage of a balance transferSign in and choose your card. Sign in and choose your card. Sign in and choose your card to see if you are eligible for any balance transfer offers.Enter the amount. Enter the amount.Complete your transfer. Complete your transfer.

Does transferring balances hurt your credit score

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Can I transfer my Chase credit card balance to another credit card

You cannot transfer a balance from one Chase card or loan to another. The balance must come from an account through another lender. The actual balance transfer is not instant. It can take up to three weeks for the balance transfer to be completed.

Do balance transfers hurt credit score

In some cases, a balance transfer can positively impact your credit scores and help you pay less interest on your debts in the long run. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run.

Is it a good idea to balance transfer

A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30%. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility.

Has Chase stopped offering balance transfers

No, Chase has not stopped offering balance transfers. Chase currently offers several credit cards that allow balance transfers, including a few with an introductory APR of 0% on transferred balances for 15 to 18 months.

What is the catch to a balance transfer

But there's a catch: If you transfer a balance and are still carrying a balance when the 0% intro APR period ends, you will have to start paying interest on the remaining balance. If you want to avoid this, make a plan to pay off your credit card balance during the no-interest intro period.

What is the downside of a balance transfer

A balance transfer generally isn't worth the cost or hassle if you can pay off your balance in three months or less. That's because balance transfers typically take at least one billing cycle to go through, and most credit cards charge balance transfer fees of 3% to 5% for moving debt.

Is it a good idea to transfer balance

A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30%. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility.

Will doing a balance transfer hurt my credit score

In some cases, a balance transfer can positively impact your credit scores and help you pay less interest on your debts in the long run. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run.