Does Citibank have custom cards?

Does Citibank allow custom cards

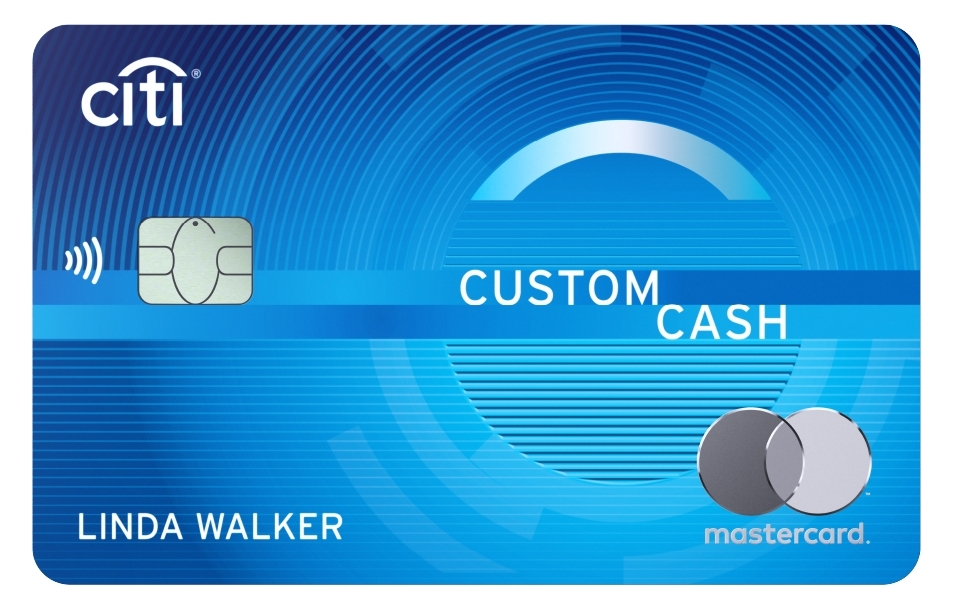

Use the Citi Custom Cash CardSM for all your purchases. Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter.

How hard is it to get a Citi Custom Cash Card

Summary. In conclusion, the Citi Custom Cash isn't hard to get. However, it may be more difficult to get than some other cards, but it's not impossible. If you have a good credit score, a stable income, and a low debt-to-income ratio, you may be a good candidate.

Is Citi Custom Cash Card easy to get approved

The Citi Custom Cash℠ Card is one of Citi's most valuable cards and is intended for consumers with good to excellent credit. A FICO® Score of 670 or higher can make it easier to qualify.

Cached

Does Citi make a metal card

To get a metal Citi credit card, you will need the Citi® / AAdvantage® Executive World Elite Mastercard®. This card has a $450 annual fee and is good for American Airlines frequent flyers. The Citi Prestige® Credit Card is also metal. Unfortunately, this premium credit card is no longer accepting new applications.

What bank lets you customize your debit card

Get a Truist Personal debit card that's uniquely yours. We've made it easy to design your card in just minutes. Need ideas Check out our image galleries and choose your favorite—or upload your own portrait at no additional cost.

What is the highest limit on Citi Custom Cash Card

If you qualify for the Citi Custom Cash Card, you're likely to receive at least a $500 minimum credit limit, though it could be higher. Citi doesn't have maximum published credit limits available.

Why is it so hard to get a Citi card

It is fairly hard to get a Citibank credit card, as most Citibank cards require good credit or better for approval. Citibank does have options for people with limited credit or fair credit, though, which means it's not as hard to get a Citibank credit card as it is to get a card from some other issuers.

Which Citibank credit card is easiest to get approved for

Citi® Secured Mastercard®

The easiest Citi card to get is the Citi® Secured Mastercard®. This is the only Citi card that will accept applicants with limited credit (less than 3 years of credit history).

What is Citi Prestige Card

The Citi Prestige® Card* is Citi's premium ThankYou Point-earning credit card, targeted toward business and leisure travelers. The card's 5 points per dollar rate on spending at restaurants and on air travel categories is generous, and the $250 annual travel credit partially offsets the hefty annual fee.

Can I turn my debit card into a metal card

You can change your plastic credit or debit card to metal with a custom design in a sleek metal or 24K gold finish. The types of metals that can be used for these cards include chrome, silver, stainless steel and a host of alloys. There are basic custom designs as well, such as flags and logos.

Can I get a different design on my debit card

Expand. The Card Design Studio service allows you to customize the look of your personal credit, debit or prepaid, or business credit or debit card to create a unique, distinctive card that reflects your personality and interests or showcases your business.

Which banks have metal debit cards

Chip Lupo, Credit Card Writer

Banks that have metal credit cards include U.S. Bank, Citibank, Chase, Capital One, and American Express, among others.

What is the minimum credit limit for Citi Custom Cash

a $500

Your credit limit for any credit card is typically based on different factors, such as your credit score, credit history, total income, debt, and history with the credit card issuer. If you qualify for the Citi Custom Cash Card, you're likely to receive at least a $500 minimum credit limit, though it could be higher.

How often does Citi raise your credit limit

every six to twelve months

Citi periodically grants automatic credit limit increases to eligible cardholders. Similarly, many card issuers tend to operate according to a status quo. In general, card issuers may increase a cardholder's credit limit every six to twelve months either automatically or by request.

Which Citi card has the highest limit

The highest credit limit for the Citi Diamond Preferred card can be over $10,000 for most creditworthy borrowers, according to multiple reports from cardholders on online forums. Citibank does not typically disclose the maximum spending limit for any of its unsecured credit cards.

Which Citi card is the easiest to get approved for

Citi® Secured Mastercard®

The easiest Citi card to get is the Citi® Secured Mastercard®. This is the only Citi card that will accept applicants with limited credit (less than 3 years of credit history).

What is Citi highest credit limit

What Is the Maximum Credit Limit for Citi Citi does not disclose maximum credit limits for its card offerings, but third-party sources report maximums of $50,000. According to Citi's card disclosures, your credit limit is based on your income and your current debt obligations.

What is the minimum income for Citi card

The minimum salary requirement to get a Citibank credit card is Rs. 20,000 per month.

What is the limit on Citibank black card

For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company. The Mastercard® Black Card's minimum credit limit is $5,000.

Can I ask my bank for a metal card

Unless a credit card normally comes in metal, you typically can't request a metal version from the issuer; however, there are some third-party companies that will convert a plastic card to metal for a fee.