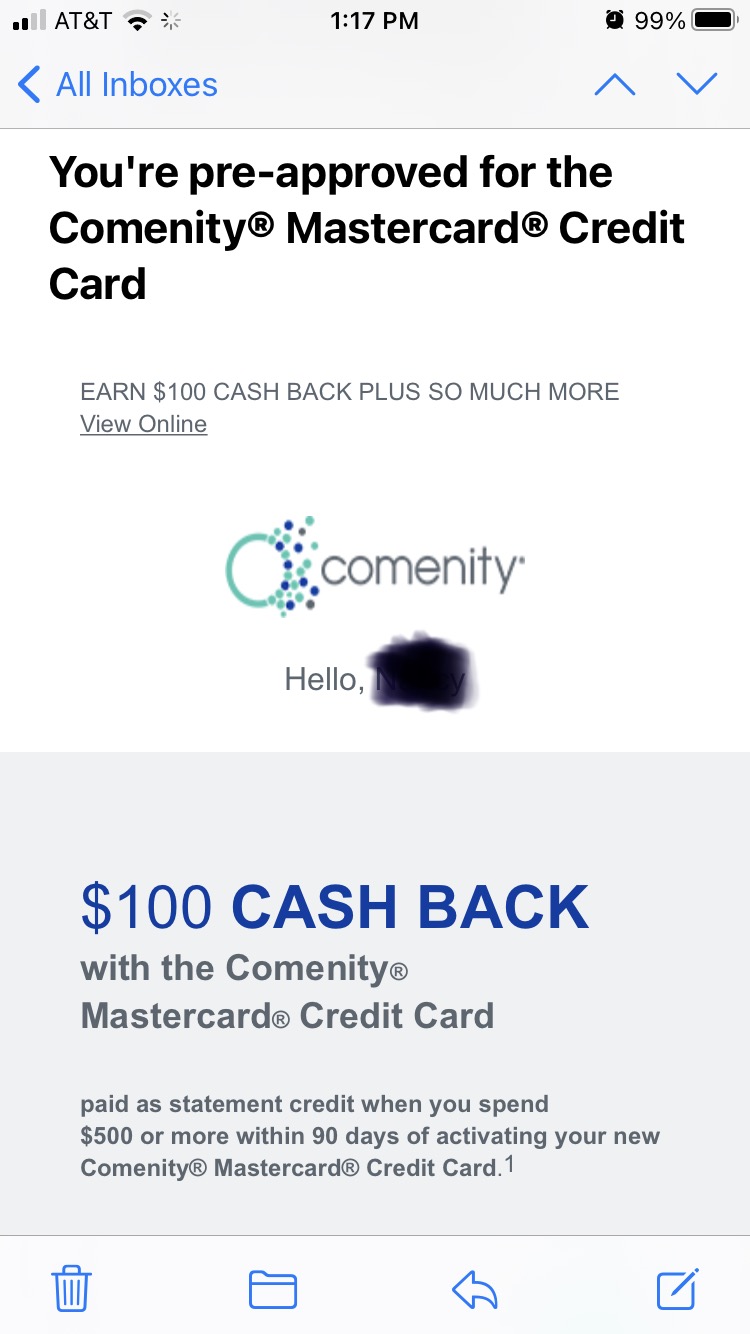

Does Comenity Bank have a pre-approval?

What credit score needed for Comenity Bank

640 or higher

A credit score of 640 or higher is needed to get a Comenity Bank credit card in most cases. That means you need at least fair credit to get approved. However, there are some Comenity credit cards that require a credit score of 700 or better (good credit).

Is Comenity Bank hard to get approved

Cards issued by Comenity Bank are generally easy to get approved for even if your credit score is lower than average. Easy approval can be attractive if you're working on building or repairing your credit.

Cached

Is Comenity Bank owned by Capital One

Comenity Capital Bank a wholly-owned subsidiary of Bread Financial Payments, Inc.

What Bank does Comenity Bank use

The bank is a subsidiary of Bread Financial, a financial services company, which recently changed its name to Bread Savings.

Cached

What is the easiest Comenity Bank card to get

The easiest Comenity Cards to get are the ones you can use the shopping cart trick on as they are not checking your credit. Out of the cards, this trick works on Victoria's Secret & Overstock – as they're the easiest to get the pop up on.

Does Comenity do a hard pull for credit increase

How a Comenity Bank Credit Limit Increase Affects Your Credit Score. Requests for credit limit increases may result in a hard inquiry on your credit report, which can temporarily lower your credit score.

Is synchrony bank easy to get approved

While Synchrony does not have a “Shopping Cart Trick” like Comenity Bank credit cards to make approvals much easier, they are still considered a bank that is more likely to approve applicants. To give yourself the best chance of approval, make sure you take care of your credit score.

Does Comenity Bank do hard pulls for credit increase

How a Comenity Bank Credit Limit Increase Affects Your Credit Score. Requests for credit limit increases may result in a hard inquiry on your credit report, which can temporarily lower your credit score.

Can I get a Walmart credit card with a 520 credit score

The Walmart Credit Card credit score requirement is 640 or higher, which means people with fair credit or better have a shot at getting approved for this card. The Walmart® Store Card also requires at least fair credit for approval.

What store card can I get with a 620 credit score

The best store credit card you can get with a 620 credit score is the Amazon.com Secured Credit Card, which has a $0 annual fee and offers 2% cash back on Amazon purchases if you are a Prime member. It requires a minimum security deposit of $100, making it easier to get with bad credit.

Which credit card companies do a soft pull for credit increase

Top credit cards that offer preapproval without a hard pullOpenSky® Secured Visa® Credit Card.Petal® 2 "Cash Back, No Fees" Visa® Credit Card.Upgrade Cash Rewards Visa®Discover it® Secured Credit Card.Mission Lane Visa® Credit Card.Prosper® Card.Capital One QuicksilverOne Cash Rewards Credit Card.

Is Comenity Bank good or bad

Overview. Comenity has a rating of 1.06 stars from 17 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers complaining about Comenity most frequently mention credit card problems. Comenity ranks 290th among Banking sites.

What FICO score do you need for Synchrony Bank

It depends on the credit card you are interested in. Most credit cards offered by Synchrony Bank are designed for people with fair (640 – 699), good (700 – 749) or excellent (750 – 850) credit.

Which FICO score does Synchrony use

Find out your score and how to improve it when you enroll in Synchrony's® free credit score program with VantageScore®. VantageScore® is a top credit scoring model used by many lenders when they consider whether or not to approve applications and decide what rates and terms to offer.

How many hard pulls is too many

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

What credit score do you need for TJ Maxx card

620 or above

You need fair credit to get approved for the TJX credit card, which means a credit score of 620 or above.

What credit score do you need for Amazon credit card

670 to 739

Typically, you can qualify for Synchrony's Amazon store cards with a fair credit score (580 to 669). On the other hand, you'll likely need at least a good credit score (670 to 739) to qualify for one of the Amazon Visa cards from Chase.

Can I get a Walmart card with 580 credit score

The Capital One Walmart Rewards Card is designed for consumers with fair credit or good credit (a FICO credit score of 580 to 740).

What credit cards can I get with a 575 credit score

Popular Credit Cards for a 575 Credit ScoreBest Overall: Discover it® Secured Credit Card.No Credit Check: OpenSky® Secured Visa® Credit Card.Unsecured: Credit One Bank® Platinum Visa® for Rebuilding Credit.Rewards & No Annual Fee: Capital One Quicksilver Secured Cash Rewards Credit Card.

Does Synchrony Bank do a soft pull

Pre-approvals use soft inquiries of your credit, so it will not affect your credit report. A pre-approved offer does not guarantee you'll get the card, but it does mean you have a 90% chance of approval, though.