Does Credit Karma help with disputes?

How long do Credit Karma disputes take

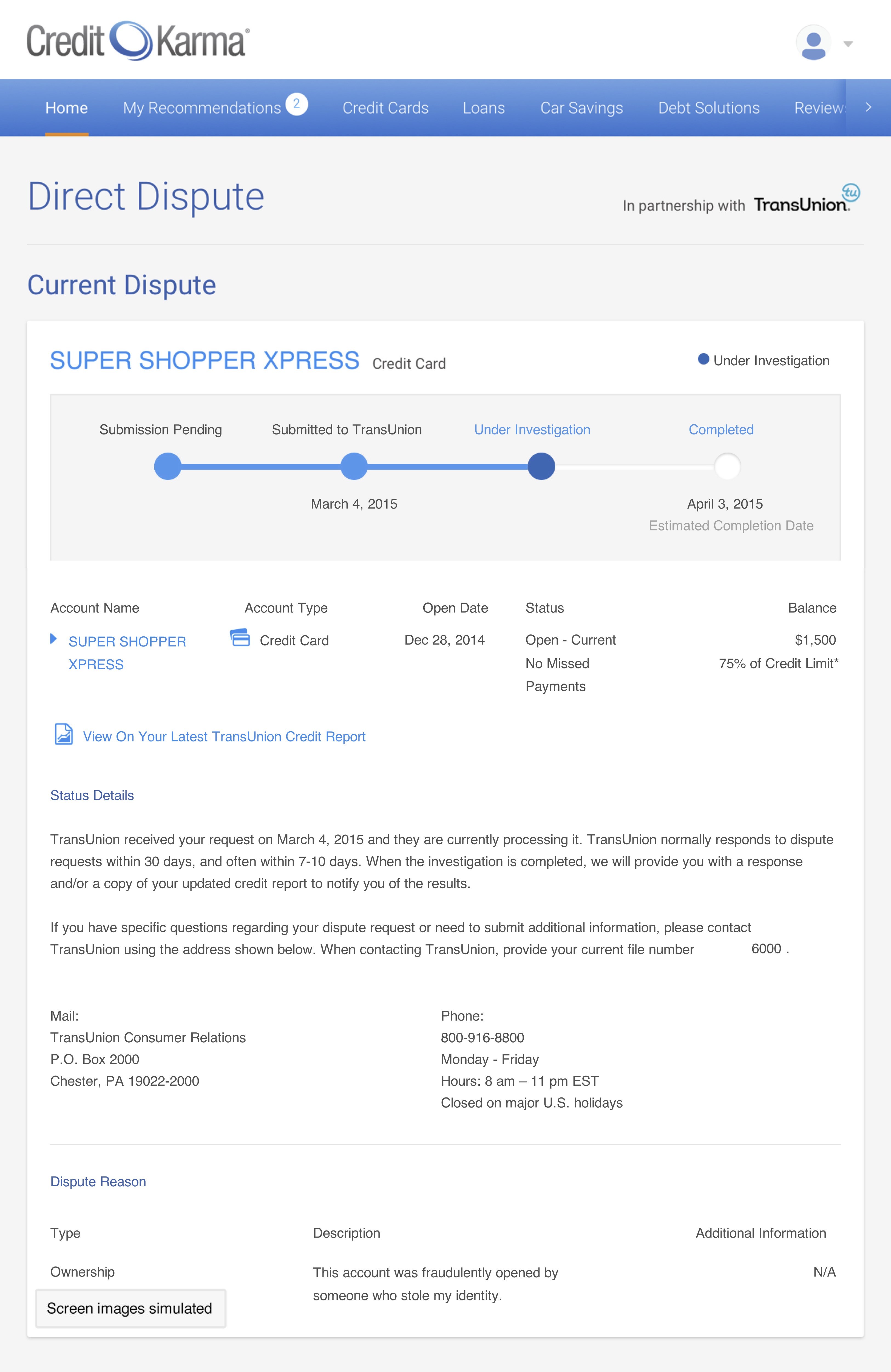

What to expect after filing a Direct Dispute™ through Credit Karma. After you send a Direct Dispute™ to TransUnion, you'll be able to check on the status of your dispute in your Dispute Center. TransUnion typically completes its investigation within 30 days of the date they receive your request.

Cached

How can I remove disputes from my credit report quickly

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian's phone number is 888-210-9101 and 866-673-0140 and it's answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

Cached

What is the most effective way to dispute a credit report

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

What is the best reason to dispute a collection on Credit Karma

Incorrect dates of payments or delinquencies. Accounts with an incorrect balance. Accounts with an incorrect credit limit. Reinsertion of disputed information that has previously been corrected and removed.

Cached

How successful are credit card disputes

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Who pays when you dispute a charge

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

Can removing disputes hurt your credit

Filing a Dispute Will Not Affect Your Score

In fact, it's important that you get the misinformation corrected or removed so that it doesn't affect your score down the road. If you are correcting identification or contact information, the change will not affect your score.

Does losing a dispute hurt your credit

Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change. The nature of that change—whether your score goes up, down or stays the same—depends on what you are disputing and the outcome of the dispute.

Is there a downside to disputing credit report

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

How do I file a credit dispute and win

You'll likely need to fill out a dispute form and provide supporting documentation that helps prove an error was made. If your dispute is accepted, follow up to make sure the credit bureau and the business that supplied the incorrect information update their records accordingly.

Does Credit Karma remove collections

Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due. Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn't affect our editors' opinions.

How do I dispute and win on Credit Karma

To open a dispute online:From your Money home screen, select the transaction you wish to dispute.You will be able to see additional information about the transaction, if you still need to dispute the transaction select See an issue with this transactionFollow the on-screen prompts to tell us more about your dispute.

How often do people win credit card disputes

What are the chances of winning a chargeback The average merchant wins roughly 45% of the chargebacks they challenge through representment. However, when we look at net recovery rate, we see that the average merchant only wins 1 in every 8 chargebacks issued against them.

How do you win a card dispute

How to Win a Credit Card DisputeContact the Merchant First. If there's a clerical error or another issue with your credit card bill, it's best to try and resolve it with the retailer.Avoid Procrastinating.Prepare to Make Your Case.Know Your Rights.Stand Your Ground.

Will a dispute get my money back

Once filed, your dispute is then turned over to the bank or card network for investigation. Your bank will typically give you a provisional refund, which will be in place until your claim can be validated by the bank.

How do you win a disputed charge

How to Win a Credit Card DisputeContact the Merchant First. If there's a clerical error or another issue with your credit card bill, it's best to try and resolve it with the retailer.Avoid Procrastinating.Prepare to Make Your Case.Know Your Rights.Stand Your Ground.

Can a disputed debt be put back on credit report

If an account is deleted as the result of a dispute and the lender later verifies the account as accurate, the account can be re-added to the credit report.

How long do disputes stay on credit report

Lisa Cahill, Credit Cards Moderator

It can take up to 30 days for a disputed item to be removed from your credit report, assuming your dispute is valid. This is the maximum amount of time for a response from the credit bureau allowed by the Fair Credit Reporting Act.

Is it a good idea to dispute credit report

If you find mistakes on your credit reports, you should dispute them. Here's how you can dispute errors you find. Errors can appear on one or more of your credit reports due to an error in the information provided about you or as the result of fraud or identity theft.

What happens if a credit dispute is denied

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.