Does credit report show all bank accounts?

Do all bank accounts show on credit file

Bank transactions and account balances are not reported to the national credit bureaus and do not appear on your credit reports—but unpaid bank fees or penalties turned over to collection agencies will appear on your credit reports and hurt your credit scores.

Cached

What bank account doesn t show up on credit report

While your credit report features plenty of financial information, it only includes financial information that's related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not.

Cached

What types of accounts show up on credit report

Three types of accounts commonly appear on credit reports: collection accounts, installment accounts and revolving accounts.

Does your credit report show how many accounts you have

Lenders report on each account you have established with them. They report the type of account (credit card, auto loan, mortgage, etc.), the date you opened the account, your credit limit or loan amount, the account balance and your payment history, including whether or not you have made your payments on time.

Cached

What report shows bank accounts

ChexSystems reports contain information about past banking mistakes, including unpaid fees and fraudulent activity. When you apply to open a new checking account, banks and credit unions may review your ChexSystems report before approving or denying your request.

How do creditors find your bank accounts

Creditors and debt collectors can find your bank accounts through your previous payment records, credit applications, skip tracers, and information subpoenas. Most of the time, the creditor must obtain a court order before garnishing your bank accounts, but this isn't the case for some government entities.

Why is my bank account not showing on Experian

Experian does not have bank account information such as checking or savings accounts, so if that is the "bank account number" you are referencing, you received something other than a credit report. Full account numbers are not provided with your personal credit report.

What are 5 things found on a credit report

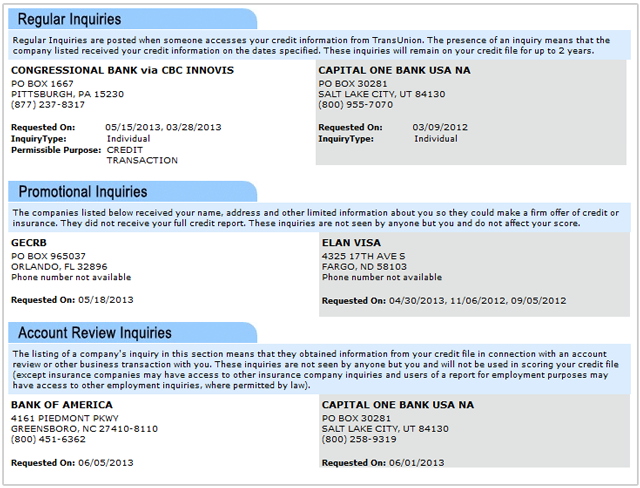

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

Can banks see if you owe other banks

Having issues opening a bank account Then you may have a record on ChexSystems, a database that banks use to check whether potential customers have outstanding accounts at other banks.

How do I find all my bank accounts

Pulling your credit report is the most accurate and convenient way to find all of the accounts in your name. Your credit report will display every open account in your name, from bank accounts to credit cards and so much more.

Can people look up your bank accounts

Even with law enforcement agencies, the most effective way to get bank records or account information is with the customer's consent. There are many private investigators who claim that they have the ability to obtain bank records, account information, account details and other financial information.

How do I hide my bank account from creditors

There are four ways to open a bank account that no creditor can touch: (1) use an exempt bank account, (2) establish a bank account in a state that prohibits garnishments, (3) open an offshore bank account, or (4) maintain a wage or government benefits account.

Can a debt collector find my new bank account

Usually, a debt collector must obtain a court order before accessing your bank account. However, certain federal agencies, including the IRS, may be able to access your bank account without permission from a court.

Why do some banks not report to credit bureaus

The primary reason some banks choose not to report customers' account activity to the credit bureaus is that doing so is costly and complicated. Reporting borrowers' information requires the lender to go through the complex steps of setting up an account with each credit bureau.

Why does my credit report not show everything

Your creditor may not have reported the information. Creditors are not required to report information to the credit reporting companies. In addition, most negative information is not reported after seven years.

What do lenders see on credit report

Account history and what types of credit you have.

Lenders also look for a consistent history of paying your bills on time. A pattern of late or missed payments makes it seem like you have trouble repaying debt, so they may see you as a risk.

What has biggest impact on credit score

Payment History

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you. This component of your score considers the following factors:3.

Can creditors see your bank account balance

Can debt collectors see your bank account balance A judgment creditor cannot see your online account balances. But a creditor can ascertain account balances using post-judgment discovery. The judgment creditor can subpoena a bank for bank statements or other records which reveal a typical balance in the account.

How do I find hidden bank accounts

To search for a hidden bank account, there are a few methods you can use:Locate private sector sources where bank accounts may be available.Utilize swift codes.Utilize check verification.Vetting.Third-party access.

Can the government see how many bank accounts you have

The federal government has no business monitoring small cash deposits and how Americans pay their bills and has no right to snoop around in private checking accounts without a warrant.