Does crypto credit card do a credit check?

Does crypto check credit

Ownership: If you need cash, a crypto loan allows you to get the money you need without forcing you to sell your holdings. Quick funding: Once you're approved, you may be able to get your loan funds within hours. No credit check: In many cases, the crypto lending platform won't run a credit check when you apply.

Cached

Does getting a crypto card affect credit score

This way, you'll avoid paying penalties like late fees or interest. Crypto credit cards affect your credit rate just like your traditional credit card, and some have annual and transaction fees associated with them.

Cached

Do crypto credit cards report to IRS

Are crypto debit cards and credit cards taxable Yes. The IRS considers cryptocurrency a form of property, similar to real estate and stocks. That means that cryptocurrency purchases and rewards are subject to both capital gains and income tax.

Cached

How does crypto credit card work

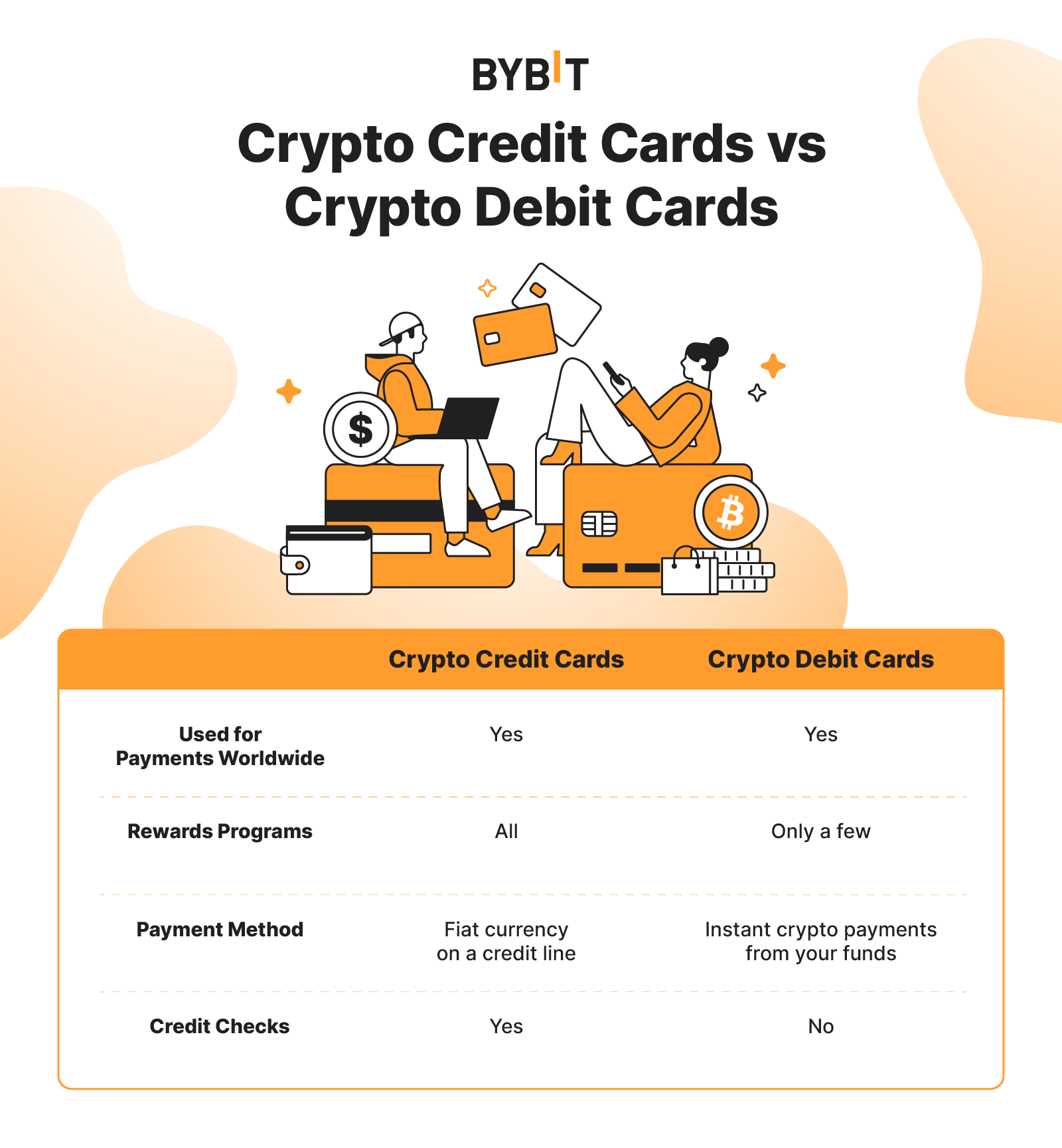

A crypto credit card is a rewards credit card that lets you earn cryptocurrency rewards on purchases instead of cash back or points. They function the same way as a normal credit card: you get a credit line from the bank that you use to make purchases then pay off at the end of the billing cycle.

Does the IRS check crypto

Yes, the IRS can track cryptocurrency, including Bitcoin, Ether and a huge variety of other cryptocurrencies. The IRS does this by collecting KYC data from centralized exchanges.

What is a crypto credit score

A relatively new phenomenon, crypto credit scores are in some ways fairly similar to the traditional credit scores issued by TransUnion, Equifax and Experian: They take into account your crypto assets, transaction history, spending habits and asset growth over time.

Is it worth having a crypto card

Also unlike traditional credit cards, crypto credit cards typically do not have annual fees and high interest rates. Still, there are small fees in certain circumstances, particularly with crypto credit cards, but all fees are announced in advance, so you won't have any surprises when you check your account.

What are the disadvantages of crypto com card

Crypto.com card cons

Restrictive rewards earning: Not all purchases qualify for rewards, including potentially high-earning purchases like loan payments. High staking requirements for best benefits: The highest tier, Obsidian, requires a steep $400,000 CRO lock up to earn its benefits.

Can the IRS see my crypto transactions

Yes, the IRS can track crypto as the agency has ordered crypto exchanges and trading platforms to report tax forms such as 1099-B and 1099-K to them. Also, in recent years, several exchanges have received several subpoenas directing them to reveal some of the user accounts.

Will the IRS audit you for crypto

Even if you haven't received a letter and you've not used an exchange that has been summoned by the IRS, the IRS may still audit your crypto investments.

Why is crypto better than credit card

Bitcoin transactions are irreversible and can only be refunded by the receiving party—a key difference from credit card transactions that can be canceled. This means there are no charge-backs for merchants when taking payment via Bitcoin.

Do I have to report crypto less than $600

Even if you earned staking or rewards income below the $600 threshold, you'll still have to report the amount on your tax return. If you've earned less than $600 in crypto income, you won't be receiving any IRS 1099 forms from us. Visit Qualifications for Coinbase tax form 1099-MISC to learn more.

What are the benefits of a crypto credit card

Building on the existing travel rewards of the Crypto.com Visa Card, which include free Priority Pass™ Airport Lounge Access, interbank exchange rates, and no overseas fees, select cards will have: Your Travel – In Style: 10% purchase rebate on each Expedia (USD 50 equiv. *) or Airbnb booking (USD 100 equiv.

Does crypto com visa affect credit

The Crypto.com Visa is not a credit card, so it does not affect your credit score. Other crypto cards might affect your score, however.

What triggers IRS audit crypto

2. What triggers a crypto audit Unreported income is one of the most common reasons for the IRS to conduct a crypto audit. Most crypto exchanges send 1099-B or 1099-K forms to clients that exceed certain transaction thresholds, the copies of which are then sent to the IRS.

How does IRS know if you own crypto

Yes, the IRS can track cryptocurrency, including Bitcoin, Ether and a huge variety of other cryptocurrencies. The IRS does this by collecting KYC data from centralized exchanges.

Is crypto card a credit card

What is a crypto credit card A crypto rewards credit card is a credit card that allows users to spend traditional fiat and earn rewards in crypto for their purchases. The main perk of a crypto credit card is the flexibility when it comes to earning rewards.

Will the IRS know if I don’t report crypto

If, after the deadline to report and any extensions have passed, you still have not properly reported your crypto gains on Form 8938, you can face additional fines and penalties. After an initial failure to file, the IRS will notify any taxpayer who hasn't completed their annual return or reports.

Will I get audited if I don’t report crypto

What happens if you don't report taxable activity. If you don't report taxable crypto activity and face an IRS audit, you may incur interest, penalties, or even criminal charges.

What is the limit on a crypto com Visa card

Top Up and Transfer Limit

| Midnight Blue | |

|---|---|

| Fiat to card transfer limit | Daily: US$10,000 Monthly: US$25,000 Yearly: No limit |

| Crypto to card transfer limit | Daily: US$10,000 Monthly: US$25,000 Yearly: No limit |

| Card to card transfer limit | Daily: US$100 Monthly: US$3,000 Yearly: No limit |