Does Discover provide real FICO score?

What is a good FICO score in Discover Card

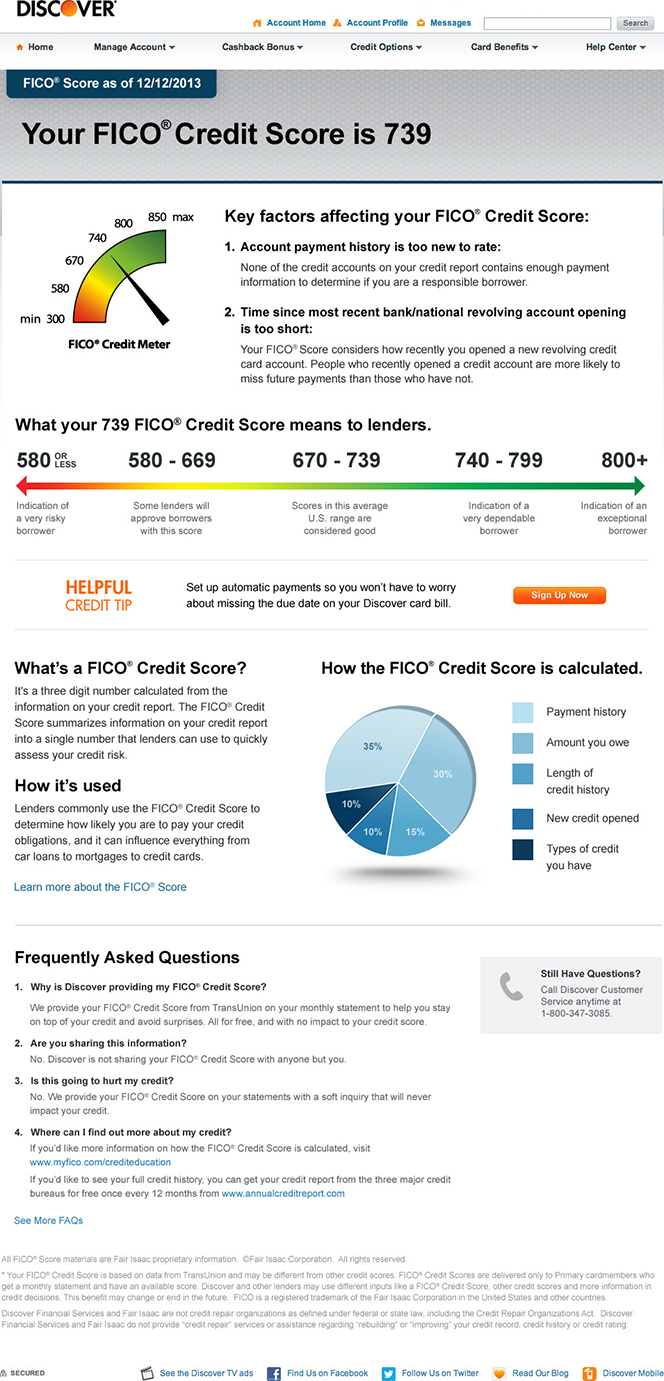

between 670 and 739

According to FICO, a 'good' credit score is a score between 670 and 739. FICO credit scores range from 300 to 850, with higher scores indicating greater creditworthiness. If you want the best shot of approval for the Discover it Cashback Card, you'll probably want a score of at least 670 or above.

Is myFICO score my actual credit score

Is "credit score" the same as "FICO® score" Basically, "credit score" and "FICO® score" are all referring to the same thing. A FICO® score is a type of credit scoring model. While different reporting agencies may weigh factors slightly differently, they are all essentially measuring the same thing.

Cached

Why is my Discover FICO score different than Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

What website has the most accurate FICO score

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

Cached

Why is my FICO score different on Discover

It's normal to have differences in your credit scores from different credit bureaus because creditors don't always report to all three major credit bureaus and don't always share the same consumer information with them at the same time.

Is 470 a bad FICO score

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 470 FICO® Score is significantly below the average credit score.

How do I find out my real credit score

You may request your reports:Online by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

Is FICO score or Credit Karma more accurate

Credit Karma compiles its own accurate VantageScore based on that information. Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check.

Why is my FICO score higher on Discover

It's normal to have differences in your credit scores from different credit bureaus because creditors don't always report to all three major credit bureaus and don't always share the same consumer information with them at the same time.

How far off is Credit Karma from FICO

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

Which credit report is closest to FICO

Experian is a credit reporting agency that also offers consumer credit monitoring products. FICO is a scoring model. A service called myFICO offers similar consumer credit monitoring products to Experian. The two services are similar in their accuracy.

How accurate is Credit Karma vs FICO

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

How can I get my true FICO score for free

If your bank, credit card issuer, auto lender or mortgage servicer participates in FICO ® Score Open Access, you can see your FICO ® Scores, along with the top factors affecting your scores, for free.

Which credit bureau is most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is 625 a good FICO score

A FICO® Score of 625 places you within a population of consumers whose credit may be seen as Fair. Your 625 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

How long does it take to get a credit score from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

Is FICO score more accurate than Credit Karma

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

How many points is Credit Karma off

In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

Why is my FICO score better than Experian

Why is my Experian credit score different from FICO The credit scores you see when you check a service like Experian may differ from the FICO scores a lender sees when checking your credit. That's because the lender may be using a FICO score based on data from a different credit bureau.

Why is my Discover FICO score different than Experian

It's normal to have differences in your credit scores from different credit bureaus because creditors don't always report to all three major credit bureaus and don't always share the same consumer information with them at the same time.