Does DoorDash mess up your taxes?

Does DoorDash affect taxes

One of the most common questions Dashers have is, “Does DoorDash take taxes out of my paycheck” The answer is no. As an independent contractor, the responsibility to pay your taxes falls on your shoulders.

Cached

How much of your DoorDash income goes to taxes

15.3%

Dashers pay 15.3% self-employment tax on profit

This is a flat rate for gig work, so you'll pay the same rate whether you earn $1,000 or $50,000 as a DoorDasher. Dashers use IRS tax form 1040, known as Schedule C, to report their profit and business deductions.

Cached

What can you write off on taxes for DoorDash

9 Best Tax Deductions for Doordash Drivers in 2023Mileage or car expenses.Phone & Service Bills.Hot bags, blankets & Courier backpacks.Tolls.Parking.Inspections.Roadside Assistance.Health Insurance.

Cached

What happens if I make less than 600 with DoorDash

Do I have to file taxes for DoorDash if I made less than $600 You'll still be required to report any income earned as an independent contractor with DoorDash, even if it was less than $600.

Can I write off gas for DoorDash

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can't deduct mileage and gasoline at the same time.

Do I have to file taxes for DoorDash if I made less than $100

Learn more. U.S. Dashers not eligible for a 1099-NEC- If you earned less than $600 dashing in 2023 you will not receive a 1099 form from DoorDash.

Why is DoorDash tax so high

“Operating our platform, paying and insuring Dashers, and ensuring high-quality service can be expensive, which is why in many markets where local governments have passed pricing regulations, we have begun charging customers a small additional fee,” a DoorDash spokesperson said.

Can I write off my car if I do DoorDash

You're only allowed to deduct only the portion of these expenses you use for your job as a delivery driver. For example, if you use your car 30% of the time for deliveries and 70% for personal reasons, you'll only be able to deduct 30% of your car expenses.

Can I write off my gas for DoorDash

Because Doordash is considered self-employment, Dashers can deduct their non-commuting business mileage. This includes miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day.

How long does it take to make $500 with DoorDash

According to DoorDash, dashers typically make about $25 per hour, including tips. This means if you work 20 hours a week you would earn $500 before tax, which makes it a decent side hustle, especially when you follow the outlined tips and strategies of this article.

Does DoorDash still tax me if I don’t make $600

Do I have to file taxes for DoorDash if I made less than $600 You'll still be required to report any income earned as an independent contractor with DoorDash, even if it was less than $600.

What happens if you didn t track your mileage DoorDash

You can expect an auditor to disallow your deduction if you claim miles without any record. When that happens, you may not claim ANY miles OR actual car expenses. You HAVE to have documentation of your miles. Statement from IRS Publication 463 related to incomplete records for your business expenses.

Is DoorDash worth it

Some will say yes, driving with DoorDash is definitely worth it. Others will say it's a lot of sitting in your car for a not-so-big payoff. However, they all seem to agree that while it's a great way to earn extra cash, you probably shouldn't quit your day job to do it.

Do I have to report DoorDash under $600

You'll still be required to report any income earned as an independent contractor with DoorDash, even if it was less than $600.

Does income under $600 need to be reported

Reporting your income under $600 for the tax year does not require any special IRS form or process as it is similar to how you would report any other income. The most important thing is to make sure you include it when calculating your taxable income.

Is DoorDash worth it as a side job

You can make a decent living with DoorDash if you live in the right area and work at the right times. It's possible to make $50,000 a year in a high-paying area. However, you could also make much less, so don't plan on DoorDash as your main income until you know it will work for you.

Can I make $1000 a week doing DoorDash

With a smart driving strategy, the odds are already in your favor for pulling down $1000 a week driving for DoorDash. Still, there's no reason to stop there. Here are some more things you can do to increase your income. While they're not overly complicated, they can make a big difference.

How much can you make with DoorDash in 3 hours

The average income for most DoorDash drivers ranges between $15 and $25 per hour. You may also earn more than this if you get plenty of additional income from tips for your orders.

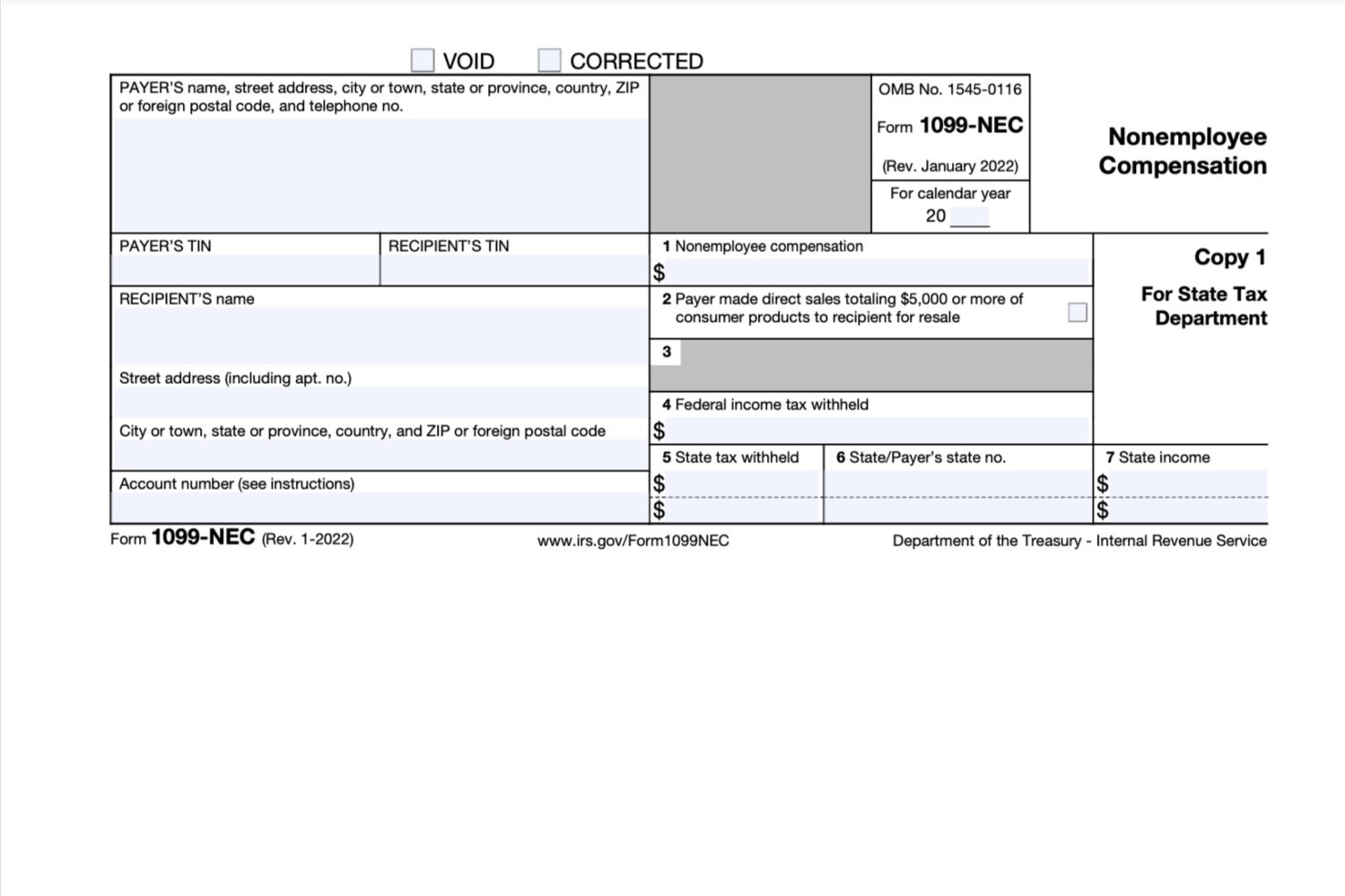

Will the IRS know if I work for DoorDash

An audit means that the IRS will review your financial records to make sure that income is reported correctly and that it matches what you've submitted on your tax return. You will likely receive Form 1099-NEC from Grubhub, Postmates, and DoorDash if you earn more than $600 during the calendar year.

What happens if I made less than 600 with DoorDash

You'll still be required to report any income earned as an independent contractor with DoorDash, even if it was less than $600.