Does DoorDash qualify as tax credits?

How do I get tax credit on DoorDash

9 Best Tax Deductions for Doordash Drivers in 2023Mileage or car expenses.Phone & Service Bills.Hot bags, blankets & Courier backpacks.Tolls.Parking.Inspections.Roadside Assistance.Health Insurance.

Cached

What counts as a tax write off DoorDash

Dashers can lower their taxable income by deducting business expenses, such as mileage, parking, tolls, cell phone usage, insulated courier bags, inspections, repairs, health insurance, and retirement contributions.

Cached

Can I write off food I eat while Doordashing

Whether your preference is Uber Eats, Grubhub, DoorDash, or a local delivery company, you can still deduct 100% of the meal's cost.

Cached

Is DoorDash worth it when it comes to taxes

Since Drivers submit claims as self-employed, DoorDash doesn't withhold any taxable income. This leads to a higher bill from the IRS. Consider sales tax in your area as well. To summarize, a DoorDash driver pays roughly 15.3% of taxes.

Can I write off gas for DoorDash

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can't deduct mileage and gasoline at the same time.

Do I have to file taxes for DoorDash if I made less than $600

Yes. You have to file taxes and report all income you receive as an independent contractor, even if it's less than $600 and you don't get a 1099 form. Does DoorDash report to the IRS DoorDash will report the income of all its DoorDashers who earn more than $600 to the IRS.

Can I write off gas as a Dasher

DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Federal mileage reimbursement of 56 cents per mile includes the cost of gas as well as maintenance and other transportation costs. An independent contractor can't deduct mileage and gasoline at the same time.

Can you write off gas for DoorDash

DoorDash drivers can deduct their mileage by either claiming the federal reimbursement for mileage (56 cents per mile in 2023) or by claiming actual expenses. This would include costs of gas and oil, maintenance, repairs, tires, registration, taxes, vehicle loan interest or lease payments and more.

How much can you make on DoorDash without paying taxes 2023

Yes – Just like everyone else, you'll need to pay taxes. If you earned more than $600 while working for DoorDash, you are required to pay taxes. It doesn't apply only to DoorDash employees. To compensate for lost income, you may have taken on some side jobs.

Is it better to write off gas or mileage

Here's the bottom line: If you drive a lot for work, it's a good idea to keep a mileage log. Otherwise, the actual expenses deduction will save you the most.

Should I keep gas receipts for DoorDash

As an independent contractor, the more business expenses you claim, the less you'll pay in taxes. With Everlance, tracking expenses is completely automatic and IRS compliant. You'll never need to keep a paper mileage log or keep track of old receipts.

Can I write off my phone bill for DoorDash

Phone and Service

And the portion of these expenses that you use for Doordash work counts as a tax write-off. Phone accessories like a car holder, car charger, and any others that are “ordinary and necessary” for your delivery job are also deductible.

Does DoorDash still tax me if I don’t make $600

Do I have to file taxes for DoorDash if I made less than $600 You'll still be required to report any income earned as an independent contractor with DoorDash, even if it was less than $600.

Do I need to keep gas receipts for taxes

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be deducted." Just make sure to keep a detailed log and all receipts, he advises, and keep track of your yearly mileage and then deduct the …

Does the IRS ask for proof of mileage DoorDash

The IRS wants more detail about your driving and your car. They will ask you when you first used your car for business. They'll also ask how many miles you drove for business, commuting, and other purposes. In the end, you'll be asked if you have evidence of your deduction and if it's written.

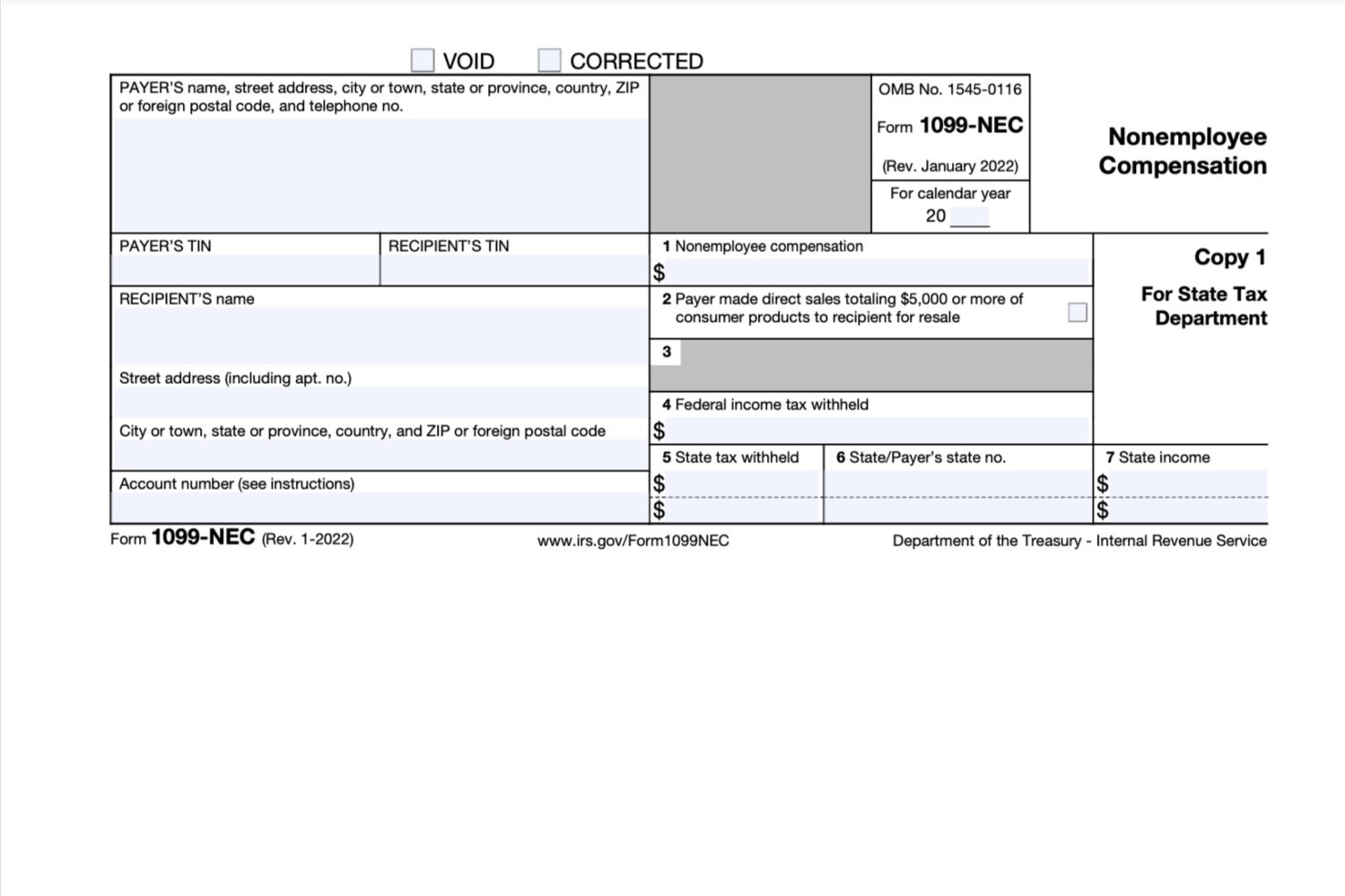

Will the IRS know if I work for DoorDash

An audit means that the IRS will review your financial records to make sure that income is reported correctly and that it matches what you've submitted on your tax return. You will likely receive Form 1099-NEC from Grubhub, Postmates, and DoorDash if you earn more than $600 during the calendar year.

How much do I have to pay in taxes if I did DoorDash

If you're self-employed, though, you're on the hook for both the employee and employer portions, bringing your total self-employment tax rate up to 15.3%.

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

What happens if you didn t track your mileage DoorDash

You can expect an auditor to disallow your deduction if you claim miles without any record. When that happens, you may not claim ANY miles OR actual car expenses. You HAVE to have documentation of your miles. Statement from IRS Publication 463 related to incomplete records for your business expenses.

Do I have to file taxes for DoorDash if I made less than $200

If you earn more than $400 from GrubHub, Postmates, DoorDash, or UberEATS, you must file a tax return and report your delivery earnings to the IRS. Most delivery providers report income as sole proprietors, which allows you to report business income on your personal tax return.