Does Equifax charge for credit lock?

Does it cost money to freeze your credit Equifax

Placing, temporarily lifting and permanently removing a security freeze on your credit reports is free. Click here to learn more about how to place, temporarily lift, or permanently remove a security freeze on your Equifax credit report.

Cached

Do I have to pay to lock my credit

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports.

Cached

Does Equifax have a fee

It's free! Access free credit reports from each of the nationwide credit bureaus each week. You may be entitled to additional free credit reports under certain circumstances.

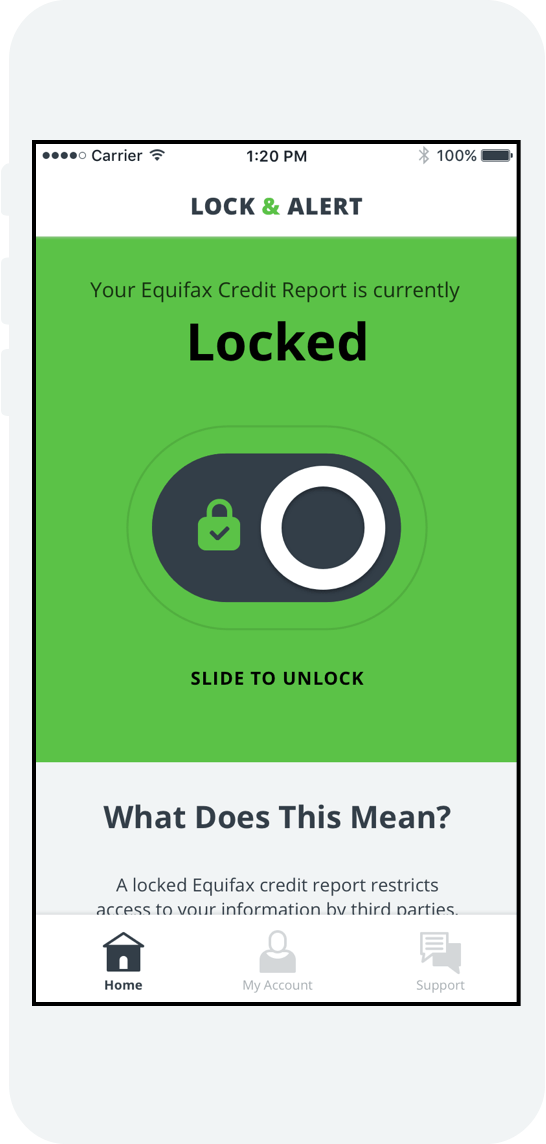

Is Equifax lock the same as freeze

A lock and a freeze have the same impact on your Equifax credit report, but they aren't the same thing. Both generally prevent access to your Equifax credit report to open new credit accounts.

Cached

What is the downside of freezing your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

What happens when you freeze Equifax

You place a credit freeze on your Equifax credit report. Your security freeze restricts access to your Equifax credit report for the purposes of extending credit in your name. When you want to apply for credit, you can temporarily lift or permanently remove your security freeze.

What is a major downside of locking your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

Do you have to pay to lock Experian

There is no fee to add or remove a freeze. If you place a security freeze on your Experian credit file, it is not shared with the other two credit reporting agencies. You will need to contact Equifax and TransUnion separately if you wish to freeze your credit files with them.

Why is Equifax so much higher

Equifax and TransUnion have different scores because slightly different information is reported to each credit reporting agency. In addition, TransUnion reports your employment history and personal information. Equifax's different credit scoring model results in lower scores.

Which is better Experian or Equifax

Experian gives a more detailed picture of a person's financial history, including payment timeliness and debt utilization. TransUnion offers more insight into a person's job history, whereas Equifax provides more information about mortgage history.

Is it good to lock your credit report

Locking or freezing your credit file may help prevent criminals from opening fraudulent accounts in your name. If you don't plan on applying for any new credit in the near future and your state doesn't allow credit freezing fees, a freeze may be the way to go.

Are credit freezes harmful

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

What’s the difference between locking and freezing your credit

Freezes are free, while CreditLock is part of paid subscriptions. CreditLock can be managed instantly, but security freeze changes could take longer. Unlike a freeze, CreditLock alerts you of attempts to access your locked Experian credit report.

Does it hurt to freeze your credit

A credit freeze means potential creditors will be unable to access your credit report, making it more difficult for an identity thief to open new lines of credit in your name. A credit freeze does not affect your credit score, and it's free.

Is freezing your credit the same as locking it

A credit freeze may offer stronger protection than a credit lock. This means you're not financially responsible if someone exploits your credit during the freeze. And under a federal law passed in 2023, credit bureaus are required to let you freeze and unfreeze your credit free of charge.

Does putting a credit freeze hurt your credit

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

How much is Experian CreditLock

If you decide not to cancel, your membership will continue and you will be billed $24.99 for each month that you continue your membership. You may easily cancel your trial membership online anytime within the trial period without charge. Experian CreditLock is a separate service from Security Freeze.

Which is better TransUnion or Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which score is higher Experian or Equifax

The main difference is Experian grades it between 0 – 1000, while Equifax grades the score between 0 – 1200. This means that there is not only a clear 200 point difference between these two bureaus but the “perfect scores” are also different, which is 1000 as reported by Experian and 1200 as reported by Equifax.

Do banks look at Experian or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.