Does Flex raise your credit?

Does Flex build credit

Flex is a monthly subscription that helps you pay rent on time, improve cash flow, and build your credit history.

Does Flex pay affect credit score

For U.S. residents: When you apply for Epic FlexPay at checkout, a “soft” credit inquiry occurs to verify your identity and determine your eligibility for financing. A soft credit inquiry doesn't affect your credit score.

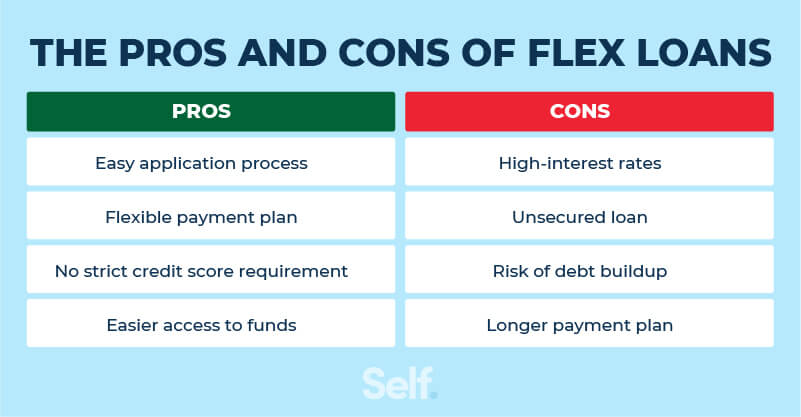

What are the downsides of a flex loan

However, flex loans aren't always a good choice. Here are some drawbacks to keep in mind: High interest rates, sometimes up to 200% APR or more. Minimum payments might not cover more than interest and fees, which could keep you in debt longer.

Cached

Is Flex payment worth it

Pros Explained. It can save you money: You can potentially pay a lower APR using Citi Flex Pay than your normal purchase APR. A fixed-rate loan could make budgeting easier: Knowing you have a set payment due every month may work better for your budget than having a credit card bill that varies monthly.

Cached

What is Flex credit limit

THE FLEXIBLE CREDIT LINE (FCL) The Flexible Credit Line (FCL) is designed to meet the demand for crisis-prevention and crisis-mitigation lending for countries with very strong policy frameworks and track records in economic performance.

What credit score do you need for Flex pay

690 or above

Good to excellent credit required

As is the case with most balance transfer cards, you'll need a good credit score — a FICO score of 690 or above — to qualify for the TD FlexPay Credit Card.

Is a flex loan a payday loan

A FLEX Loan is not a payday loan. It's an open-end line of credit. You apply once and are approved for a maximum amount of cash, called your credit limit. You can withdraw any amount up to your maximum credit limit.

How much can you get with a flex loan

Wells Fargo's small-dollar loan, known as Flex Loan, allows customers to borrow $250 or $500 for a flat fee of $12 or $20, respectively.

How do I increase my flex limit

You can decrease your limit whenever you want to, but not below the amount you're currently flexing. To increase your limit you'll need to request a higher amount, this typically takes a few minutes to find out if you're eligible for a higher limit through the app.

What are the benefits of the Flex card

While their use varies by Medicare Advantage plan, flex cards typically contain quarterly or annual allowances for OTC medications, drugstore items, healthy food, meal delivery, transportation and other extra benefits.

Why did I get denied for Flex

If your FSA claim is denied, it might be because you had insufficient funds in your account or that the price of the item you tried to purchase is higher than your balance. Be sure to check your balance before you use your card again.

Can you pay off a flex loan early

You can choose to pay more than the minimum at any time, and there is no prepayment penalty applied if you pay your balances off early.

What credit score is needed for Flex

You'll likely need a good to excellent credit score of at least 670 or higher to be considered for the Freedom Flex card.

What is a flex card for Social Security

Flex cards are like pre-paid debit cards that Medicare beneficiaries can use to purchase durable medical equipment and other qualifying medical expenses. These cards are not a Medicare benefit, but are available on some specific Medicare Advantage (MA) plans offered by private insurance companies.

What is the $2800 Flex card

If you've been watching some TV or scrolling through social media channels, you may have seen some enticing posts about “Medicare flex cards” with over $2,800 to use towards groceries, clothes, gas…or anything. Does this sound too good to be true Well it is. This is a scam.

How long does it take to pay off a flex loan

There are no loan origination fees. The monthly payment is fixed over the life of the loan. The borrower chooses the loan repayment length — up to 60 months. The APR is fixed, so even if the credit card's interest rate fluctuates, the Flex Loan APR remains the same.

Is the Flex card for seniors real

Luckily, the Medicare Flex card program is not a scam; it is legitimate although limited in its use on plans and carriers. This means it is perfectly safe to provide your information to a Medicare Flex card application so long as it is coming from a secure source like directly from your insurance carrier.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

What is a flex card with Social Security

The flex card allows seniors and their caregivers to pay for services without relying on third-party payment systems. Seniors can pay for medications, insurance copays, and dentures with a simple swipe.

What is a flex card for seniors and how does it work

Flex cards are like pre-paid debit cards that Medicare beneficiaries can use to purchase durable medical equipment and other qualifying medical expenses. These cards are not a Medicare benefit, but are available on some specific Medicare Advantage (MA) plans offered by private insurance companies.