Does getting sent to collections hurt credit score?

How much does a collection hurt your credit score

A collection on a debt of less than $100 shouldn't affect your score at all, but anything over $100 could cause a big drop. In many cases, it doesn't even matter how much it is if it's over $100. Whether you owe $500 or $150,000, you may see a credit score drop of 100 points or more, depending on where you started.

Cached

Does collections immediately affect credit score

Collections can only impact your credit score once they've been listed on your credit reports with one or more of the three major credit bureaus: TransUnion, Experian, or Equifax. Collections are typically reported to the credit bureaus as soon as collection agencies receive the debt.

Cached

How hard does collections affect credit score

Collections fall under payment history, which is the biggest factor in your FICO® Score☉ calculation, driving 35% of your score. Consumers with collections on their credit reports are likely to have lower credit scores than consumers who have no collections.

Can you get collections removed from credit report

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

Cached

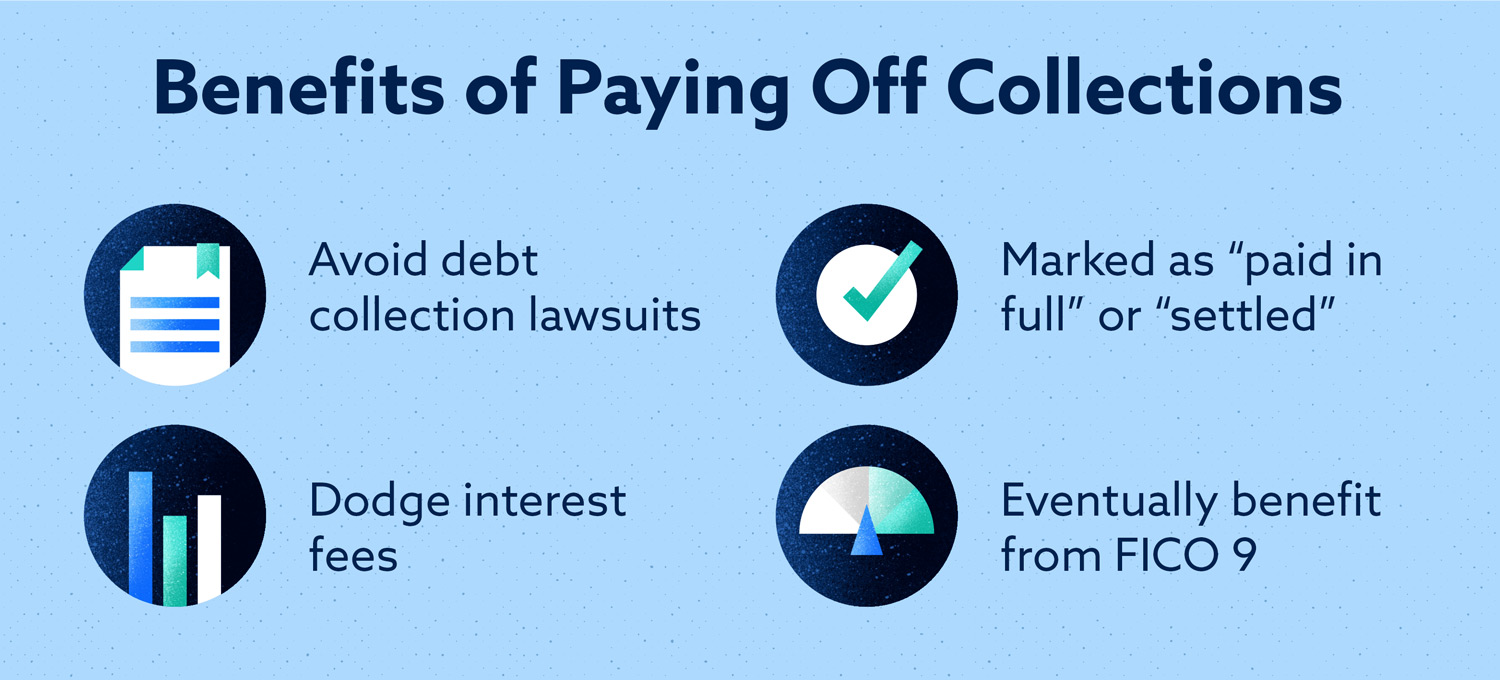

Is it worth it to pay off collections

And if you have multiple debt collections on your credit report, paying off a single collections account may not significantly raise your credit scores. But if you have a recent debt collection and it's the only negative item on your credit report, paying it off could have a positive effect on your score.

Will my score go up if I pay collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

How do I rebuild my credit after collections

Taking Steps to Rebuild Your CreditPay Bills on Time. Pay all your bills on time, every month.Think About Your Credit Utilization Ratio.Consider a Secured Account.Ask for Help from Family and Friends.Be Careful with New Credit.Get Help with Debt.

Do collections go away after paying

How long will collections stay on your credit report Like other adverse information, collections will remain on your credit report for 7 years. A paid collection account will remain on your credit report for 7 years as well.

What happens if you never pay collections

If you ignore a debt in collections, you can be sued and have your bank account or wages garnished or may even lose property like your home. You'll also hurt your credit score. If you aren't paying because you don't have the money, remember that you still have options!

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

Is it bad to ignore collections

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

How bad is it if a bill goes to collections

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely. So when a debt is sent to collections, it can have a severe impact on your credit scores.

Is it better to pay off collections or let them go

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years. Finally, paying off a debt can be a tremendous relief to your mental health.

Is it better to pay collections or not

And if you have multiple debt collections on your credit report, paying off a single collections account may not significantly raise your credit scores. But if you have a recent debt collection and it's the only negative item on your credit report, paying it off could have a positive effect on your score.

Why you shouldn’t pay off collections

Having an account sent to collections will lead to a negative item on your credit report. The mark is likely to stay on your credit report for up to seven years even if you pay off your debt with the collection agency. It's also possible that paying off your collection account may not increase your credit score.

Will I get rid of collections if I pay it

A paid collection account will not disappear from your credit history just because you've paid it off. It will stay there until the statute of limitations has passed, which is at least seven years in most cases. You cannot have it removed by contacting the credit bureaus and requesting it be removed.

Do collections get removed

Collections are a continuation of debt owed and can stay on your credit report for up to 7 years from the date the debt first became delinquent and was not brought current.

Do collections just go away

How long will collections stay on your credit report Like other adverse information, collections will remain on your credit report for 7 years. A paid collection account will remain on your credit report for 7 years as well.

Do collections go away once paid

How long will collections stay on your credit report Like other adverse information, collections will remain on your credit report for 7 years. A paid collection account will remain on your credit report for 7 years as well.

Is it bad to let a bill go to collections

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely. So when a debt is sent to collections, it can have a severe impact on your credit scores.