Does Google pay offer Buy Now, Pay Later?

Does Google offer buy now, pay later

Yes- once you have a Google Store Financing account, you can finance purchases on it up to your approved credit limit.

How do I activate Google Pay later

Get the Google Pay appDownload Google Pay on phones running Android 5.0 (Lollipop) or higher.Enter your phone number.Sign in with your Google Account.Follow the instructions to secure your Google Pay app and add a bank account. You can also add a debit or credit card. Fix problems verifying your phone number.

Does Google Pay use Afterpay

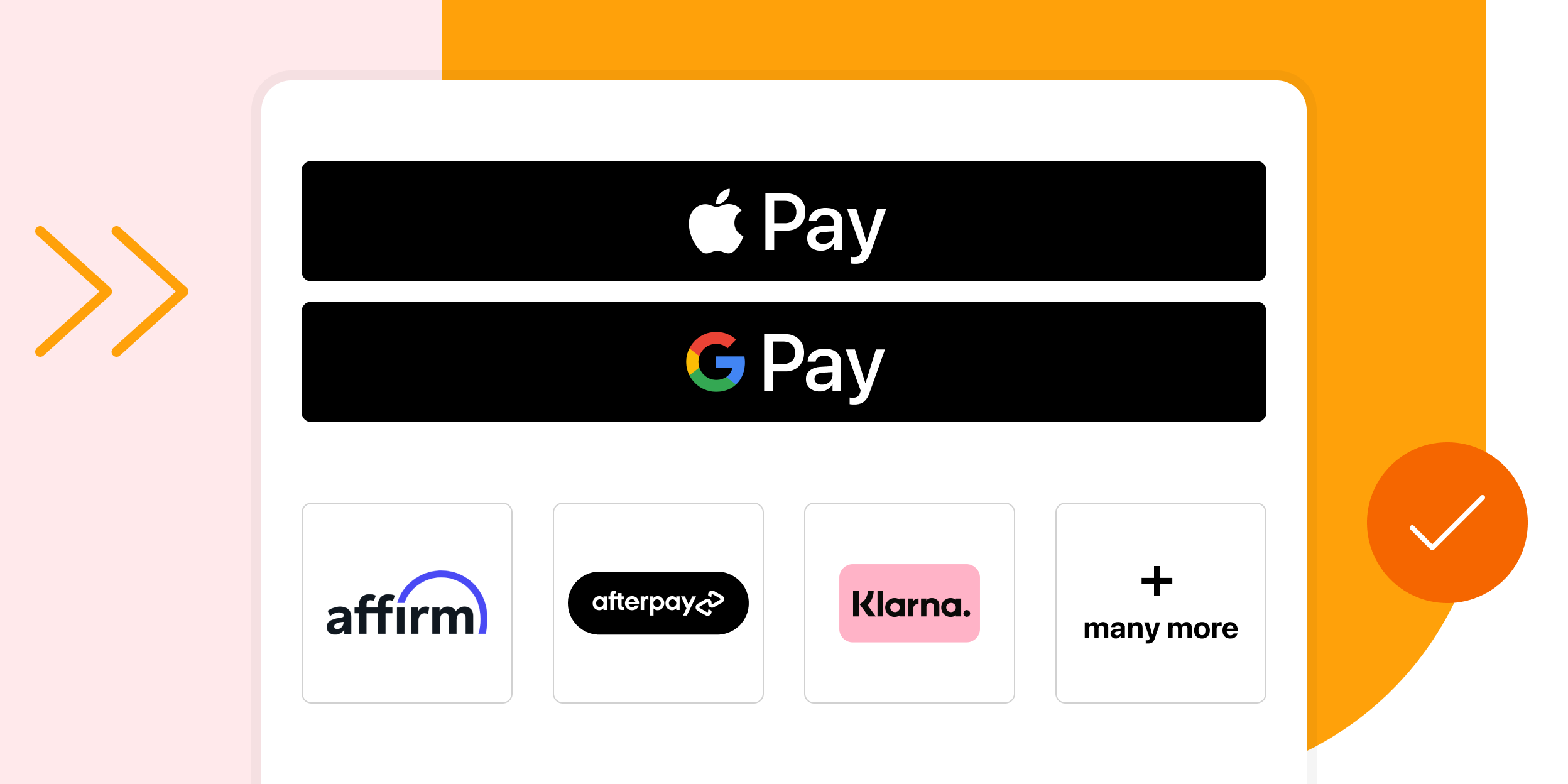

Both cards are a digital card that is added to your Apple Pay or Google Pay wallet.

Can I pay in 4 with Google Pay

8. Four accepts Google and Apple Pay for installment payments. Four is a split-it-into-four-payments service that allows you to shop through their apps or check out with Four during the checkout process at one of the participating retailers' websites.

Cached

What is Google Pay later

Buy now, pay later: Increases conversions by allowing customers to pay in installments while businesses receive immediate full payment. Real-time payments: Enables instant transactions directly from a bank account or funding source with authentication.

How does Google AfterPay work

AfterPay is a digital payment platform offered to online shoppers that allows them to delay payments on purchases. Users can make weekly payments on items purchased until they are paid in full. No credit check is required to use AfterPay, and no interest is charged.

Does Klarna accept Google Pay

Search for the store in the Klarna app and create a Digital card for your purchase. Add the card to your Google Pay wallet (or Apple Pay for iPhone users) and tap for contactless payment at checkout.

Can you pay in full with PayPal pay in 4

Yes. Log into your PayPal account, go to your Pay Later section, choose the Pay in 4 plan you want to pay off and click Make a Payment. Then you can make an unscheduled repayment to pay off the entire Pay in 4 loan.

What is the difference between Google Pay and Google Pay

The difference between Google Pay and GPay

For those who want their payments to be simple, Google Pay is the way to go, while GPay is the best option for those who want a more feature-rich payment app. GPay is essentially Google Pay's upgrade, even though both apps are still available and usable at any time.

How do I get $3000 on Afterpay

Currently, customers receive an initial $600 credit limit via Afterpay, which can increase to up to $3,000 after payments are made consistently and on-time.

Can you use Afterpay anywhere Google Pay is accepted

When you're ready to pay, select the Afterpay Plus Card in your digital wallet and tap to pay anywhere Apple Pay or Google Pay are accepted.

What payment options does Klarna accept

Klarna accepts all major debit and credit cards such as Visa, Discover, Maestro and Mastercard. Prepaid cards are not accepted. Please note: Capital One does not support Buy Now, Pay Later (BNPL) products.

Is Klarna the same as Sezzle

Klarna and Sezzle are both legitimate and secure services. Both keep customer data safe and sound and act much the same as credit cards, personal loans, and payday loans except with shorter-term repayment plans.

How can I borrow money from PayPal

Even if you can't get a cash advance, there are three ways to borrow money from PayPal:PayPal business loans.PayPal working capital.PayPal credit.

What is the credit limit for PayPal Pay in 4

PayPal will automatically convert the purchase amount into U.S. dollars during the checkout process. PayPal sets purchase limits for Pay in 4, and will typically only approve this payment method for transaction amounts between $30 and $1,500.

What are two disadvantages of Google Pay

Cons of Google PayThe app was designed primarily for Android and Google phone users.You can only add a credit or debit card to Google Wallet if the credit card company or your bank supports contactless payments.Not all in-person stores accept contactless payment.Google Pay in stores is only available via mobile app.

Which is better GPay or Google Pay

The difference between Google Pay and GPay

For those who want their payments to be simple, Google Pay is the way to go, while GPay is the best option for those who want a more feature-rich payment app. GPay is essentially Google Pay's upgrade, even though both apps are still available and usable at any time.

How to get $600 with Afterpay

Every Afterpay customer starts with a limit of $600. Your pre-approved spend amount increases gradually. The longer you have been a responsible shopper with Afterpay – making all payments on time – the more likely the amount you can spend will increase.

What’s the highest limit on Afterpay

For Afterpay, the highest limit is $1,500 per transaction and customers can hold a maximum of $2,000 as outstanding balance, but these limits are variable and depend on a variety of factors such as payment history and frequency of on-time payments.

Can I use Sezzle anywhere with Google Pay

You can use your Sezzle Virtual Card to place orders either online or in-store using your mobile wallet like Apple Pay or Google Pay at select retailers. To view which retailers accept your Sezzle Virtual Card, log in to the Sezzle mobile app and navigate to the “Virtual Card” tab.