Does increase in investment reduce interest rate?

How does investment affect interest rate

The investment demand curve shows the relationship between the real interest rate and the amount of investment demanded in an economy. Simply put, if the real interest rate increases, firms will demand less investment.

Does investment increase with lower interest rates

Interest rate fluctuations have a substantial effect on the stock market, inflation, and the economy as a whole. 2 Lowering interest rates is the Fed's most powerful tool to increase investment spending in the U.S. and to attempt to steer the country clear of recessions.

Cached

What happens to interest rate if investment increases

An explanation of how the rate of interest influences the level of investment in the economy. Typically, higher interest rates reduce investment, because higher rates increase the cost of borrowing and require investment to have a higher rate of return to be profitable.

What decreases interest rates

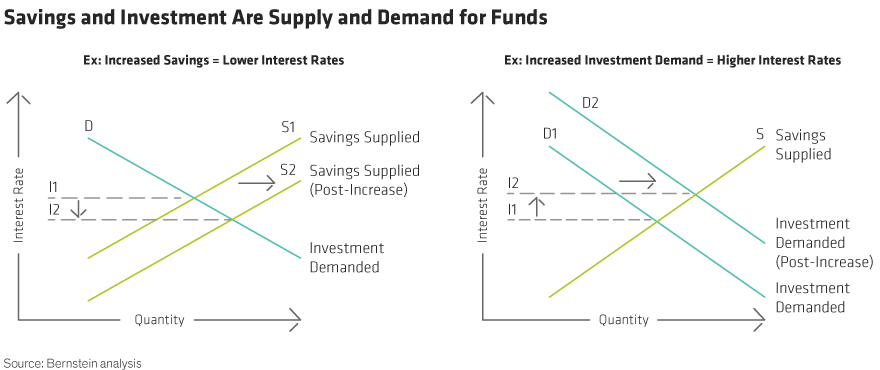

Supply and Demand. Interest rate levels are a factor in the supply and demand of credit: an increase in the demand for money or credit will raise interest rates, while a decrease in the demand for credit will decrease them.

What happens when investment decreases

A reduction in investment would shift the aggregate demand curve to the left by an amount equal to the multiplier times the change in investment. The relationship between investment and interest rates is one key to the effectiveness of monetary policy to the economy.

How does increased investment help the economy

Investment is a component of aggregate demand (AD). Therefore, if there is an increase in investment, it will help to boost AD and short-run economic growth. If there is spare capacity, then increased investment and a rise in AD will increase the rate of economic growth.

What happens to investments when interest rates fall

When rates go up, bond prices typically go down, and when interest rates decline, bond prices typically rise. This is a fundamental principle of bond investing, which leaves investors exposed to interest rate risk—the risk that an investment's value will fluctuate due to changes in interest rates.

What affects your interest rate the most

Lenders consider your credit score, payment history and the current economic conditions when determining interest rates. Generally speaking, the higher your credit score, the less you can expect to pay in interest. But loan-specific factors such as repayment terms play a role too.

What causes interest income to decrease

Circumstances such as a deteriorating economy and heavy job losses can cause borrowers to default on their loans, resulting in a lower net interest income.

What causes a decrease in real interest rate

Fundamentally, real interest rates are determined by the levels of saving and fixed investment in the economy. All else equal, a decrease in the real interest rate occurs if saving increases or fixed investment decreases; an increase in the real interest rate occurs if saving decreases or fixed investment increases.

What causes an increase in investment

Summary – Investment levels are influenced by:

Interest rates (the cost of borrowing) Economic growth (changes in demand) Confidence/expectations. Technological developments (productivity of capital)

Why is increasing investment important

Why is investing important Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in value. The greater growth potential of investing is primarily due to the power of compounding and the risk-return tradeoff.

What are the 4 factors that influence interest rates

What influences Interest RatesInflation.Stock market conditions.International Investors.Fiscal deficit and government borrowings.

What are three factors that affect interest

Lenders consider your credit score, payment history and the current economic conditions when determining interest rates. Generally speaking, the higher your credit score, the less you can expect to pay in interest. But loan-specific factors such as repayment terms play a role too.

Does an increase in income increase interest rates

The increase in income from the higher investment demand also raises interest rates. This happens because the higher income raises demand for money; since the supply of money does not change, the interest rate must rise in order to restore equilibrium in the money market.

Why does lower interest rate decrease investment

As the real interest rate decreases, the cost of investment decreases. A lower cost encourages firms to demand more money for investment purposes and increase their production level. This would raise their expected return on investment. A higher expected rate of return stimulates the investment demand in the economy.

What are the main factors that affect interest rates

Factors that affect interest rates are economic strength, inflation, government policy, supply and demand, credit risk, and loan period.

What affects interest rates

Interest rates are influenced by the supply and demand for loans and credit. Central banks raise or lower short-term interest rates to ensure stability and liquidity in the economy. Long-term interest rates are affected by the demand for 10- and 30-year U.S. Treasury notes.

What is the effect of an increase in investment quizlet

Prices will increase, because increased investment spending leads to higher GDP levels and higher prices. C. Prices will increase, as an increase in investment spending will lead to higher interest rates and therefore higher prices.

What is it called when an investment increases

Capital growth, or capital appreciation, is an increase in the value of an asset or investment over time.