Does insurance go off your credit score?

Does insurance go by credit score

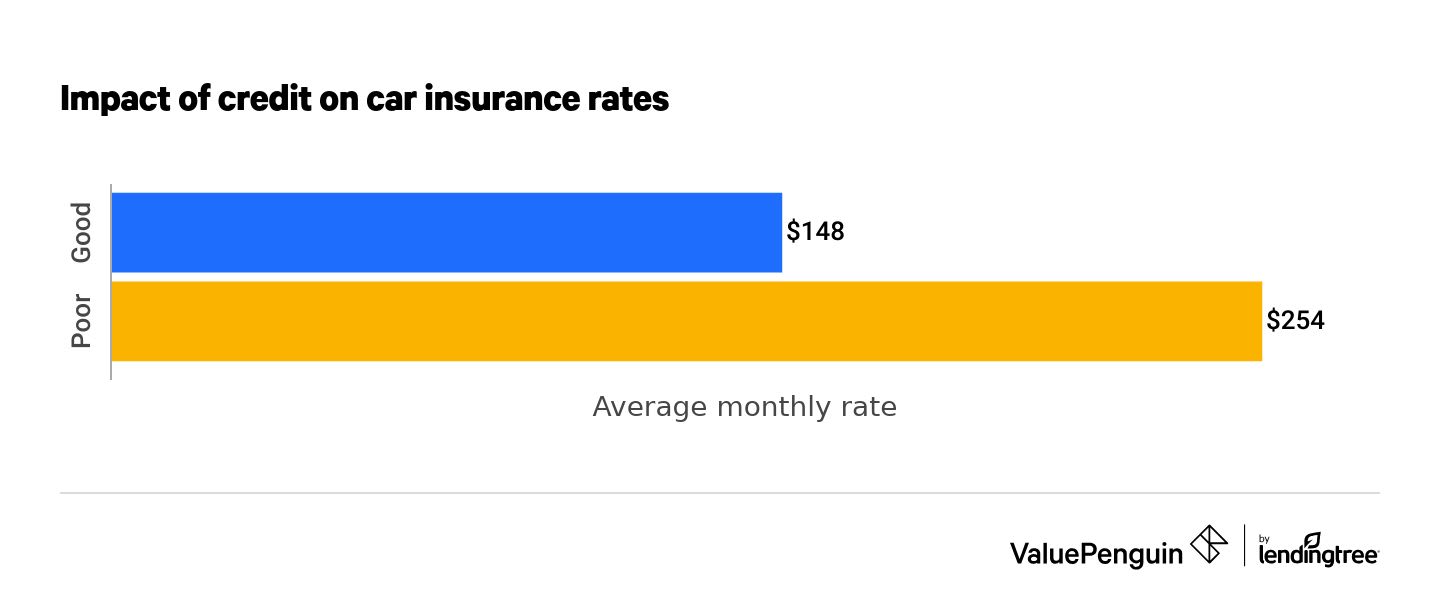

Insurance companies check your credit score in order to gauge the risk they'll take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

Cached

Does car insurance go off credit score

No, getting an auto insurance quote does not affect your credit.

What is a good credit score for car insurance

A good insurance score is roughly 700 or higher, though it differs by company. You can improve your auto insurance score by checking your credit reports for errors, managing credit responsibly, and building a long credit history.

Why is credit score used for insurance

However, credit-based insurance scores are generally built to help insurance companies understand the likelihood that someone will file insurance claims that cost the company more than it collects in premiums. Factors that influence your credit scores can also affect your credit-based insurance scores.

What bills help build credit

What Bills Help Build CreditRent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health.Utility Bills.Auto Loan Payments.Student Loan Payments.Credit Card Payments.Medical Bills.

Does Geico quote affect credit score

First things first—your credit score won't be impacted.

Insurance-related inquiries are NOT counted against your credit score. If you obtain your credit report from one (or more) of the major bureaus, you will be able to see the inquiry, but it will never lower your score or impact your ability to obtain credit.

What is the highest insurance score

According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

Is car insurance a hard inquiry

Does getting insurance quotes affect your credit score No, there is no hard credit pull when you get a car insurance quote, so shopping around won't affect your credit score. A hard credit pull generally happens when you apply for credit, such as a mortgage or credit card.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

Do utility bills help credit score

You cannot usually use utility bills to improve your credit. Most utility bills typically have no impact on your credit score because the information is not generally reported to credit bureaus as they are not credit accounts.

Does Allstate use credit scores

It's important to understand that while Allstate uses certain elements from your credit history, we never see your credit score, and we're not evaluating your overall credit worthiness. We simply use elements from your credit report that have proven effective in predicting insurance losses.

What is a good insurance score

According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

What causes insurance score to drop

What makes your insurance score decrease Anything that makes your credit score worse will negatively impact your insurance score. Being late on your bills and debt payments, taking out excessive lines and types of credit and maintaining a high credit utilization rate can reduce (worsen) your insurance score.

Is insurance a soft or hard pull

Insurance quotes do not affect credit scores. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to lenders. You can get as many inquiries as you want without negative consequences to your credit score.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to get a 700 credit score in 2 months

Here's what you need to do.Make every payment on time.Keep your credit utilization low.Don't close old accounts.Pay off credit card balances.Ask your card issuer to increase your limit.Use the authorized user strategy.Put your bill payments to work.Use a rent reporting company.

What bills go towards credit score

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

What builds your credit score

You can improve your credit score by opening accounts that report to the credit bureaus, maintaining low balances, paying your bills on time and limiting how often you apply for new accounts.

What is the best credit score for insurance

What, then, is a good credit score to get a car insurance policy with competitive prices A score in the “good” range — between 670 and 739, according to the FICO scoring model — is generally considered to be the baseline for competitive pricing.

What is the 80% rule in insurance

The 80% rule describes a policy in which insurers only cover the costs of damage to your house or property if you've purchased coverage that equals at least 80% of the property's total replacement value.