Does it hurt credit to increase limit?

Does getting a credit limit increase affect your score

Increasing your credit limit won't necessarily hurt your credit score. In fact, you might improve your credit score. How you utilize the credit access line after the increase is one of the multiple factors that can impact your score.

Cached

Is increasing credit card limit good or bad

Increasing a credit card limit lowers your credit utilization ratio, which boosts your credit score. It can be a better choice than taking out a new credit card, which shortens your credit history and decreases your credit score.

What is the disadvantage of increasing credit limit

With a higher credit limit, one may end up spending more impulsively than they can afford to repay. If you fail to pay your bills on time, it will negatively impact your credit score and make it difficult for you to obtain better credit in the future.

Is a credit limit increase a soft pull

If your credit card issuer offers an increase in your credit limit, it might have carried out a soft credit pull. Whether or not you accept the increase is up to you. If you choose not to accept the increase, you might need to call your card issuer or reduce it on your own by using your card provider's website or app.

Cached

Is it better to request a credit line increase

Although a limit increase is preferable for people who already have a few credit cards, opening a new account might be a good idea if you have only one card. In fact, your credit scores will be enhanced by getting a second line of credit, despite the initial decrease that results from a hard credit inquiry.

How long should I wait to ask for a higher credit limit

You can request a credit line increase every 4-6 months, or even more frequently. But your chances of being approved for an increase are best if you wait at least 6 months from when you opened your account or last requested a higher limit.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

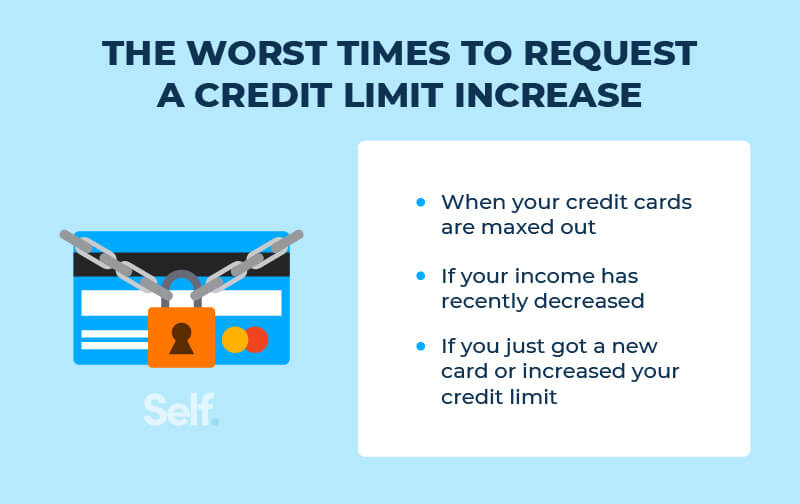

When should I increase my credit limit

When to Request a Credit Limit IncreaseYour Income Increases or Housing Costs Decrease. Card issuers need to be sure you have enough income to support a higher credit limit.You've Paid Off or Closed Other Credit Accounts.Your Credit Score Improves.You Have a Good History With the Issuer.

What are good reasons for increasing credit limit

When to Request a Credit Limit IncreaseYour Income Increases or Housing Costs Decrease. Card issuers need to be sure you have enough income to support a higher credit limit.You've Paid Off or Closed Other Credit Accounts.Your Credit Score Improves.You Have a Good History With the Issuer.

What are the pros and cons of increasing credit limit

What are the benefits of increasing your credit card limitGain more purchasing power.Improve your credit score.An emergency safety net (when your emergency fund isn't enough)Higher limit means more total debt.A hard credit check will impact your credit score.It will impact your credit mix.It impacts other borrowing.

Is a limit increase a hard inquiry

Requesting a credit limit increase can hurt your score, but only in the short term. If you ask for a higher credit limit, most issuers will do a hard “pull,” or “hard inquiry,” of your credit history. A hard inquiry will temporarily lower your credit score.

Is there a downside to requesting a credit line increase

Although a credit limit increase is generally good for your credit, requesting one could temporarily ding your score. That's because credit card issuers will sometimes perform a hard pull on your credit to verify you meet their standards for the higher limit.

Does being denied a credit limit increase hurt your credit score

Does Asking for a Credit Limit Increase Affect Your Credit Score That can depend on your credit card issuer. If it does what's known as a soft credit check, it will not affect your credit score in any way. If the company makes a hard credit check, that may lower your score a bit, but usually only temporarily.

How much is too much to ask for credit limit increase

Credit experts suggest that you only ask for an increase when you've paid your bills promptly. They also recommend waiting at least six months after you received the credit card and asking for no more than a 10% to 25% increase. Asking for more than 25% might raise questions about your intentions.

Is 10000 a good credit limit

Is a $10,000 credit limit good Yes a $10,000 credit limit is good for a credit card. Most credit card offers have much lower minimum credit limits than that, since $10,000 credit limits are generally for people with excellent credit scores and high income.

Is $30000 a high credit limit

Yes, a $30,000 credit limit is very good, as it is well above the average credit limit in America. The average credit card limit overall is around $13,000, and people who have limits as high as $30,000 typically have good to excellent credit, a high income and little to no existing debt.

Is a $10,000 credit limit high

Is a $10,000 credit limit good Yes a $10,000 credit limit is good for a credit card. Most credit card offers have much lower minimum credit limits than that, since $10,000 credit limits are generally for people with excellent credit scores and high income.

Is it bad to have a lot of credit cards with zero balance

It is not bad to have a lot of credit cards with zero balance because positive information will appear on your credit reports each month since all of the accounts are current. Having credit cards with zero balance also results in a low credit utilization ratio, which is good for your credit score, too.

How can I increase my credit limit without hard inquiries

How to Get a Credit Limit Increase Without AskingAlways pay all your bills on time.Pay off the card you want the higher limit on fully each month.Update your income on the credit card company's website/mobile app.Keep your account open for at least 6-12 months.

How high of a credit increase should I request

Decide how much you want to ask for

The typical increase amount is about 10% to 25% of your current limit. Anything further may trigger a hard inquiry on your credit.