Does it hurt your credit if you cosign for someone?

Is cosigning bad for your credit

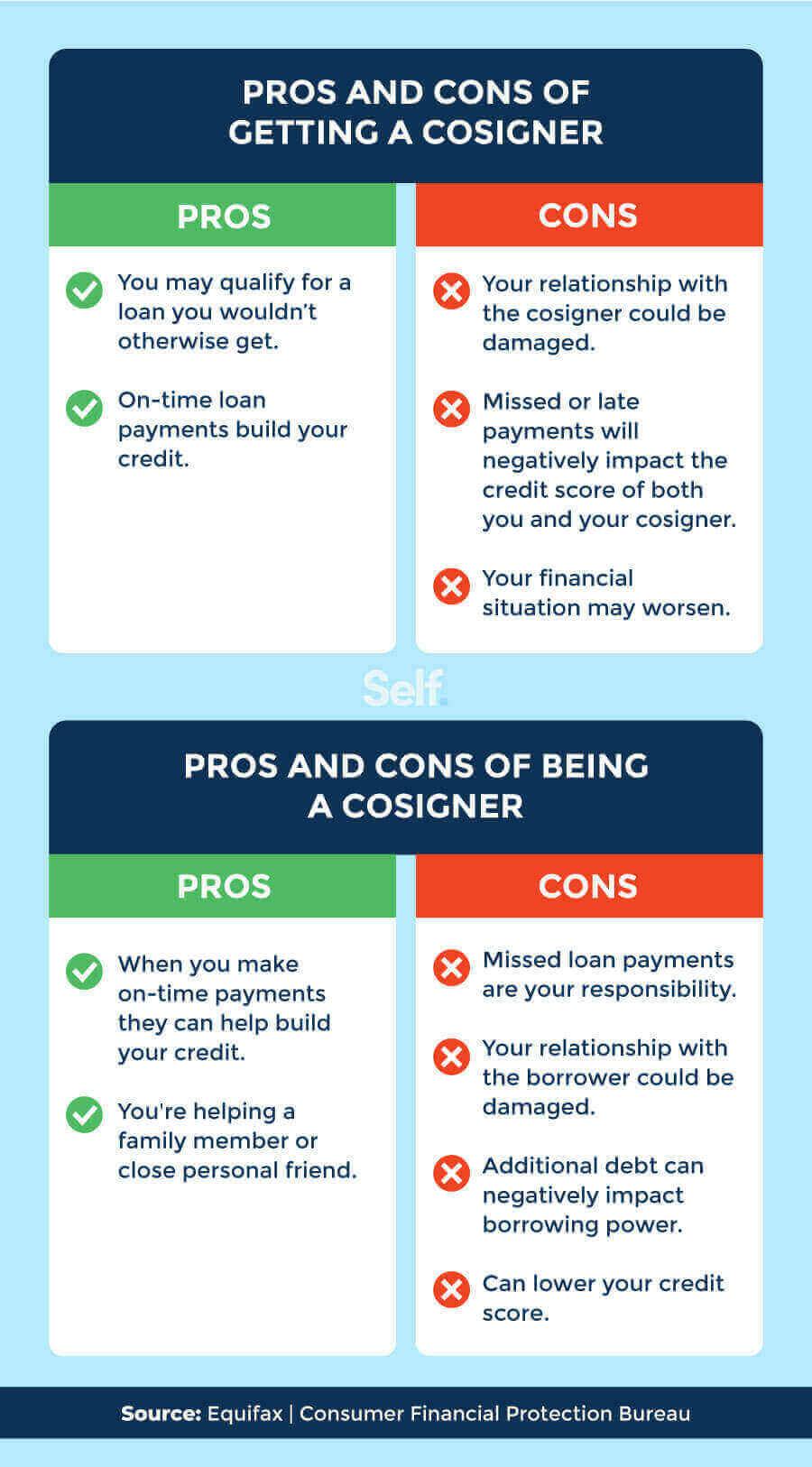

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Cached

Does cosigning still build credit

Having a co-signer on the loan will help the primary borrower build their credit score (as long as they continue to make on-time payments). It could also help the co-signer build their credit score and credit history, if the primary borrower makes on-time payments throughout the course of the loan.

Cached

Is it ever a good idea to cosign

The bottom line is this: co-signing on a loan for anyone is never a good idea. If you feel compelled, lend them some money with a written agreement on how it is to be repaid. But never put your credit on the line by co-signing documents with a lender.

Cached

Who gets the credit on a cosigned loan

Both the primary borrower and the cosigner on a loan will get credit if the primary borrower makes the payments on time. On the other hand, if the primary borrower does not keep up with the monthly payments, both their credit score and the cosigner's credit score will drop.

Is it smart to cosign

The bottom line. The decision to sign on as a co-signer comes down to the trust you have in the primary borrower. If you believe they will meet their payments and are willing to risk your own finances, then helping a friend or family member may be the right thing to do. Otherwise, it is best to say no to this agreement …

What are the cons of cosigning

Cons of Cosigning a LoanIncreased responsibility — Once again, if you cosign for a loan, you are responsible for paying if the other party can't.Potentially strained relationship — Many personal relationships have been damaged or ended because of financial strain.

What are the risks of cosigning

Precautions to Take Before You Cosign

Be sure you can afford to pay the loan. If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

Can you remove yourself as a cosigner

Fortunately, you can have your name removed, but you will have to take the appropriate steps depending on the cosigned loan type. Basically, you have two options: You can enable the main borrower to assume total control of the debt or you can get rid of the debt entirely.

Why is it risky to be a co-signer

The lender can sue the cosigner for interest, late fees, and any attorney's fees involved in collection. If the primary borrower falls on hard times financially and cannot make payments, AND the cosigner fails to make the payments, the lender may also decide to pursue garnishment of the wages of the cosigner.

What are the risks for a co-signer

Be sure you can afford to pay the loan. If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

What are the cons of being a cosigner

Cons of Cosigning a LoanIncreased responsibility — Once again, if you cosign for a loan, you are responsible for paying if the other party can't.Potentially strained relationship — Many personal relationships have been damaged or ended because of financial strain.

How high does a co-signer’s credit have to be

670 or better

Although lender requirements vary, a cosigner generally needs a credit score that is at least considered "very good," which usually means at least 670 or better.

What are the cons of Cosigning

Cons of Cosigning a LoanIncreased responsibility — Once again, if you cosign for a loan, you are responsible for paying if the other party can't.Potentially strained relationship — Many personal relationships have been damaged or ended because of financial strain.

Why is it never a good idea to cosign a loan

Depending on how much debt you already have, the addition of the cosigned loan on your credit reports may make it look like you have more debt than you can handle. As a result, lenders may shy away from you as a borrower. It could lower your credit scores.

How do I protect myself as a cosigner

5 ways to protect yourself as a co-signerServe as a co-signer only for close friends or relatives. A big risk that comes with acting as a loan co-signer is potential damage to your credit score.Make sure your name is on the vehicle title.Create a contract.Track monthly payments.Ensure you can afford payments.

How long does it take to be removed as a cosigner

See if your loan has cosigner release

If the conditions are met, the lender will remove the cosigner from the loan. The lender may require two years of on-time payments, for example. If that's the case, after the 24th consecutive month of payments, there'd be an opportunity to get the cosigner off the loan.

What are the risks of being a cosigner

If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

Can I cosign with a 650 credit score

Typically, a cosigner needs a credit score of 670 or better to be approved. This range is usually classified as very good to excellent credit.

What is the disadvantage of being a cosigner

Risks of Cosigning. Credit is at stake for both cosigners. If one person fails to pay, the other signer is pressured to pay the other person's part to protect both of their credit scores. Relationships can be tarnished if one of the cosigners aren't responsible with their payments.

Can I kick out my cosigner

In short, removing a cosigner is possible when: You can qualify for the loan or lease without the help of the cosigner. The lender or landlord allows for the cosigner to be removed, or. The lease is re-done or the loan refinanced, without the cosigner's name.