Does it hurt your credit to take off an authorized user?

Will my credit score go down if I removed as an authorized user

Your credit score may either improve or drop slightly when you are removed as an authorized user on a credit card. That is because the account history for the credit card will automatically drop off your credit reports upon removal.

Cached

Why did my credit score drop when I was added as an authorized user

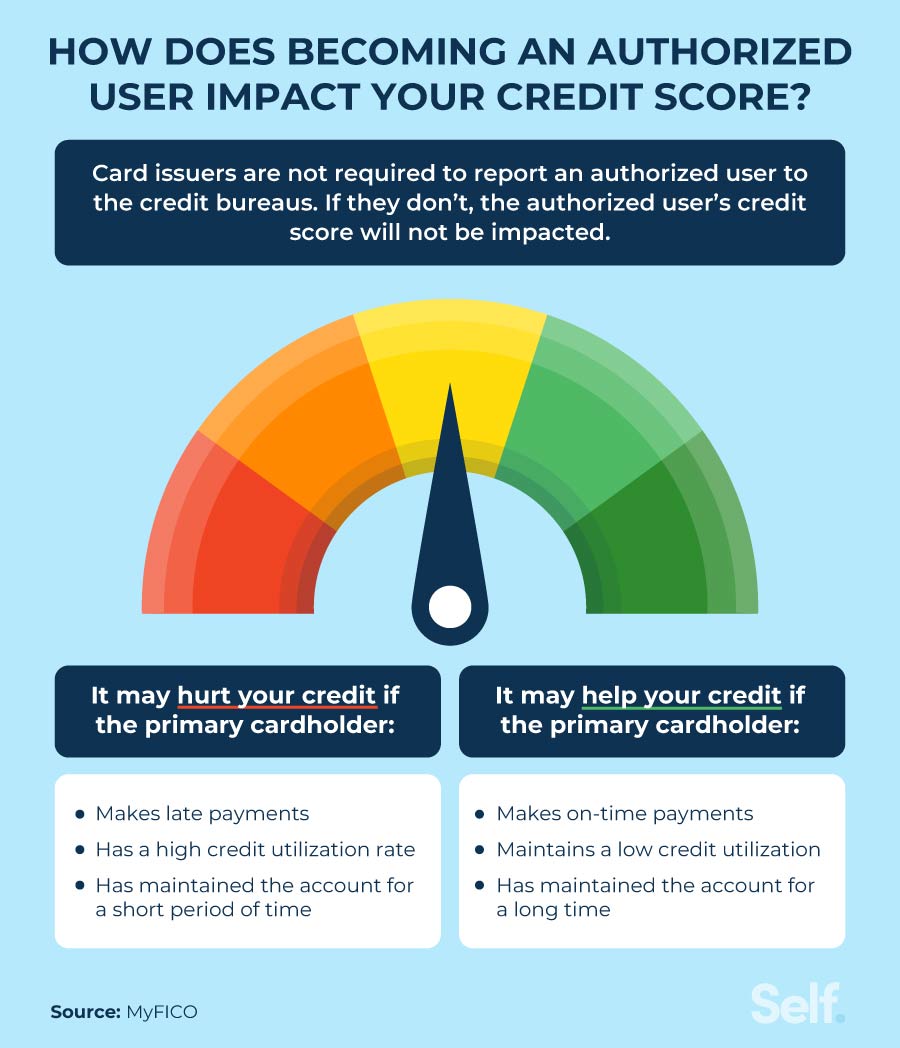

If you've added an authorized user to your credit card account, they'll typically get a credit card linked to your account and can use it to make charges, but they're not responsible for paying the balance. Any charges the authorized user makes can increase your credit utilization, which can lower your credit scores.

Does being an authorized user affect your credit negatively

Being an Authorized User Might Not Impact Your Credit

Credit scoring models only consider information that's currently on your credit report—nothing more and nothing less. So, in order for a credit card to affect your scores, it must show up on your credit reports with Equifax, TransUnion and Experian.

How long does it take for authorized user to be removed on credit report

Call the issuer and ask to have your name removed as an authorized user. It should take only a few days, and the issuer will cease making reports under your name to credit bureaus. At some point, that account should vanish from your report entirely.

When should you remove an authorized user

If the account holder made late payments or has a high credit card balance, for instance, the account could hurt you more than it helps. On the other hand, you may want to leave the authorized user account if it's helping your credit score—at least until you've established credit in your name.

What happens if you remove yourself as an authorized user on a credit card

The account will no longer appear on your credit report, and its activity will not be factored into your credit scores. That also means that your length of credit history, which constitutes 15% of your FICO® Score, will be affected.

How fast will my credit score go up as an authorized user

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

How many points can your credit score go up as an authorized user

For instance, for those with bad credit (a credit score below 550), becoming an authorized user improved their credit score by 10% — in just 30 days. Fast forward to 12 months, and that figure jumps to 30%.

How fast can your credit score go up being an authorized user

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

How much will my credit score go up if I become an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

How much will my credit score go up as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

What are the effects of being removed as an authorized user

When you're removed as an authorized user, you no longer have the privilege of using the account, and the credit card issuer will stop updating the account on your credit report.

How much will my credit score increase as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

When should I remove myself as an authorized user

There are a few reasons you'd want to be removed as an authorized user. If having the account on your credit report is hurting your credit score and your ability to be approved for other credit cards and loans, removing yourself from the credit card allows you to have the account removed from your credit report.

Do authorized users get a hard credit pull

Adding an authorized user typically doesn't result in a hard inquiry (also called a hard credit pull) for either the authorized user or the primary account holder. The only exception to this might be if the account holder has rocky credit and already has an authorized user listed on the account.

How much will piggybacking raise my score

The only good news is that mortgage loans still use the older Fico scoring models. Therefore, piggybacking credit still works to boost your score when applying for a mortgage. Piggybacking credit can be a great tool to use to boost your Fico score by 100 or more points, in just a few days.

Will my credit improve if I am an authorized user

Being an authorized user on someone else's account can allow you to build and improve your credit score. Before you become an authorized user, make sure the primary account holder has good credit and responsibly manages their account.

Will adding my child as an authorized user help his credit

Will adding my child as an authorized user help his or her credit Yes, adding children as authorized users can help their credit scores. It's up to the primary cardholder to maintain a healthy credit score so the authorized users can reap the benefits.

Is there a downside to adding authorized user

The primary cardholder is solely liable for payments. The card issuer may charge an annual fee to add an authorized user. The credit scores of both authorized user and primary cardholder can suffer when either person mismanages the account.

How to increase credit score by 400 points

4 tips to boost your credit score fastPay down your revolving credit balances. If you have the funds to pay more than your minimum payment each month, you should do so.Increase your credit limit.Check your credit report for errors.Ask to have negative entries that are paid off removed from your credit report.