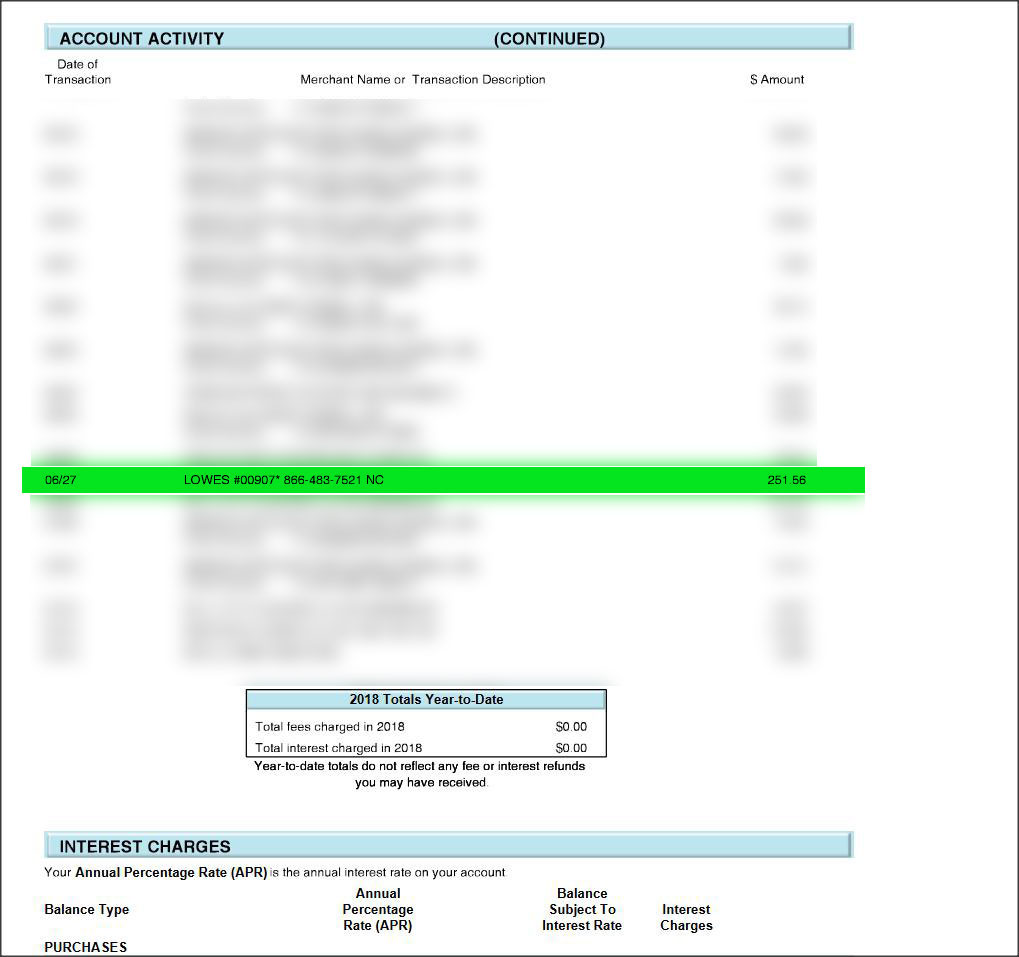

Does Lowes check your credit?

Is it hard to get approved for Lowes

What credit score do I need for a Lowe's card You'll likely need a fair, good, or excellent credit score to qualify for the Lowe's credit card. Fair credit scores typically start around 600. Good scores start around the high 600s, and excellent scores start around 800.

Cached

What credit score do you need for Lowes

The credit score that you need for the Lowe's Store Card is 640, at a minimum.

Cached

Does Lowes do a soft or hard credit check

Yes, the Lowe's Store Card does a hard pull when you apply for it. And a hard pull could temporarily affect your credit score, as you might already know. You'll need at least fair credit to be approved, and luckily you can check if you pre-qualify without hurting your credit.

Is applying for a Lowes card a hard inquiry

What you should know before applying for the Lowe's Store Card: However, if you do prequalify and want to get the card, you will need to submit an actual application which will result in a hard pull. This inquiry might negatively affect your credit score for a little while.

Why would you be denied a Lowes credit card

A low credit score. Not enough income. Too much existing debt. A recent delinquency on your credit report.

How do you pass a Lowe’s interview

Okay first of all let's take a look at that first loads interview question that I recommend you prepare for which is 10 tell me about yourself. And why you want this job at Lowe's. Now this interview

What is the max limit on a Lowes credit card

Credit limits for the Lowe's Advantage Card can range from $300 to $5,000 or more depending on creditworthiness. Where can I use a Lowe's Advantage Card You can use the Lowe's Advantage Card at Lowe's stores and online at Lowes.com.

Do you have to have good credit to work at Lowes

Lowe's runs a complete background check when they screen potential new hires. Their background check includes: Credit worthiness. Credit standing.

Is it better to apply for Lowes card online or in person

It's usually better to apply online, simply because you might get approved instantly. After you get approved, you can then take the card and get 20% off your first purchase, up to $100 off. It's a pretty good deal, especially if you had been planning on making a big Lowe's purchase.

Does Lowes do a hard pull for credit increase

When you request a Lowe's Store Card credit limit increase, the issuer will conduct a soft pull of your credit report. This inquiry will not affect your credit score. Alternatively, you could be eligible for a Lowe's Store Card credit limit increase without even requesting one.

What are the chances of getting hired at Lowes

Only 5% of all Lowe's candidates get hired, so you should familiarize yourself with their hiring process, assessment tests, and interviews.

What are the steps to getting hired at Lowes

The hiring process at Lowe's typically involves an initial phone screening, followed by an in-person interview with a store manager or hiring team. Following the interview, applicants may be asked to take a drug test and/or background check before finally being offered the position.

Why was my Lowes card declined

A low credit score. Not enough income. Too much existing debt. A recent delinquency on your credit report.

How much do you get off for opening a Lowes credit card

Accounts opened in store: One-time 20% off discount is not automatic; you must ask cashier to apply discount (barcode) at time of in-store purchase.

Can I get a Lowes card with bad credit

At Lowe's, you will need a minimum credit score of 620 based on the FICO system. If your credit score is lower than 620, you won't be able to apply for a card with Lowe's – but there are options!

Can you apply for a Lowes card and use it the same day

Ask your cashier about filling out an application, or go to the customer service desk. If you're approved the same day, you'll be able to use the card for your purchases. New cardholders are usually eligible for a discount on their first purchase, regardless of whether they're approved the same day they apply.

Does Home Depot do a soft pull on credit

You can use the Home Depot's pre-qualification tool to see if you're pre-qualified for the Home Depot consumer credit card. It's a quick, “soft” credit check that won't impact your credit score.

What position at Lowes pays the most

Salaries By Department At Lowe's Companies

| Rank | Department | Hourly Rate |

|---|---|---|

| 1 | Facilities | $17.81 |

| 2 | Supply Chain | $16.44 |

| 3 | Administrative | $16.32 |

| 4 | Sales | $15.02 |

What do Lowes employees get paid

ranges from an average of $11.30 to $19.27 an hour. Lowe's Home Improvement Inc. employees with the job title Operations Supervisor make the most with an average hourly rate of $21.62, while employees with the title Customer Service Cashier make the least with an average hourly rate of $11.86.

Why would I be refused credit if my credit score is excellent

If there's concern that the account you're applying for, combined with your existing financial commitments, will strain you, they may decline the application. Having a high Credit Score may not be enough to be accepted if the potential lender finds your affordability too low.