Does manufacturing overhead have a debit or credit?

Is manufacturing overhead a debit or credit

debited

As the overhead costs are actually incurred, the Factory Overhead account is debited, and logically offsetting accounts are credited.

Cached

Is manufacturing overhead a credit account

Note that the manufacturing overhead account has a credit balance when overhead is overapplied because more costs were applied to jobs than were actually incurred.

CachedSimilar

When manufacturing overhead has a debit balance

If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied.

What do you credit for manufacturing overhead

To calculate manufacturing overhead, you need to add all the indirect factory-related expenses incurred in manufacturing a product. This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more.

How do you account for manufacturing overhead

First, you have to identify the manufacturing expenses in your business. Once you do, add them all up or multiply the overhead cost per unit by the number of units you manufacture. To get a percentage, divide by your monthly sales and multiply that number by 100.

Does manufacturing overhead increase with debit

Factory Payroll and Factory Overhead are temporary accounts that act like assets/expenses meaning Debit will increase and Credit will decrease. Both accounts are zeroed out at the end of the period so they will not appear on a financial statement.

What is the journal entry for manufacturing overhead

To allocate manufacturing overhead, Work-in-Process Inventory is debited and Manufacturing Overhead is credited. Work-in-Process Inventory is treated as an current asset, and increase the assets of the company and Manufacturing Overhead is decreased, which increases equity of the company.

Is overhead control account a debit or credit

Factory Overhead Control Account:

It is debited by the amount of indirect material, indirect labour and indirect expenses incurred. This account is credited by the amount of overhead recovered.

What is manufacturing overhead applied with a debit to

The manufacturing overhead account is used to bridge the gap between the irregular way overhead costs are incurred and the regular systematic application or allocation of overhead costs to units of production. The overhead account is debited for the actual overhead costs as incurred.

What is the manufacturing overhead control account debited for

Manufacturing Overhead Control Account:

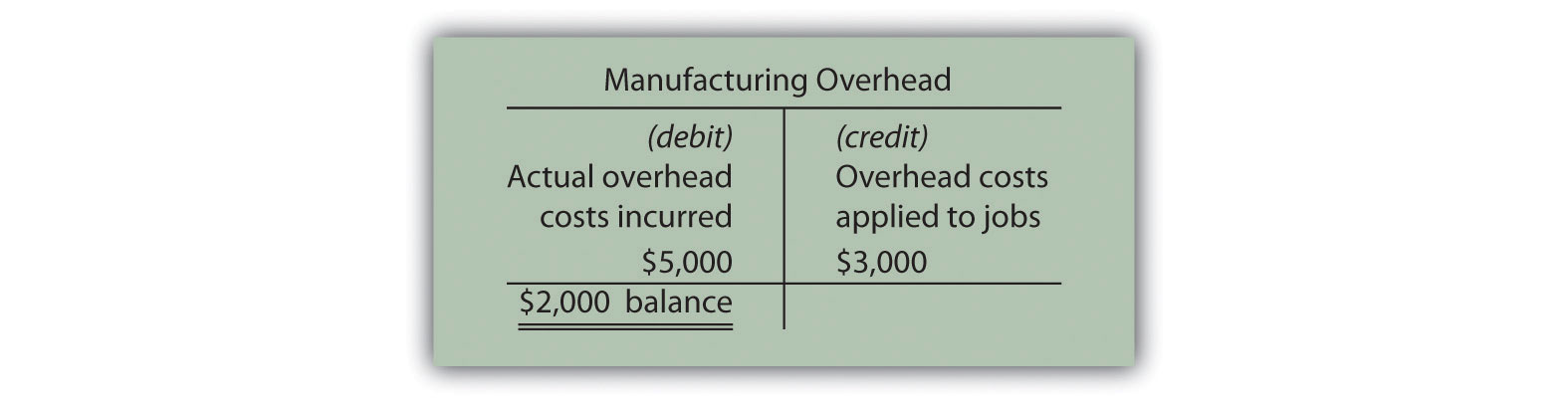

In manufacturing companies, the Manufacturing Overhead Control account is used to record all the actual overhead costs incurred (on its debit side) and the overhead applied to production (on its credit side).

What is the debit side of an overhead account

Expenses being incurred are recorded on the debit side of the ledger, meaning that almost all expenses possess a normal debit balance. Negative expenses, called contra-expenses, are recorded as a credit when they increase.

What side of the manufacturing overhead account

2: The right side of the manufacturing overhead account is used to record overhead APPLIED to WIP Inv. While the left side of the MOH account accumulates actual overhead costs, the right side applies overhead costs using the predetermined overhead rate based on estimated overhead costs.