Does minimum due payment affect credit score?

Does it hurt my credit score if I pay the minimum

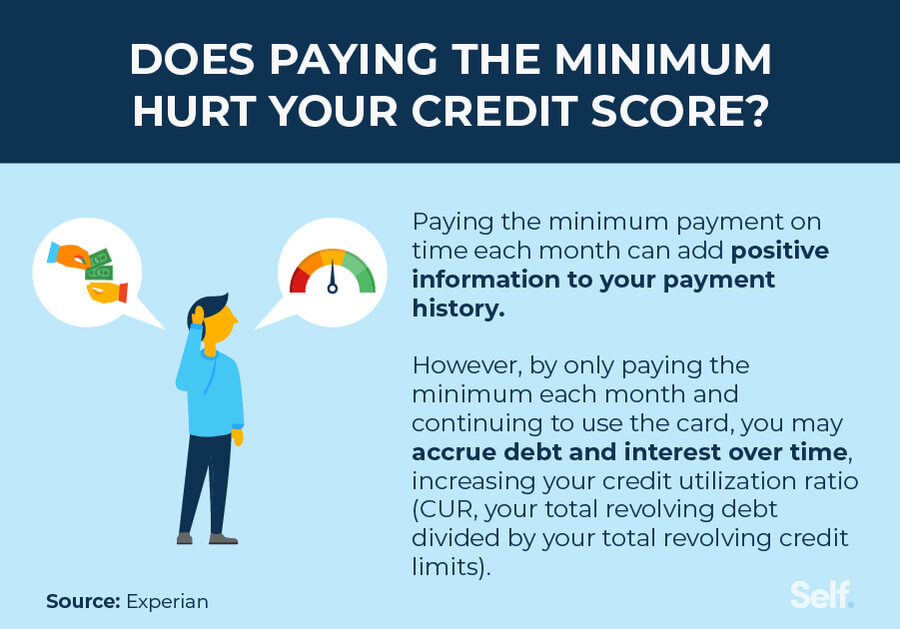

No, making just the minimum payment on a credit card does not hurt your credit score, at least not directly. It actually does the opposite. Every time you make at least the minimum credit card payment by the due date, positive information is reported to credit bureaus.

Cached

Why did my credit score drop when I paid the minimum payment

Lenders like to see a mix of both installment loans and revolving credit on your credit portfolio. So if you pay off a car loan and don't have any other installment loans, you might actually see that your credit score dropped because you now have only revolving debt.

Is it better to pay minimum payments or in full

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

What happens if I pay only minimum due

If you pay only the minimum amount due for a long time, you will have to pay high interest charges on the outstanding amount. You won't get any interest-free credit period. Along with this, your credit limit will also be reduced to the amount that you haven't repaid.

Why shouldn t you only pay the minimum on your credit card

Offering only the minimum payment keeps you in debt longer and racks up interest charges. It can also put your credit score at risk.

What has the biggest impact on your credit score

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Why did my credit score drop 40 points

Your credit score may have dropped by 40 points because a late payment was listed on your credit report or you became further delinquent on past-due bills. It's also possible that your credit score fell because your credit card balances increased, causing your credit utilization to rise.

Is it okay to just pay minimum payment

While paying the full statement balance is preferred, there may be times when you can only make the minimum payment. For those situations, it can be OK to only pay the minimum — but not long term. Once you have the funds available to cover your balance, pay it off in full.

What is potentially bad about paying only the minimum monthly payment

But paying the minimum due on credit cards can lead to utilization problems. An increasing credit utilization is even more likely if you continue to use your credit cards for additional charges without paying off your balance (or at least paying as much as possible) when your bill comes due each month.

What is the disadvantage of paying minimum due

Disadvantages of Paying only the Minimum Payment Due

You will not be offered any interest free credit period if you have paid only the Minimum Amount Due (MAD) and not the credit card outstanding in full. Rather, you will be charged interest amount from the date of purchase.

What is the disadvantage of paying minimum due on credit card

Disadvantages of Paying only the Minimum Payment Due

You will not be offered any interest free credit period if you have paid only the Minimum Amount Due (MAD) and not the credit card outstanding in full. Rather, you will be charged interest amount from the date of purchase.

What bills affect your credit score

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

What are 3 things that have a good effect on your credit score

The 5 Factors that Make Up Your Credit ScorePayment History. Weight: 35% Payment history defines how consistently you've made your payments on time.Amounts You Owe. Weight: 30%Length of Your Credit History. Weight: 15%New Credit You Apply For. Weight: 10%Types of Credit You Use. Weight: 10%

Why did my credit score drop 70 points after paying off debt

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why would my credit score drop 50 points in one month

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

Why did my credit score go from 524 to 0

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

What are the disadvantages of minimum payment

Disadvantages of Paying only the Minimum Payment Due

You will not be offered any interest free credit period if you have paid only the Minimum Amount Due (MAD) and not the credit card outstanding in full. Rather, you will be charged interest amount from the date of purchase.

Why you shouldn’t make minimum payments

The true cost of only making minimum payments

Making only minimum payments on your credit card can significantly extend the time it takes you to pay off debt while also increasing the amount of interest you pay.