Does Model y qualify for EV tax credit 2023?

Will Model Y get $7,500 tax credit

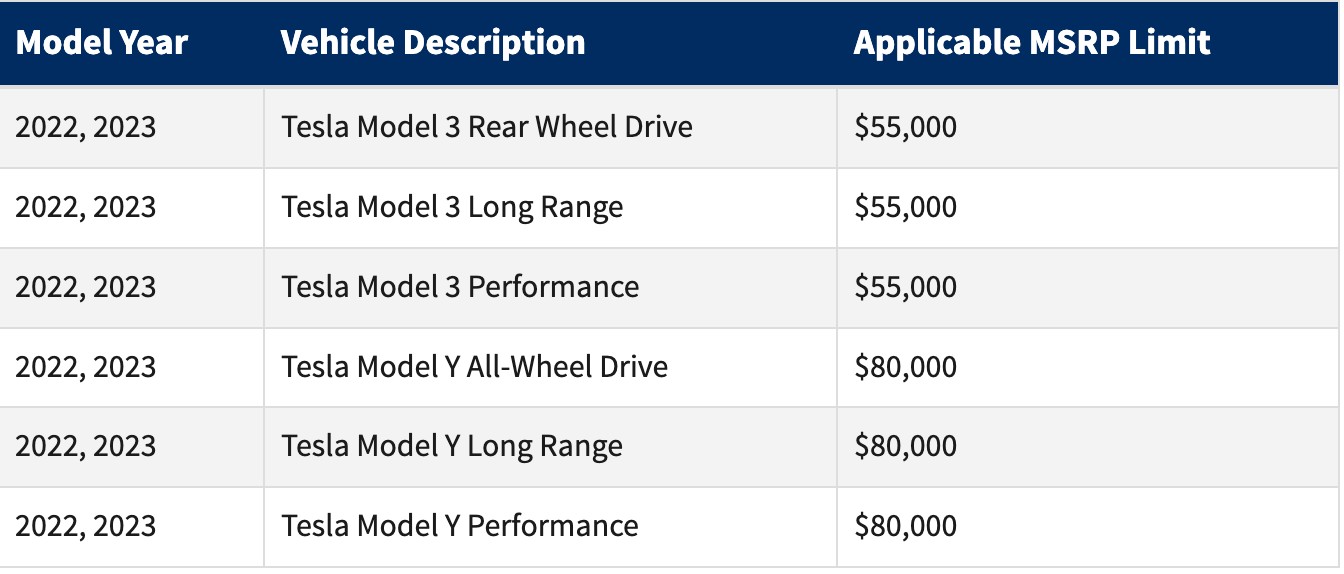

The complete Tesla Model 3 and Y lineup now qualifies for a full $7,500 federal tax credit for clean cars. On Tuesday, the U.S. EPA officially added all Tesla Model 3 and Model Y variants to its list of tax-credit eligible vehicles.

Cached

Is Tesla Model Y eligible for EV tax credit

The Chevrolet Bolt, Ford F-150 Lightning, and Tesla Model Y are among the 11 EVs eligible for a full $7,500 credit—and a base-model Bolt should cost just $19,995 after the tax credit and destination fee.

Cached

Will Tesla be eligible for tax credit in 2023

On January 1, 2023, the Inflation Reduction Act of 2023 qualified certain electric vehicles (EVs) for a tax credit of up to $7,500. Qualifications include: Customers must buy it for their own use, not for resale. Use the vehicle primarily in the U.S.

CachedSimilar

Is there a tax credit for Tesla Model Y after March 2023

Is there a tax credit for buying a Tesla in 2023 Yes. Tesla customers are once again eligible for the new tax credit of up to $7,500 since the beginning of 2023. That said, the vehicle must fall under the manufacturing, pricing and income requirements discussed in this article.

CachedSimilar

What is the Model Y Performance tax credit 2023

Customers who purchase qualified residential fueling equipment after January 1, 2023, may receive a tax credit of up to $1,000.

What qualifies for energy tax credit in 2023

Energy Efficient Home Improvement Credit

1, 2023, the credit equals 30% of certain qualified expenses: Qualified energy efficiency improvements installed during the year which can include things like: Exterior doors, windows and skylights. Insulation and air sealing materials or systems.

Can you write off a Tesla Model Y

Tesla's Model Y and other EVs will now qualify for $7,500 tax credit, IRS says. Tesla's Model Y model and other electric vehicles from auto manufacturers including Ford, General Motors and Volkswagen will now qualify for a federal tax credit of $7,500, the IRS said Friday.

What tax credits are available for 2023

Changes for 2023

The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit. Those who got $3,600 per dependent in 2023 for the CTC will, if eligible, get $2,000 for the 2023 tax year.

Why doesn t the Model Y qualify for tax credit

Previously, the five-seat Tesla Model Y was classified as a sedan, which meant it didn't qualify for the EV tax credit because it cost more than $55,000 price cap for sedans stipulated under the government's rules.

How to get full 7500 EV tax credit

To claim the tax break, known as the Qualified Plug-In Electric Drive Motor Vehicle Credit, you will need to file IRS Form 8936 with your tax return.(You will need to provide the VIN for your vehicle.) You can only claim the credit once, when you purchase the vehicle.

What SEER rating qualifies for tax credit 2023

To be eligible for the 30% tax credit, an air-source heat pump must be purchased and installed between January 1, 2023, and December 31, 2032, and meet the following criteria: SEER2 rating greater than or equal to 16. EER2 rating greater than or equal to 12. HSPF2 rating greater than or equal to 9.

What is the income limit for the solar tax credit 2023

no income limit

There is no income limit for the federal solar tax credit, but to claim the full credit, you'll need a significant enough tax liability. If you owe fewer taxes than the credit, the remaining credit will roll over to the following year.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Is the Model Y considered an SUV

Tesla Model Y models. The 2023 Tesla Model Y is a fully electric small crossover SUV with seating for five passengers. An optional third row increases seating capacity to seven. It comes in three main trims: an unnamed standard-range version, Long Range and Performance.

How long will the 7500 EV tax credit last

10 years

Federal EV Tax Credit 2023: How it Works

For EVs placed into service in 2023, the up to $7,500 EV tax credit is extended for 10 years — until December 2032. The tax credit is taken in the year that you take delivery of the EV.

How many times can you use $7500 EV tax credit

The tax benefit, which was recently modified by the Inflation Reduction Act for years 2023 through 2032, allows for a maximum credit of $7,500 for new EVs, and up to $4,000, limited to 30% of the sale price, for used EVs. Taxpayers can only claim one credit per vehicle.

Is the SEER rating changing in 2023

Beginning January 1, 2023, there will be two SEER-related changes. First, the minimum SEER rating will increase on HVAC equipment. Currently, new air conditioners must have a minimum SEER of 13 in northern states and 14 in southern states. In 2023, this will change to 14 and 15, respectively.

Will I get a bigger tax refund in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.

What to expect 2023 tax refund

The IRS has announced it will start accepting tax returns on January 23, 2023 (as we predicted as far back as October 2023). So, early tax filers who are a due a refund can often see the refund as early as mid- or late February. That's without an expensive “tax refund loan” or other similar product.

Is Model Y considered SUV tax credit

The Tesla Model Y, Ford Mustang Mach-E, and Cadillac Lyriq, are examples of popular electric vehicles that qualify as SUVs for purposes of the EV tax credit, according to the IRS.