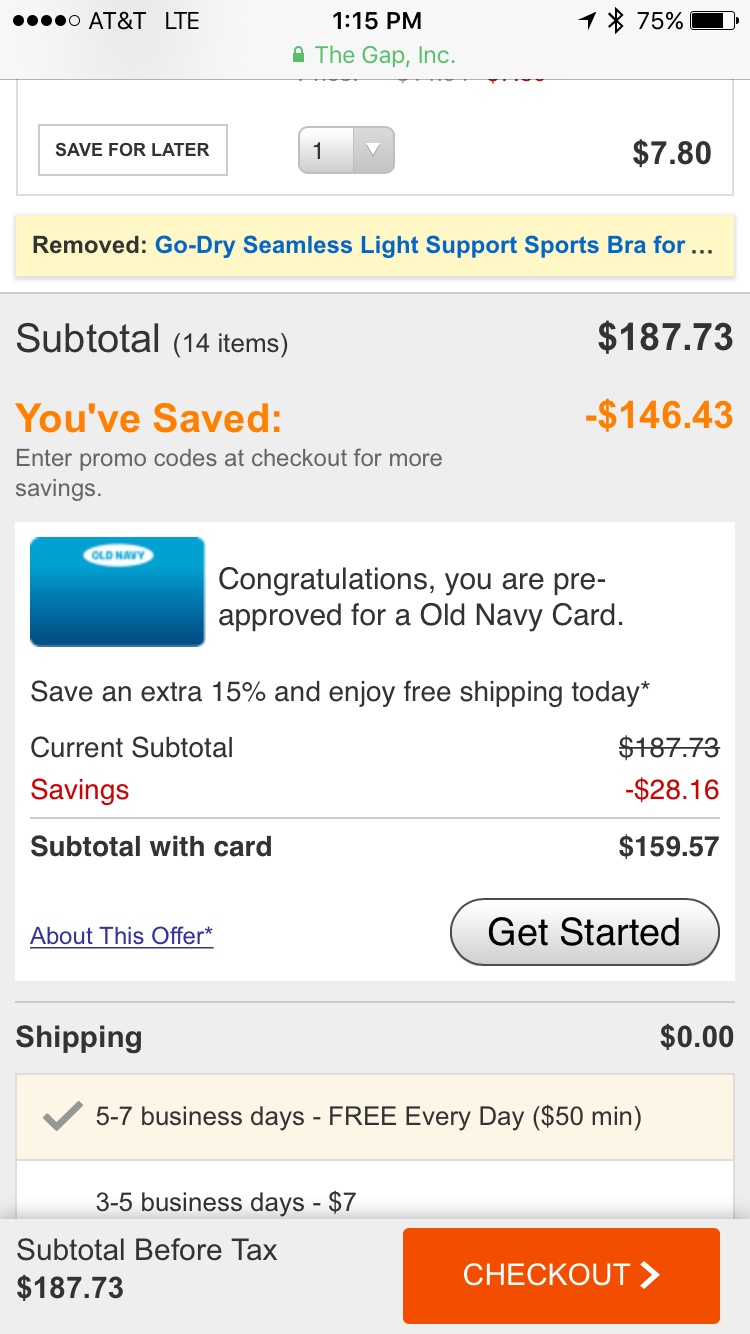

Does Old Navy have a pre-approval?

What credit score does Old Navy require

700+

You need a credit score of 700+ to get the Old Navy Credit Card. This means at least good credit is required for approval. On the other hand, you'll need a score of 640+ (fair credit) to have a decent chance of being approved for the Old Navy Store Card.

Is it hard to get approved for Old Navy card

Is it hard to get an Old Navy credit card Yes, it is hard to get the Old Navy Credit Card because it requires at least good credit for approval. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for this card.

How do I know if I prequalify for a credit card

The easiest way to see if you're pre-approved for a credit card is to check a credit card company's website. Most major issuers let you see which of their cards you're pre-approved for by simply entering your name, address and the last four digits of your Social Security number into an online form.

Does Navy Federal pre approval affect credit score

Do You Prequalify If you're already a member, you can find out if you prequalify for a credit card before you submit an application. This won't affect your credit score.

Can I join the Navy with bad credit

Are There Financial Requirements Unpaid loans, overdue bills or a history of bad credit could impact your ability to serve in the military because you must be eligible for security clearance. In certain cases, you must prove you can meet your current financial obligations before joining.

What credit score do you need for Synchrony Bank

What's the Synchrony Bank credit card credit score requirement It depends on the credit card you are interested in. Most credit cards offered by Synchrony Bank are designed for people with fair (640 – 699), good (700 – 749) or excellent (750 – 850) credit.

Which Navy Federal card is the easiest to get approved for

The easiest Navy Federal credit card to get is the Navy Federal Credit Union nRewards® Secured Credit Card because you can get approved with Bad credit. The Navy Federal nRewards Secured Card requires a refundable deposit (minimum of $200), and the deposit becomes your credit limit.

What bank issue Old Navy credit card

Synchrony Bank

The Old Navy Credit Card, issued by Synchrony Bank, earns 5 points per dollar on all purchases at Old Navy, Gap, Banana Republic, Athleta, Hill City, Gap Factory and Banana Republic Factory. Synchrony also offers a Visa variant of the card that earns 1 point on all purchases, redeemable for merchandise at the Gap Inc.

Which card is easiest to get approved for

FULL LIST OF EDITORIAL PICKS: EASIEST CREDIT CARDS TO GETOpenSky® Plus Secured Visa® Credit Card. Our pick for: No credit check and no bank account required.Chime Credit Builder Visa® Credit Card.Petal® 2 "Cash Back, No Fees" Visa® Credit Card.Mission Lane Visa® Credit Card.Self Visa® Secured Card.Grow Credit Mastercard.

Can you be denied a pre-approved credit card

It's important to understand that preapproved credit card offers do not guarantee approval. You still have to apply for the credit card you've been preapproved for, and there are numerous reasons you could be denied. For example, it's possible you met a minimum credit score requirement but your income is insufficient.

Can I get denied if I’m pre-approved

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval.

What is the personal line of credit limit for Navy Federal

At Navy Federal, members can request a personal loan of $250 to $50,000, with an APR that starts at 7.49% for a loan term of up to 36 months, 14.79% for 37 to 60 months and 15.29% for 61 to 180 months.

What is the minimum credit score for a secret clearance

There is no specific credit score needed for security clearance. “It's one component,” said Edmunds, whose law firm has been handling security clearance cases for more than three decades and has offices in six cities across the country.

Does the Navy check your credit

The Army, Navy and Marine Corps usually run credit checks only on applicants who need to qualify for a security clearance or who require a dependency waiver. But they forgo hard-and-fast rules in favor of a case-by-case approach.

Does Synchrony Bank have pre approval

Plus, like all major credit card issuers, Synchrony Bank also mails pre-approved offers to certain people who appear to meet the criteria for one of its nearly 100 cards. Generally, a pre-approval tool allows consumers to gauge the likelihood of getting approved for a credit account before they apply.

What is the easiest Synchrony card to get

Easy Credit Cards To Get (Low or No Credit)

We recommend the The OpenSky® Secured Visa® Credit Card which doesn't require a credit check and is a solid option for those looking to boost their credit score. By boosting your score, you'll have a much stronger chance of applying for more premium (and rewarding) cards.

What score does Navy Federal use

TransUnion® credit

Navy Federal Credit Union members have free access to their TransUnion® credit score with our Mission: Credit Confidence® Dashboard.

What Navy Federal card has the highest credit limit

The Navy Federal Platinum Credit Card credit limit is between $500 and $50,000.

What credit score does Synchrony Bank use

Find out your score and how to improve it when you enroll in Synchrony's® free credit score program with VantageScore®. VantageScore® is a top credit scoring model used by many lenders when they consider whether or not to approve applications and decide what rates and terms to offer.

Can I get a Walmart credit card with a 520 credit score

The Walmart Credit Card credit score requirement is 640 or higher, which means people with fair credit or better have a shot at getting approved for this card. The Walmart® Store Card also requires at least fair credit for approval.