Does pay in 3 do a credit check?

Does pay in 3 affect my credit score

Currently, Pay in 3 does not impact your credit score although using Pay in 3 may impact your ability to obtain credit and the cost of accessing it.

Does PayPal pay in 3 positively affect credit score

Yes, responsible use of PayPal Credit can help you build credit. PayPal Credit reports to credit bureaus, so timely payments and responsible use can increase your credit score and help you establish a favourable credit profile.

Does Klarna work with bad credit

Klarna does not have a minimum credit score requirement for its pay-in-four credit product.

Do they do a credit check for Afterpay

Afterpay may conduct a soft credit check for new customers when they first sign-up to use the platform. This soft credit check will not impact a customer's credit score.

Cached

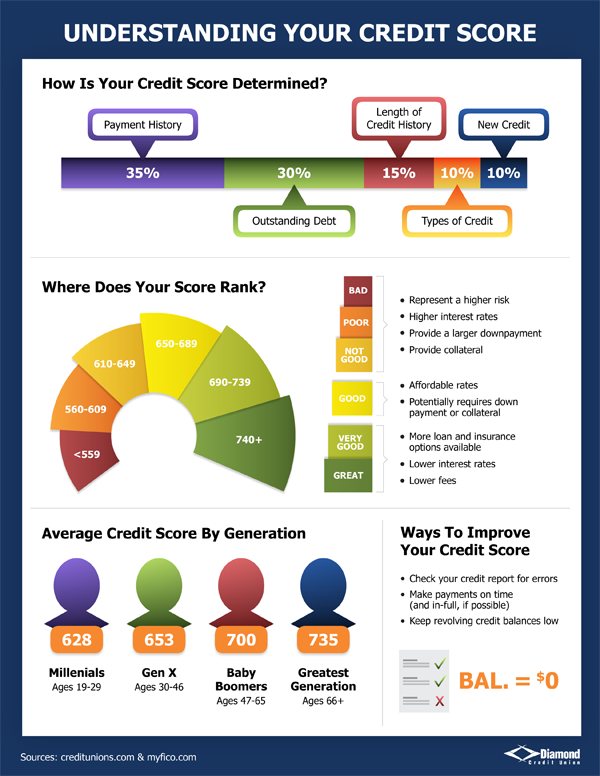

How to raise a 480 credit score

Paying bills consistently and on time is the single best thing you can do to promote a good credit score. This can account for more than a third (35%) of your FICO® Score. Length of credit history. All other things being equal, a longer credit history will tend to yield a higher credit score than a shorter history.

Will 3 late payments affect my credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Does PayPal pay later check credit

When applying, a soft credit check may be needed, but will not affect your credit score. You must be of legal age in your U.S. state of residence to use Pay in 4.

Why is PayPal rejecting my pay in 3

There are a number of reasons we may not have been able to complete your scheduled payment. For example, if the debit card used to sign up to your Pay in 3 plan has expired or if there were insufficient funds available in your bank account balance. If you need further assistance, contact us here.

What is the lowest credit score for Klarna

Do I need a good credit score for Klarna Klarna doesn't set a minimum credit score to qualify for its finance products.

Can anyone get approved for Klarna

To be eligible to use the Klarna you must: Be a resident of the United States or its territories. Be at least 18. Have a valid bank card/bank account.

Does Afterpay accept bad credit

Does Afterpay check credit Afterpay may perform a soft credit check, which does not hurt your credit score. While Afterpay does not disclose its minimum credit score requirement, borrowers with bad credit or no credit are likely eligible to use Afterpay's payment plan.

Which buy now pay later does not do credit checks

The winner of the best BNPL app for those with bad credit is Perpay because it does not check credit history and uses your verified income to set your spending limits. After completing your Perpay profile, customers can access their spending limit and start shopping within 60 seconds of joining.

How to go from 500 to 700 credit score in a year

Pay all your dues on time and in full if you wish to increase your credit score from 500 to 700. Missing a repayment or failing to repay the debt will significantly impact your credit score.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Can you have a 700 credit score with late payments

It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates. Late payments (past due 30 days) appear in the credit reports of 33% of people with FICO® Scores of 700.

How much can 1 late payment affect credit score

Once a late payment hits your credit reports, your credit score can drop as much as 180 points. Consumers with high credit scores may see a bigger drop than those with low scores. Some lenders don't report a payment late until it's 60 days past due, but you shouldn't count on this when planning your payment.

Why did PayPal deny me Pay in 4

When applying to use PayPal Pay in 4, a soft credit check may be required to assess your credit worthiness, so your application to use PayPal Pay in 4 may be rejected. Your credit score will not be impacted by the soft credit check.

What credit score is needed for PayPal bill me later

Getting Approved for “Bill Me Later” Programs

Unfortunately, if you have poor credit, Bill Me Later isn't going to be for you. Paypal Credit, for example, requires a credit score of at least 650. Related: What Is a Bad Credit Score

How do I qualify for PayPal pay in 3

Once you've logged in to PayPal, if PayPal Pay in 3 is available as a payment method, you'll need to give your name, phone number, address, date of birth and your debit card information. You should know instantly whether you're approved for financing.

Why am i not eligible for PayPal pay in 4

To be eligible for PayPal Pay in 4, you must purchase an eligible item that costs between $30 and $1,500 from a participating online merchant that accepts PayPal. You also must be at least 18 years old and live in an eligible state.