Does paying off a Judgement improve credit?

Will paying off a Judgement remove it from my credit report

Even after you settle with a creditor or pay them back through wage garnishment, tax return garnishment, a monthly payment plan, etc. — what is called a satisfied judgment — the judgment will still remain on your credit report.

Cached

How long does a Judgement stay on your credit report after its paid

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

Will a Judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

How much will paying off collections raise credit score

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Does a satisfied judgment hurt credit

Even a satisfied judgment will negatively impact a credit report. However, a paid or satisfied judgment will hurt a credit score less than an unpaid one. Even after a satisfaction and release has been generated, a satisfied judgment remains on a person's credit report for seven years.

How do I get a Judgement off my credit report

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

Can lenders see Judgements

Since judgments are not included in credit reports, they won't be factored into credit score calculations. However, judgments are a matter of public record, so potential lenders may choose to search for this information from sources other than the national credit bureaus as part of the application process.

Will collections be removed if paid off

Once you've paid off an account in collections, it will eventually fall off your credit report. If you'd like to expedite the process, you can request a goodwill removal. Removing a paid collection account is up to the discretion of your original creditor, who doesn't have to agree to your request.

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

How many points will a judgement lower my credit score

Judgments Don't Affect Your Credit Score, But Can Impact Your Application. Since judgments are not included in credit reports, they won't be factored into credit score calculations.

How do I remove a satisfied judgement from my credit report

To remove a judgment from your credit report, you must file an appeal to the original creditor or collection agency.

How many points does a Judgement affect your credit score

Judgments Don't Affect Your Credit Score, But Can Impact Your Application. Since judgments are not included in credit reports, they won't be factored into credit score calculations.

How do I remove a Judgement from my credit report

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

Is it better to have a collection removed or paid in full

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years.

How do I rebuild my credit after collections

Taking Steps to Rebuild Your CreditPay Bills on Time. Pay all your bills on time, every month.Think About Your Credit Utilization Ratio.Consider a Secured Account.Ask for Help from Family and Friends.Be Careful with New Credit.Get Help with Debt.

Is it worth paying off old collection accounts

And if you have multiple debt collections on your credit report, paying off a single collections account may not significantly raise your credit scores. But if you have a recent debt collection and it's the only negative item on your credit report, paying it off could have a positive effect on your score.

Why did my credit score drop when I paid off collections

This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio. Additionally, if the account you closed was your oldest line of credit, it could negatively impact the length of your credit history and cause a drop in your scores.

How do I fix a Judgement on my credit report

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

Can you pay to delete a Judgement

Removing A Judgment from Your Record

There are only three ways in which a judgment can be made to go away: paying the debt, vacating the judgment or discharging the debt through bankruptcy.

Will the removal of a collection raise my score

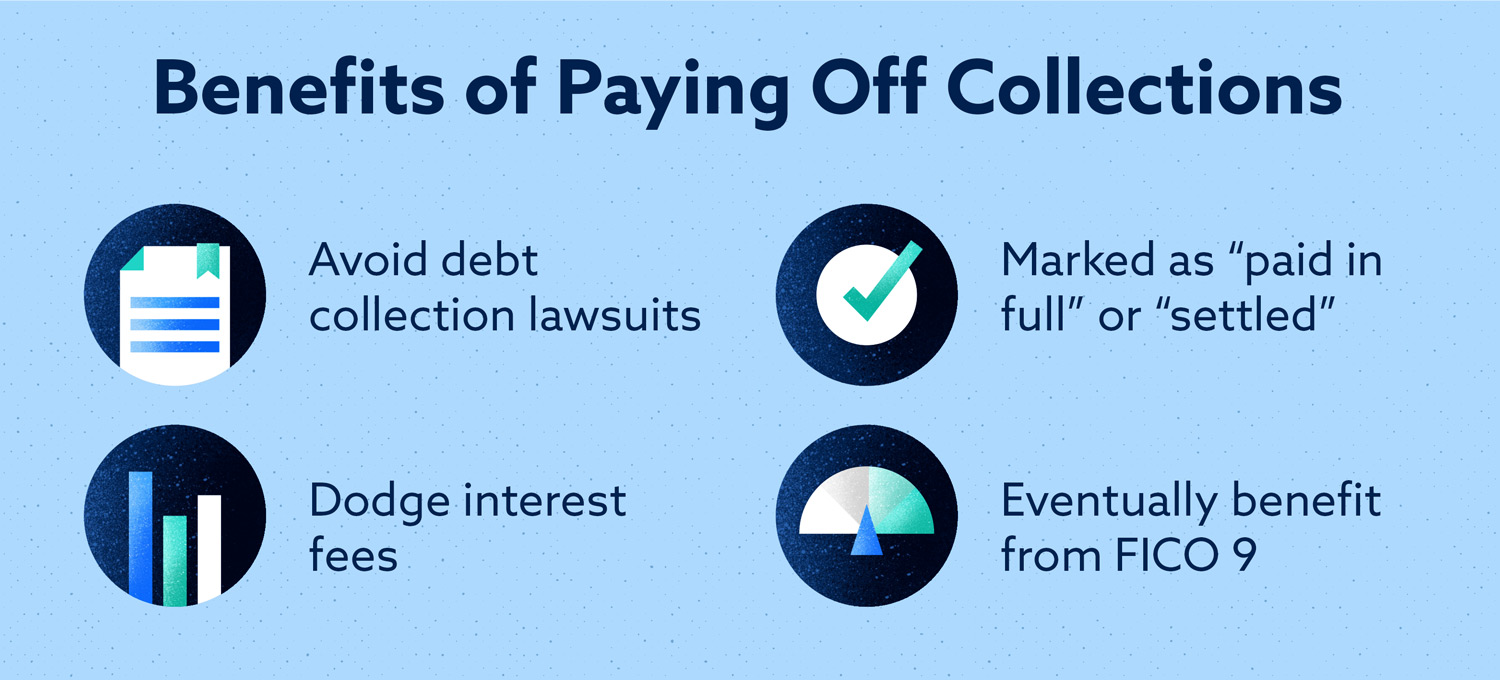

While there may not be an immediate boost to your credit score, paying off collections accounts is overall beneficial for your personal finances. Some benefits of taking care of unpaid collections include: Avoiding a lawsuit from the debt collection agency or the original creditor.