Does paying off debt collectors help your credit?

Will paying off collections raise my credit score

And if you have multiple debt collections on your credit report, paying off a single collections account may not significantly raise your credit scores. But if you have a recent debt collection and it's the only negative item on your credit report, paying it off could have a positive effect on your score.

Cached

How many points will my credit score increase when I pay off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Cached

Is it good to pay off debt collectors

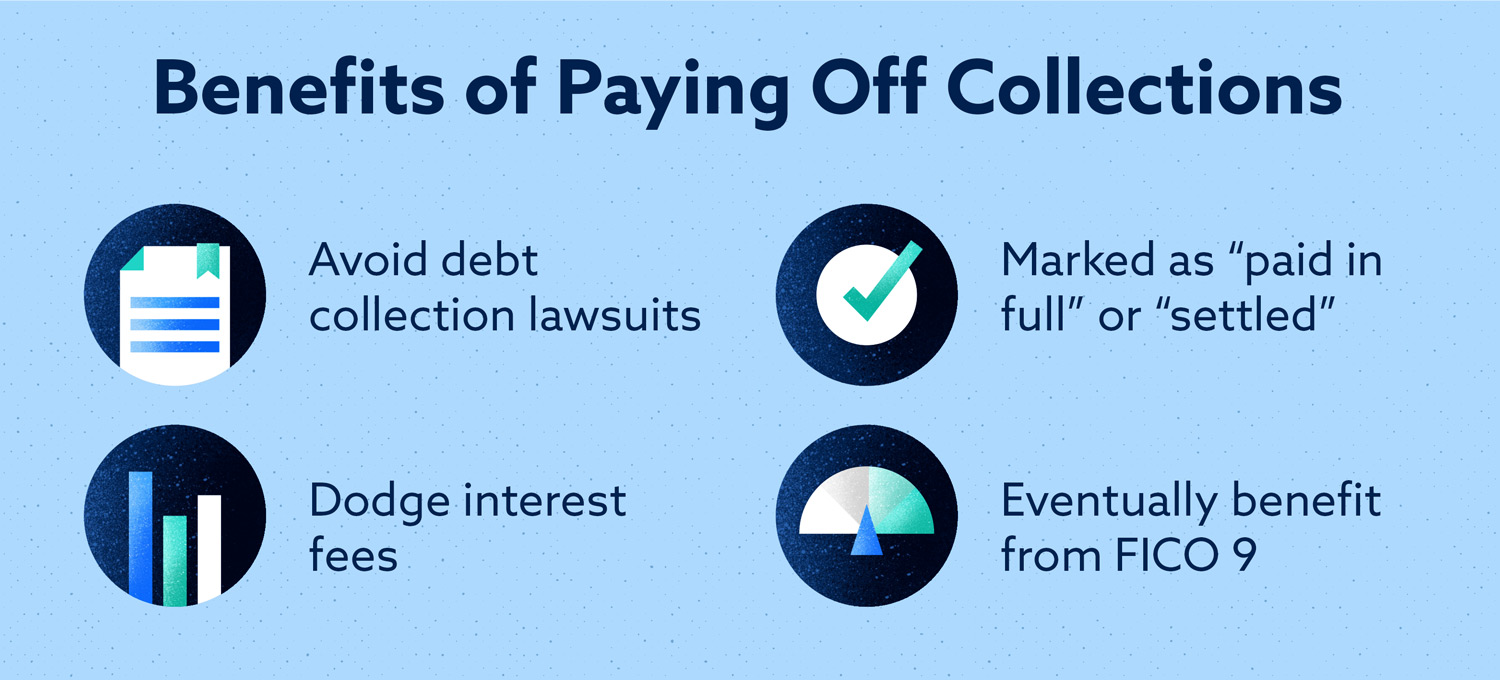

Paying off the debt will likely improve your score with credit bureaus that use FICO 9 or Vantage Score 3.0 or 4.0—the newest versions of credit scoring. Debt in collections is considered under payment history, which is the biggest factor in the most common credit score, FICO.

Why does credit score go down when you pay off collections

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Cached

What happens after I pay off a collection

Paying won't take a collections account off your credit reports. Many people believe paying off an account in collections will remove the negative mark from their credit reports. This isn't true; if you pay an account in collections in full, it will show up on your credit reports as “paid,” but it won't disappear.

How do I get good credit after collections

How to Improve Your Credit Score After a CollectionDispute errors. If a collection is not yours or is reported incorrectly, you can dispute the error with the credit bureaus.Get some positive information on your credit report. Pay other credit cards or loans on time.Be patient.

Is it better to pay off collections in full or settle

It's better to pay off a debt in full (if you can) than settle. Summary: Ultimately, it's better to pay off a debt in full than settle. This will look better on your credit report and help you avoid a lawsuit. If you can't afford to pay off your debt fully, debt settlement is still a good option.

What happens when a collection is paid off

Paying won't take a collections account off your credit reports. Many people believe paying off an account in collections will remove the negative mark from their credit reports. This isn't true; if you pay an account in collections in full, it will show up on your credit reports as “paid,” but it won't disappear.

How do I rebuild my credit after collections

Taking Steps to Rebuild Your CreditPay Bills on Time. Pay all your bills on time, every month.Think About Your Credit Utilization Ratio.Consider a Secured Account.Ask for Help from Family and Friends.Be Careful with New Credit.Get Help with Debt.

Why did my credit score drop 20 points after paying off debt

Why credit scores can drop after paying off a loan. Credit scores are calculated using a specific formula and indicate how likely you are to pay back a loan on time. But while paying off debt is a good thing, it may lower your credit score if it changes your credit mix, credit utilization or average account age.

How long after paying off collections can you buy a house

Charged-off debt is not forgiven and will show up on your credit report for seven years. Lenders may also sell charge-offs to collection agencies who may try to collect the debt until the statute of limitations runs out in your state.

How long does it take to rebuild credit after a collection

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Should I pay off a 5 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

How long after paying off collections does credit improve

The effects of paying a collection account in full do not vanish instantly. You will have to wait until it hits the limitation period, which is approximately seven years before it is even erased from your credit history. Luckily, the older data has little to no influence on your credit score.

How do I build credit after paying off collections

Then consider these six basic strategies for rebuilding credit:Pay on time. Pay bills and any existing lines of credit on time if you possibly can.Try to keep most of your credit limit available.Get a secured credit card.Get a credit-builder loan or secured loan.Become an authorized user.Get a co-signer.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

What to do after paying off collections

After you pay the debt collection, there are a few more steps you should take to make sure the collection account is completely closed.Make Sure the Payment Cleared Your Bank.Check Your Credit Report.Save a Copy of Your Settlement Agreement.Frequently Asked Questions (FAQs)

Should I pay collections after 2 years

With most collection accounts, if you pay them in full, their impact on your credit doesn't go away immediately. You'll usually have to wait until they reach the end of their seven-year reporting window. The good news is that the older the information is, the less impact it should have on your credit.

Is it better to pay off collections or wait 7 years

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years. Finally, paying off a debt can be a tremendous relief to your mental health.

How can I build my credit fast after collections

Taking Steps to Rebuild Your CreditPay Bills on Time. Pay all your bills on time, every month.Think About Your Credit Utilization Ratio.Consider a Secured Account.Ask for Help from Family and Friends.Be Careful with New Credit.Get Help with Debt.