Does paying rent with credit card hurt credit score?

Does paying rent with credit card affect credit score

“Paying rent with a credit card could affect your credit score by increasing your credit utilization ratio — the total amount of debt you have compared with the amount of available credit you have.”

Cached

Does paying rent build your credit score

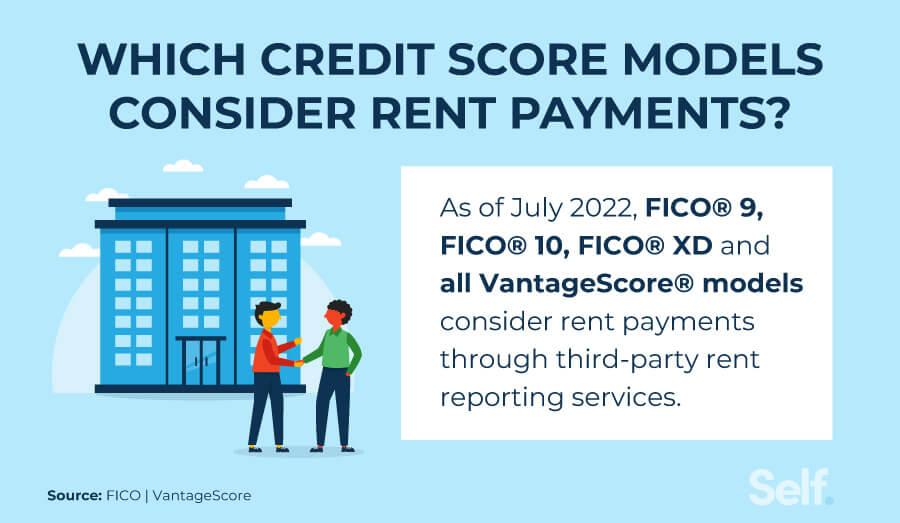

Does paying rent build credit Simply paying your rent will not help you build credit. But reporting your rent payments can help you build credit — especially if you are new to credit or do not have a lot of experience using it.

Is it recommended to pay rent with credit card

Your monthly rent payment could boost your credit score

If you put your rent payment on credit, the best way to improve your credit score is to pay your credit card bill in full every month.

Why can’t you pay rent with a credit card

Many individual landlords and property managers will only allow tenants to cover their rent with either cash or check payments. They often refuse to accept credit cards due to the fees involved or the hassle of collecting and processing credit card payments—or they may simply prefer the reliability of cold hard cash.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

Is it worth it to report rent to credit

Reporting your rent to credit bureaus can help your credit by logging more on-time payments. Payment history makes up 35% of your FICO Score, so adding your rental data to this category can help increase your score.

What should you pay for with a credit card

Electronics and Appliances.Event Tickets.Travel Arrangements.Car Rentals.Overseas Purchases.Online Purchases.Cellphone Bills.The Bottom Line.

Can I pay my car payment with a credit card

You can pay your car payment with a credit card if your lender allows you to or if you use certain third-party payment platforms. But many lenders don't provide this option. And using a credit card to make a car payment might not make sense because of fees and potentially higher interest charges.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get my credit score from 500 to 700

Average Recovery Time for Negative Marks on Your Credit ReportHow You Can Improve Your Credit Score From 500 to 700.Pay All of Your Bills on Time.Reduce Your Debt.Use a Secured Card Responsibly.Bring Your Utilization Below 30%

Why is rent not included in credit score

Because landlords and property management companies aren't considered creditors, they do not automatically report your payment history to the three major consumer credit bureaus—Experian, TransUnion and Equifax. Nor will they report evictions, bounced checks, broken leases or property damage.

Does your credit score go down if you don’t pay rent

Not paying rent can affect your credit score negatively, making it drop. However, your landlord needs to report it, and oftentimes unpaid rent might stay off your credit report for a long time. This is because many landlords do not report unpaid rent to credit bureaus.

What not to use a credit card for

The 5 types of expenses experts say you should never charge on a credit cardYour monthly rent or mortgage payment.A large purchase that will wipe out available credit.Taxes.Medical bills.A series of small impulse splurges.

Does paying bills with credit card build credit

If you're new to credit, putting one or more monthly bills on a credit card can help build a positive credit history; just make your credit card payments on time.

What bills can be paid with a credit card

The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes, can often be paid with a credit card but with a processing fee. Loan payments, are usually check or bank withdrawal payments only.

Can I pay my loan with a credit card

Can you pay a loan with a credit card Yes, you can pay a loan with a credit card, but it's usually less convenient and has extra fees. If you can afford to make your loan payment from your bank account, that tends to be the better option. Hardly any lenders accept credit card payments.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How long does it take to go from 650 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

Is rent considered debt

Here are some examples of what's typically considered debt when applying for a mortgage: Your rent or monthly mortgage payment. Any homeowners association (HOA) fees that are paid monthly. Property tax payments.

Does paying rent 1 day late affect credit

Missing a rent payment by a few days won't hurt your credit. But if you leave your rent unpaid by 30 days or more, it could damage your credit if your landlord reports the delinquency to one or more credit reporting agencies.