Does payoff hurt your credit score?

How many points does paying off debt affect credit score

Your credit score could increase by 10 to 50 points after paying off your credit cards. Exactly how much your score will increase depends on factors such as the amounts of the balances you paid off and how you handle other credit accounts. Everyone's credit profile is different.

Why did my credit score drop 30 points after paying off a car

If you pay off and close the auto loan, your credit mix now has less variety since it only contains credit cards. This could lead to a temporary drop in your credit score. That said, it's not necessary to go out of your way to take on as many different types of credit as possible.

Cached

Is payoff a good idea

Payoff is legit and may be worthwhile

In some cases, it can be helpful, but only if the loan's APR, which can range from 5.99% to 24.99%, is lower than the credit cards you intend to pay off. Also, it's only beneficial if you can afford the monthly payment.

Is it better to pay off debt or save

Wiping out high-interest debt on a timely basis will reduce the amount of total interest you'll end up paying, and it'll free up money in your budget for other purposes. On the other hand, not having enough emergency savings can lead to even more credit card debt when you're hit with an unplanned expense.

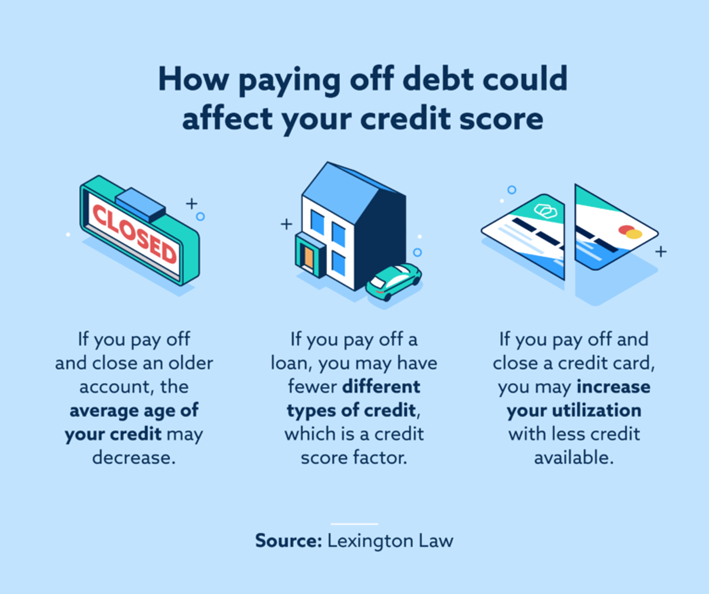

Why did my credit score drop 20 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Why did my credit score drop 70 points after paying off debt

Why credit scores can drop after paying off a loan. Credit scores are calculated using a specific formula and indicate how likely you are to pay back a loan on time. But while paying off debt is a good thing, it may lower your credit score if it changes your credit mix, credit utilization or average account age.

Why does my credit score go down when I pay off my car

Lenders like to see a mix of both installment loans and revolving credit on your credit portfolio. So if you pay off a car loan and don't have any other installment loans, you might actually see that your credit score dropped because you now have only revolving debt.

Why did my credit score drop 70 points after paying off my car

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

How long does a payoff take to hit your credit

How long does it take for my credit score to update after paying off debt It can often take as long as one to two months for debt payment information to be reflected on your credit score. This has to do with both the timing of credit card and loan billing cycles and the monthly reporting process followed by lenders.

Does payoff do hard credit pulls

For added security, we do a hard inquiry right before your Payoff Loan is finalized to check for new unsecured personal loans as well as bankruptcies and delinquencies. A hard inquiry may impact your credit score, but the good news is Happy Money Members see an average increase of 40 points † to their credit score.

What are the disadvantages of paying off debt

ConsPrepayment penalties.Impact on your credit score.Miss out on an opportunity to pay off debt.

Is it good to pay off debt in full

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

How do I keep my credit score high after paying off debt

Keep your accounts open.

Even if you've paid off your debt, keeping the account open can help boost your credit. Having a higher credit limit can help your credit utilization ratio, and having older accounts helps extend the average age of your credit.

Can your credit score go up 100 points if you pay off all your debt

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Is it smart to pay off your car

The bottom line

Paying off a car loan early can save you money — provided the lender doesn't assess too large a prepayment penalty and you don't have other high-interest debt. Even a few extra payments can go a long way to reducing your costs.

Will my credit score go up if I pay off my car

In the short-term, paying off your car loan early will impact your credit score — usually by dropping it a few points. Over the long-term, it depends on quite a few factors, including your credit mix and payment history.

Why does my credit score go down when I pay off my car loan

Lenders like to see a mix of both installment loans and revolving credit on your credit portfolio. So if you pay off a car loan and don't have any other installment loans, you might actually see that your credit score dropped because you now have only revolving debt.

Why did my credit score drop when I pay everything off

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

What happens when you request a payoff

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.