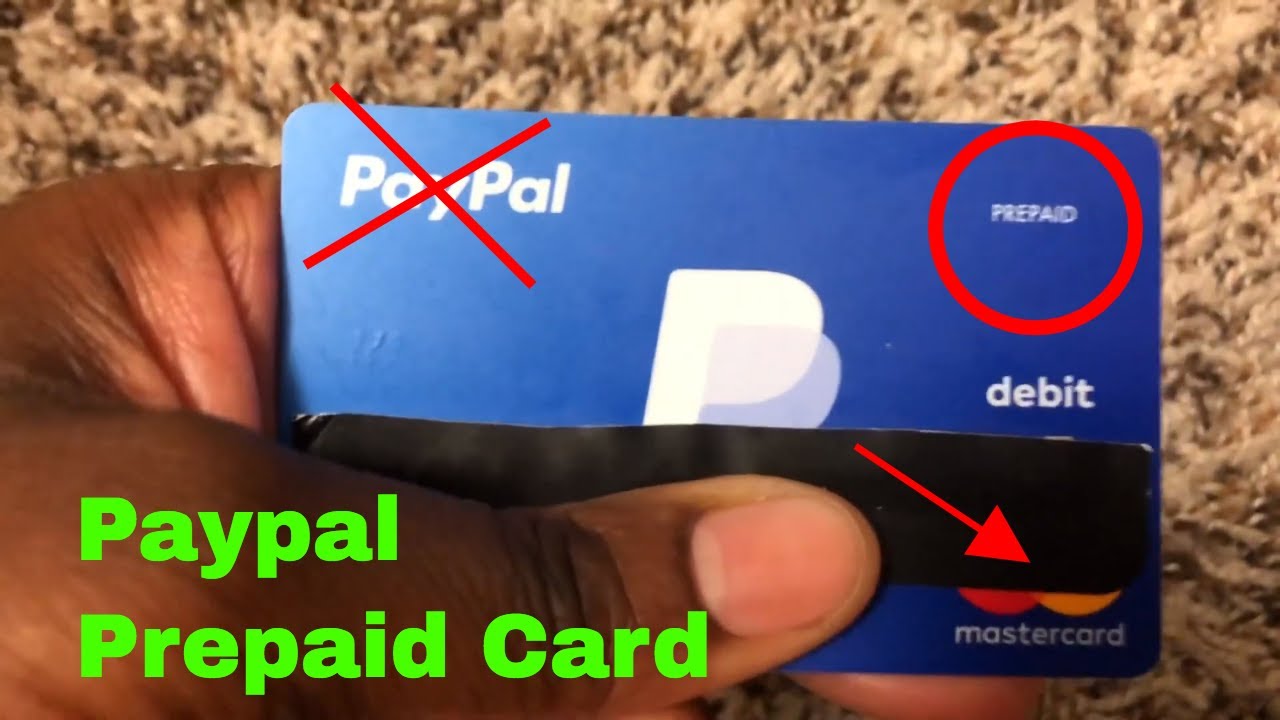

Does PayPal have prepaid credit cards?

Does PayPal have a prepaid credit card

You can use the PayPal Prepaid Mastercard® to eat, drink and shop anywhere Debit Mastercard is accepted. Order online and once your information has been verified, you'll receive your Card in the mail within 7-10 business days. Subject to activation and identity verifications. Already have a PayPal Prepaid Card account

CachedSimilar

Where can I buy a PayPal prepaid card

Which Stores Sell PayPal Prepaid Cards The card is widely available at stores, including drugstores, gas stations, supermarkets, convenience stores, dollar stores, Western Union Reload+ locations, and Walmart stores. These are all members of the Netspend Reload Network.

How much does a PayPal prepaid card cost

There is no fee to set up your account and get a card. We don't charge a monthly fee and no minimum balance is required. We don't charge for inactivity or limited use of the card. A fee of up to $3.95 will apply when loading cash to your PayPal balance at supported stores.

What is the best prepaid card for PayPal

In our opinion, the best prepaid card to use with PayPal is PayPal's own prepaid Mastercard. But Since PayPal accepts prepaid cards from American Express, Discover, Visa, and Mastercard, you can use just about any reloadable prepaid card with your PayPal account.

Is there a monthly fee for PayPal prepaid Mastercard

The PayPal Prepaid Mastercard® comes with a variety of fees. For starters, you'll pay a plan fee of $4.95 per month, and the first month's fee will be deducted from your account within 36 hours from the first time you load the card. The fee to get cash from an ATM is $1.95, plus any bank or ATM operator fees.

Can I buy a PayPal prepaid card at a store

A. There is one way to get a PayPal Prepaid Card. Visit a retail location to purchase a temporary PayPal Prepaid Card.

How does a PayPal prepaid card work

The PayPal Prepaid card is a debit card that can be used anywhere Mastercard is accepted, provided there are funds in the account. This specific card may be loaded with funds for use via direct deposit, a transfer from a linked PayPal Account, or in person at a Netspend Reload Network location (fees apply).

What kind of cards does PayPal offer

PayPal supports a large number of credit cards, including Visa, Mastercard®, American Express, Discover, JCB, Diners Club, and EnRoute. Depending on your processor, Payflow Pro also supports level 2 and level 3 Purchasing Cards (P-Cards).

What are the downsides of using a prepaid card

There are only a few downsides to using prepaid cards, but they are significant. Prepaid cards come with fees. Cardholders may have a lot of fees, including activation fees, transaction fees, ATM withdrawal fees, reloading fees, monthly fees, or inactivity fees. Check the fine print on the card for fee types.

How do I use a PayPal prepaid card

For PayPal members, you can simply add prepaid gift cards to your wallet then start using them during checkout – just like any other credit or debit cards. For users without PayPal account, you can just enter the card information during checkout in the same way you would do with credit or debit cards.

How do I put money on my PayPal prepaid card

You can load a PayPal prepaid card through instant transfers. Being a PayPal-to-PayPal transaction, there is no fee for the service. You can also load another card that is connected to your account through instant transfers but will be required to pay the 25 cent transaction fee.

What is the difference between PayPal Mastercard and PayPal Credit

PayPal Credit allows you to take advantage of the interest-free period again and again as long as your transactions are above the $99 threshold. If you are more interested in earning cash back rewards or want more flexibility in using your credit card, the PayPal Cashback Mastercard is the better option.

Is it a good idea to have a prepaid credit card

Prepaid cards can be a good way to stay out of debt because you can't spend more than the amount you've already deposited. They're also a useful budgeting tool. Even if you have a checking account, you could put a fixed amount on a prepaid card each month for certain spending categories, such as dining out.

Is it better to use a credit card or a prepaid card

Much like a regular credit card, a secured card helps you build credit by making on-time payments each month. A prepaid card is best for those who simply want a convenient way to pay without cash. Since prepaid cards aren't a form of borrowing, you won't see an impact on your credit score.

What is the difference between a PayPal prepaid card and a debit card

Prepaid cards and debit cards are both widely accepted at merchants worldwide, but one is preloaded and the other is not. Debit cards are linked to a checking account, while prepaid cards aren't and instead require you to load money onto the card.

What bank does PayPal prepaid use

The Bancorp Bank, N.A. Member

The PayPal Prepaid Mastercard is issued by The Bancorp Bank, N.A. Member FDIC, pursuant to license by Mastercard International Incorporated.

Can I load a prepaid PayPal card with a debit card

Money cannot be moved directly from individual funding sources like credit or debit cards, bank accounts, etc., attached to the PayPal Account to the PayPal Prepaid Card Account. Transfers from the PayPal Account to the PayPal Prepaid Card Account cannot be reversed or canceled.

What credit score needed for PayPal Mastercard

The PayPal Cashback Mastercard® shouldn't be hard to get if you have good credit. Applicants should aim for a 670 or higher FICO® Score, but if your score isn't that high yet, you may want to work on building credit first.

Why do people use PayPal instead of credit card

First, PayPal lets you connect your preferred payment method to your account, whether you want to pay with a credit card, a debit card, a bank account or a rewards balance. PayPal also encrypts your bank or credit card information, which helps keep that information safe.

What are the disadvantages of having a prepaid credit card

There are only a few downsides to using prepaid cards, but they are significant. Prepaid cards come with fees. Cardholders may have a lot of fees, including activation fees, transaction fees, ATM withdrawal fees, reloading fees, monthly fees, or inactivity fees. Check the fine print on the card for fee types.