Does pre selected affect credit score?

Is it good to be pre selected for a credit card

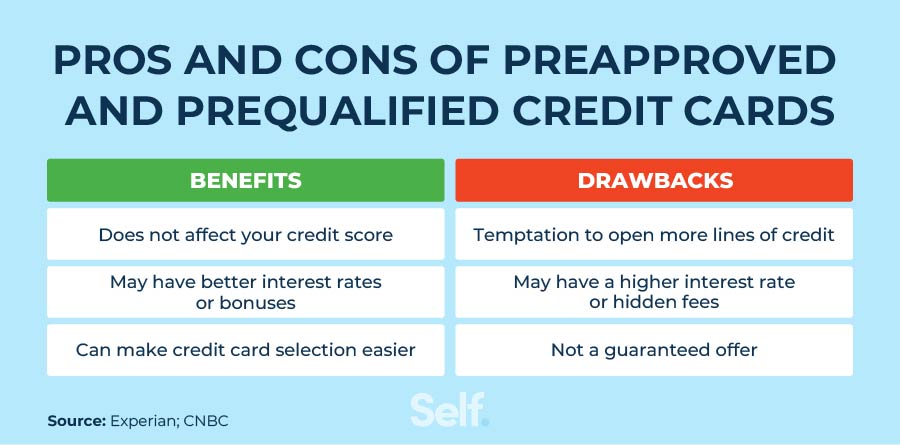

A "preapproved" credit card offer indicates a high likelihood of approval, should you choose to apply for the card. Being "pre-qualified" for a card is a good sign, but probably not as strong an indicator as preapproval — although some credit card issuers use the terms interchangeably.

Is pre selected a hard inquiry

Getting pre-qualified or pre-approved for a credit card doesn't guarantee approval. Pre-qualification and pre-approval for credit cards both typically involve soft inquiries, which don't affect credit scores. But an official application involves hard inquiries, which do affect scores.

Cached

Does preselected mean I will get the credit card

It's important to note that pre-approved and pre-qualified offers do not guarantee that you'll ultimately be approved for a new credit card. They simply mean that you have met at least some of the criteria required for approval.

Cached

Is pre selected or pre-approved better

Pre-approved and pre-qualified offers generally provide an 80% – 90% chance of approval. On the other hand, if you get a “pre-selected” offer, it means you fit some general criteria established by the issuer and have around a 70% chance of approval.

Cached

Can I be denied credit card after pre approval

It isn't common, but a credit card issuer could deny your application even after sending you a pre-approved offer of credit. The exact reason for such a denial can vary from one applicant to the next.

How do I stop getting pre selected credit card offers

A: You can call 1-888-5-OPTOUT (1-888-567-8688) or go to OptOutPrescreen.com* to remove your name from the lists supplied to credit card companies and the three nationwide credit reporting companies (Equifax, Experian, and TransUnion) and another credit company, Innovis.

Can I get denied if I’m pre-approved

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval.

What does pre selected mean for a personal loan

When you're pre-approved for a loan, it means the lender provisionally agrees to lend you the money, based on the preliminary information you give them. It doesn't mean you are guaranteed to get the loan. Final approval for the loan will be subject to a hard credit check and other final checks.

Can I be denied credit card after pre-approval

It isn't common, but a credit card issuer could deny your application even after sending you a pre-approved offer of credit. The exact reason for such a denial can vary from one applicant to the next.

What does it mean to be pre selected for a loan

When you're pre-approved for a loan, it means the lender provisionally agrees to lend you the money, based on the preliminary information you give them. It doesn't mean you are guaranteed to get the loan. Final approval for the loan will be subject to a hard credit check and other final checks.

How much does your credit score drop after pre-approval

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have. The good news is that this ding on your credit score is only temporary.

How hard does a pre-approval affect credit score

Does getting a prescreened pre-approved offer hurt your credit The short answer is: No. That's because a prescreened pre-approval involves a soft inquiry, which doesn't affect your credit scores. The prescreen soft inquiry is simply a way for lenders to determine if you may qualify for their credit card offer.

Do you destroy pre-approved credit card applications

Identity theft is a serious crime that can happen to anyone. Take these steps to prevent criminals from abusing your information. Destroy all unused pre-approved credit card and loan applications. A mailbox thief only has to fill them out and redirect the return address to start using your credit.

Is it good to opt out of prescreened offers

Does opting out hurt my credit score Removing your name from prescreened lists has no effect on your credit score or your ability to apply for or get credit or insurance.

How many pre approvals can I get without hurting my credit

While many home buyers will only need one mortgage preapproval letter, there really is no limit to the number of times you can get preapproved. In fact, you can — and should — get preapproved with multiple lenders. Many experts recommend getting at least three preapproval letters from three different lenders.

Can you get rejected for a pre-approved loan

Pre-approved loan offers do not mean that your loan application will be approved for certain. Your loan request, although "pre-approved", can be rejected by the lender if your credit score is low or if you do not meet an eligibility requirement during the verification process.

Can I get denied after preapproval

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval.

Why did my credit score drop more than 30 points after buying a house

Don't worry—a change in your credit score is normal after you purchase a home. Your credit often dips after you take out a mortgage since your mortgage is likely a large debt compared to your income and credit history, which often leads to a decline.

Why did my credit score drop after pre-approval

This occurs when a lender is considering extending a line of credit to you. Hard inquiries show up on your credit report and can affect your credit scores. For example, if you apply for a pre-approval offer, it will trigger a hard inquiry, and you could see a dip in your credit scores.

How much does your credit score drop when you get pre-approved

five points

The pre-approval typically requires a hard credit inquiry, which decreases a buyer's credit score by five points or less.