Does processing mean approved?

Does processing mean approved for tax refund

This means the IRS has your tax return and is processing it. Your personalized refund date will be available as soon as the IRS finishes processing your return and confirms that your refund has been approved. Most refunds are issued in less than 21 days.

Cached

What does it mean when my taxes says processing

Return Being Processed Means The IRS Received Your Tax Return, But It Could Still Be Delayed.

Cached

Does still being processed mean approved

If their refund status changes from “being processed” status to “still being processed” status, the issue detected in the tax forms was likely resolved and the refund may be released when it is approved for a future cycle date.

Cached

How long does it take for refund to go from processing to approved

We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return.

CachedSimilar

Is being processed the same as accepted

A federal return that's been 'accepted' means it has passed an initial screening, which includes some basic checks. Once it has entered this phase, its status will remain the same until it has been “Approved.” This would mean it has been processed and that the IRS has approved the release of your refund.

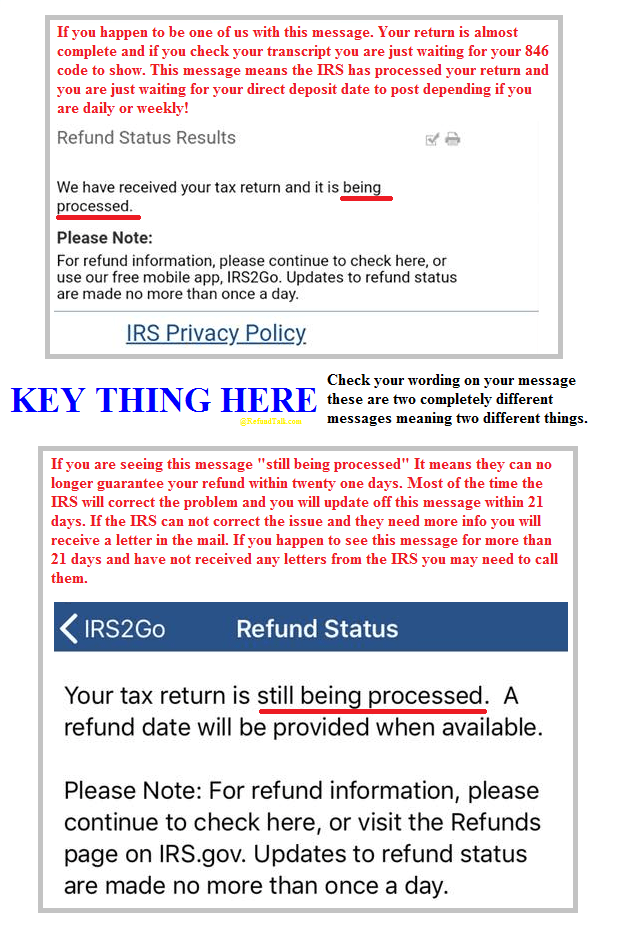

What’s the difference between being processed and still processing

If you are seeing this refund status “still being processed” it means the IRS can no longer guarantee your refund within the 21-day time frame. In some cases, the IRS will correct the issue without further information being needed and you will update from this message to the “being processed refund status.

Why would my refund still be processing

We continue to process tax returns that need to be manually reviewed due to errors in the order received. As the return is processed, whether it was filed electronically or on paper, it may be delayed because it has a mistake, is missing information, or there is suspected identity theft or fraud.

Why is my refund still processing

We continue to process tax returns that need to be manually reviewed due to errors in the order received. As the return is processed, whether it was filed electronically or on paper, it may be delayed because it has a mistake, is missing information, or there is suspected identity theft or fraud.

How do you know when your refund is approved

Check your federal tax refund status

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

Does processed mean done

That has completed a required process.

Why is my refund still processing after 21 days

This usually happens if the tax return has errors, is not accurate, or if a tax credit has been claimed, such as the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). In these cases, tax returns are reviewed more thoroughly.

Why has my refund been accepted but not approved

“Accepted” simply means that the IRS has received your tax return. This does not necessarily mean that your tax return has been approved, and it does not mean that you will receive a refund. Your return is marked as “accepted” usually within 24-48 hours of submitting it electronically.

Is still being processed good or bad

If you don't see the word still and it just has the message, “We have received your tax return and it is being processed,” then this is a good sign and it means your return and refund should be paid within 21 days, unless other issues are found during processing.

How do I know if my tax return has been flagged

If the IRS decides that your return merits a second glance, you'll be issued a CP05 Notice. This notice lets you know that your return is being reviewed to verify any or all of the following: Your income. Your tax withholding.

How do I know if my refund wasn’t approved

Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation). However, if you filed a married filing jointly return, you can't initiate a trace using the automated systems.

How will I know if my tax refund was not approved

Check your federal tax refund status

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

How do you know if your refund is rejected

It will generally mail you a notice if there is a problem with your return. An IRS agent may call you or visit your home, but usually only after sending several letters first. When an e-filed return gets rejected, the IRS will often let you know within a few hours.

Can your refund be accepted but not approved

“Accepted” simply means that the IRS has received your tax return. This does not necessarily mean that your tax return has been approved, and it does not mean that you will receive a refund. Your return is marked as “accepted” usually within 24-48 hours of submitting it electronically.

Can your tax refund be accepted but not approved

“Accepted” simply means that the IRS has received your tax return. This does not necessarily mean that your tax return has been approved, and it does not mean that you will receive a refund.

Why was my refund accepted but still processing

The following are some of the reasons why tax returns take longer than others to process: Your tax return includes errors, such as incorrect Recovery Rebate Credit. Your tax return Is incomplete. Your tax return needs further review in general.