Does Robinhood allow debit spreads?

How to do a debit spread in Robinhood

So for this example we'll do the 690.. Now we got to sell a call so we'll click sell. And then hit the 700. Click that see the spread. Type how many contracts go in between the bid and the ask and.

Does Robinhood allow vertical spreads

Choose and customize your strategy, then place an order. Depending on your trading level, you can build vertical spreads, calendar spreads, strangles, straddles, and more.

Can you do call spreads on Robinhood

Today we can be talking about bull call spreads in Robin Hood also known as long call vertical sprints. And they are a great way to trade options and go long in a stock without using so much capital.

Does Robinhood have level 4 options

Robinhood options trading levels

Robinhood has two levels of options trading: Level 2 and Level 3. New options traders will start in Level 2. Check your options trading level in your Robinhood account details under Settings.

Cached

Are debit spreads profitable

Debit spreads can be profitable and can be the right option for traders who believe stock prices are going to move in a particular direction. In order to achieve the maximum profit from a debit spread, the security must expire at or be higher than the option's strike price.

How do I buy a debit spread

You can construct a call debit spread by purchasing a call option and selling another call option against it with a higher strike price within the same expiration date. This trade will result in you paying a net debit to open it since the call you buy will be more expensive than the one you sell.

How much of the spread does Robinhood take

We pass this fee to our customers, except for sales of 50 shares or less. As of January 1, 2023, the TAF is $0.000145 per share (equity sells) and $0.00244 per contract (options sells). This fee is rounded up to the nearest penny, which will be no greater than $7.27 per trade.

How do you roll a spread on Robinhood

You can access rolling for your existing options by selecting Trade > Roll position.

Why can’t i do call options on Robinhood

Robinhood does not support market orders for options contracts due to greater volatility in the options market relative to equities markets. Placing limit orders will give your order a better chance of being executed at the price you want.

What is level 3 vs level 2 Robinhood

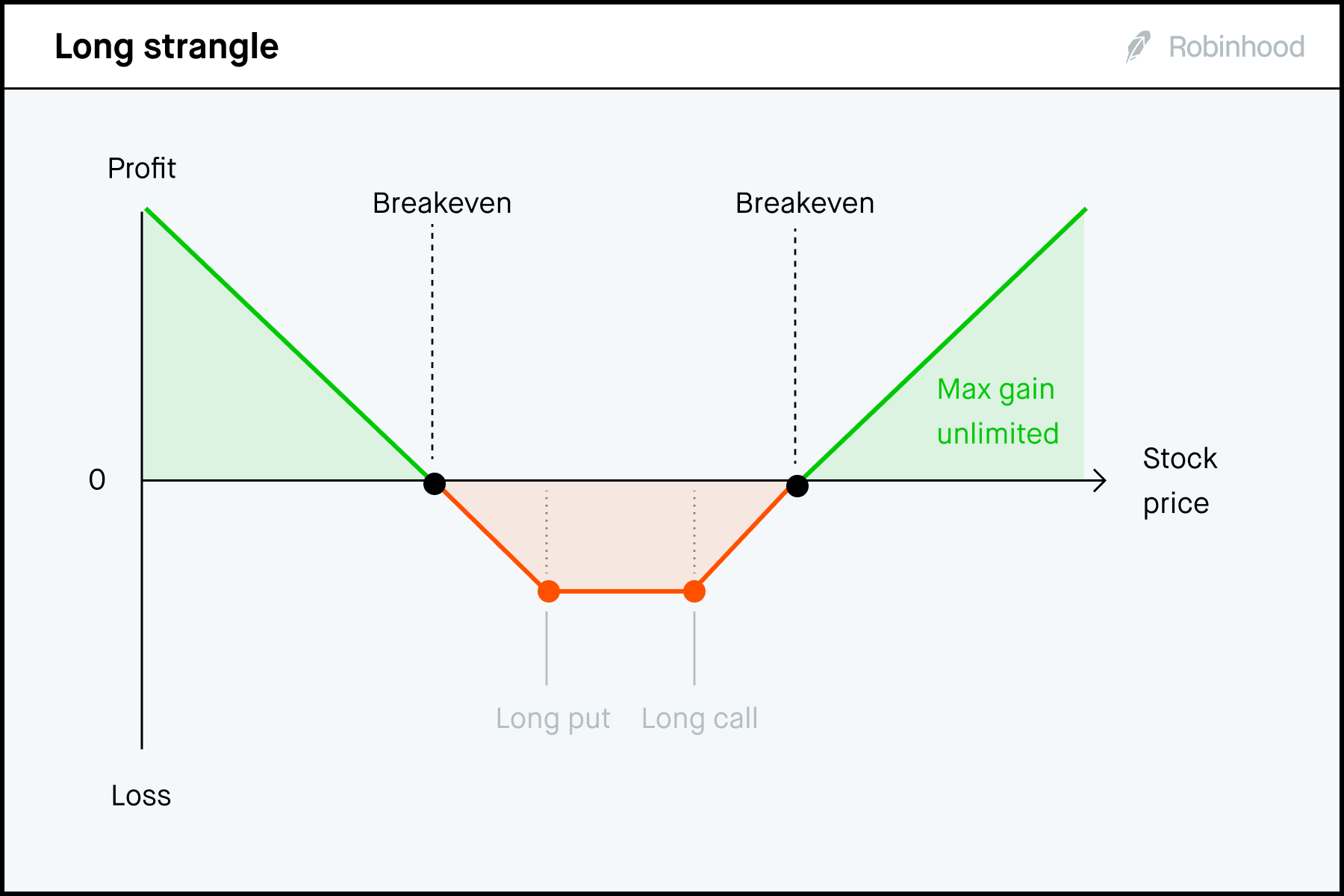

Respondent's Level 2 options trading allows customers to engage in the options strategies of covered calls, cash-back puts, long calls and puts, and long straddles and strangles. Level 3 options trading allows more advanced trading such as options spreads.

Does Robinhood offer Level 2

We partnered with Nasdaq to give Robinhood Gold members access to Level II market data powered by Nasdaq Totalview. Level II market data shows multiple bid and ask prices from Nasdaq for any given security so investors can better determine the availability or desire for a security at a certain price.

What is the downside of a debit spread

The downside of this strategy is that it limits your profit potential. The upside is that you can use it to acquire stock and sell the higher strike call option when the stock price increases. Also, If both legs of a long debit spread expire in the money, you will automatically lose money.

Are debit spreads risky

Debit spreads can cut the risk if the trader knows the price will move in a specific direction. Credit spreads, though, can help traders manage risk because they can limit the amount of potential profit. They can be used when traders aren't sure of where the price for the underlying asset will move.

Is Robinhood really commission free

Investing with a Robinhood brokerage account is commission free. We don't charge you fees to open your account, to maintain your account, or to transfer funds to your account. However, self-regulatory organizations, such as the Financial Industry Regulatory Authority (FINRA) charge us a small fee for sell orders.

What happens when you have 25,000 in Robinhood

This means you can't place any day trades for 90 days unless you bring your portfolio value (excluding any crypto positions) above $25,000.

What is a debit spread Robinhood

What's a call debit spread A call debit spread is one type of vertical spread. It's a bullish, two-legged options strategy that involves buying a call option and selling another with a higher strike price. Both options have the same expiration date and underlying stock or ETF.

Can you roll debit spreads

Rolling a Bull Call Debit Spread

Bull call debit spreads can be rolled out to a later expiration date if the underlying stock price has not moved enough. To roll the position, sell the existing bull call spread and purchase a new spread at a later expiration date.

How do I enable buying and selling spreads on Robinhood

But let's talk about this and this is one you know if anybody wants to do any spreads. I will show you guys some companies McDonald's or Home Depot are some of my favorite ones where you go here this

Is Robinhood good for options trading

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Robinhood Financial does not guarantee favorable investment outcomes and there is always the potential of losing money when you invest in securities, or other financial products.

What is level 4 options trading

Option approval level 4 involves the sale of short calls and short puts, which are options sold on margin where the potential settlement cost is unlimited.